Bitcoin miners’ changing strategies: from hoarding to selling

Bitcoin miners’ changing strategies: from hoarding to selling Quick Take

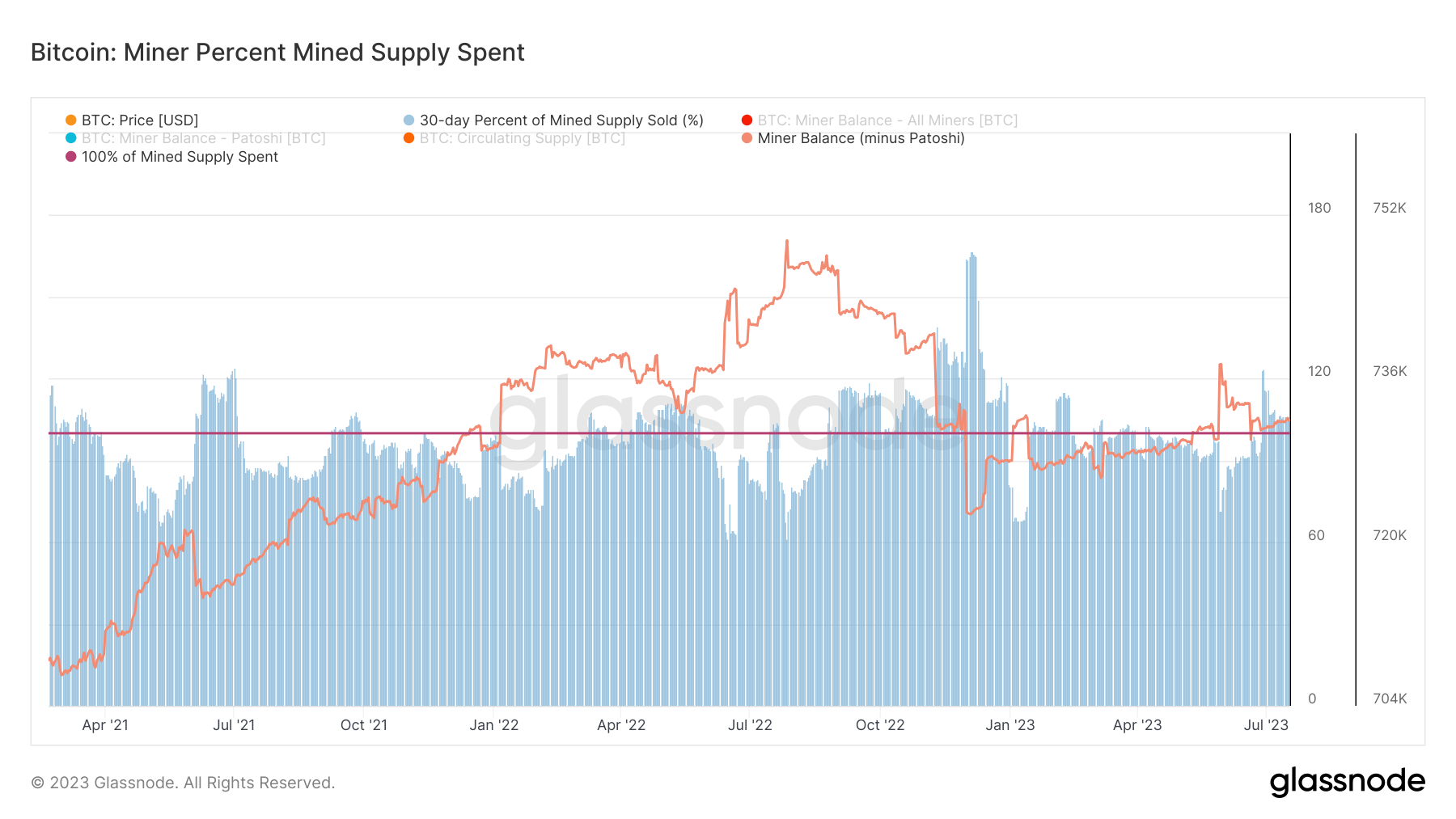

According to Accountant and Bitcoin Mining Analyst at Compass Mining, Anthony Power, throughout 2021, we saw a trend of Bitcoin miners retaining most of their Bitcoin production as the cryptocurrency’s price experienced significant growth.

However, the subsequent decrease in Bitcoin’s price in 2022 forced a number of miners, burdened with substantial debt, to liquidate their holdings. Marathon Digital and Hut 8, in particular, were committed to maintaining their Bitcoin assets for as long as feasible, according to Power.

Data from Glassnode support this; as we can see throughout 2021, miner balance on aggregate continued to increase, but as 2022 continued, miners were offloading to cover debts and obligations from a lowering Bitcoin price.

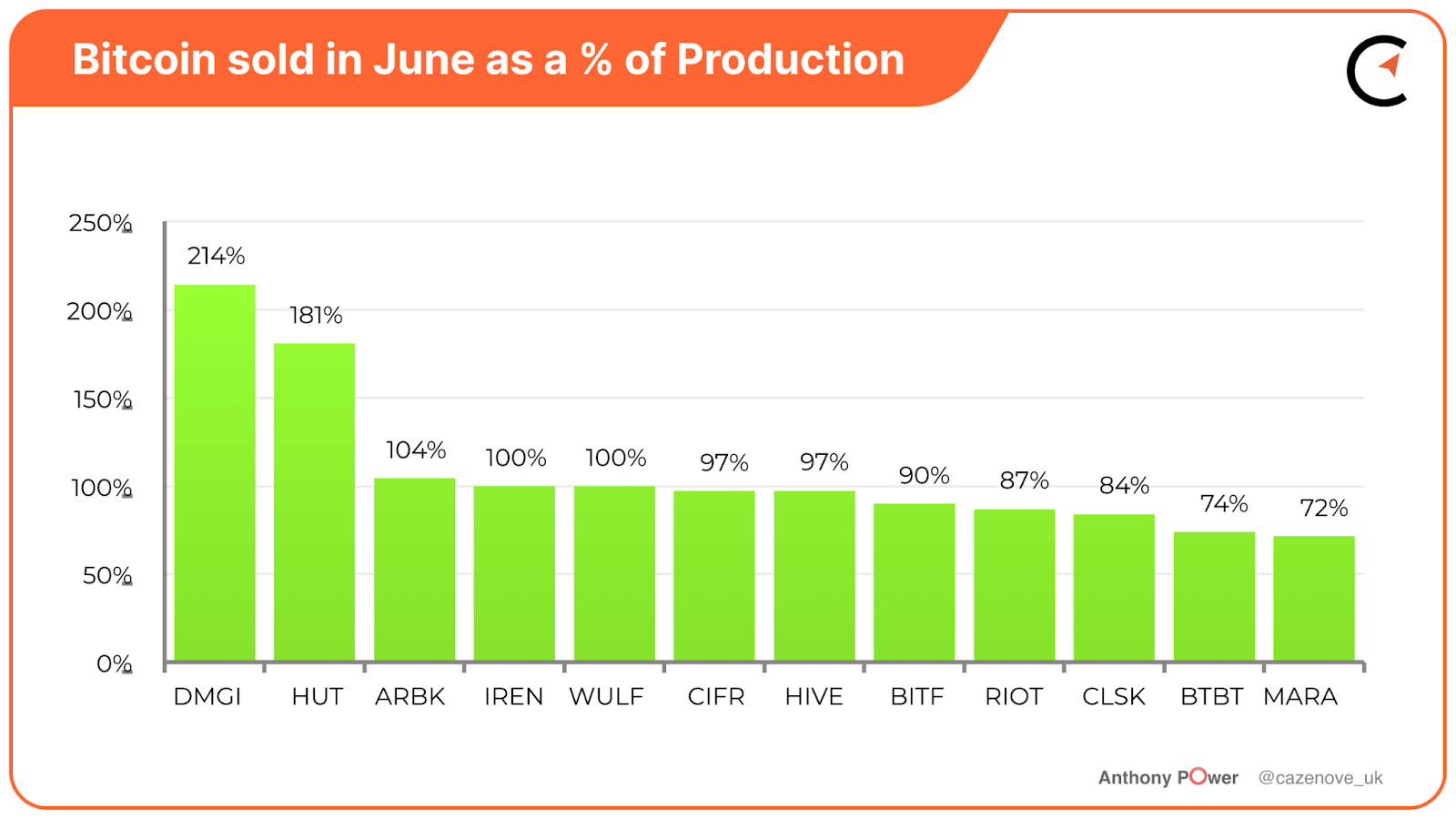

Fast forward to the current year, it’s noticeable that all miners have begun to liquidate some, if not all, of their Bitcoin production in response to the rebound in Bitcoin’s price, according to Anthony Power.

The graph provided below underlines the adopted strategy by 58% of miners. They’re not only liquidating a part of their Bitcoin production but also increasing their cryptocurrency reserves in anticipation of the halving event next year, according to Anthony Power.