Bitcoin hits $39,000 while gold approaches all-time high

Bitcoin hits $39,000 while gold approaches all-time high Quick Take

After a stunning run-up, Bitcoin reached its year-to-date high on Dec. 1, touching $39,000.

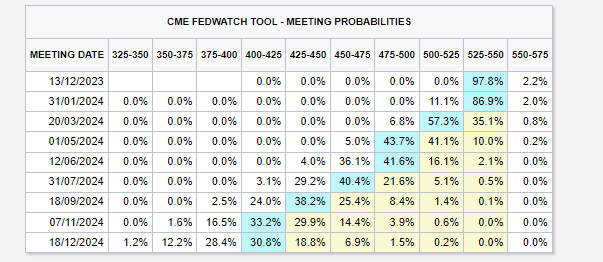

The price action could be correlated to expected cuts to the federal funds rate in 2024. Data from CME indicate a 57% probability of a rate cut in March 2024, hinting at a possible shift in the economic landscape.

Thus, the forthcoming meetings of the Federal Open Market Committee (FOMC) in December and January, which are currently predicted to result in a pause in the rate cycle, hold significant implications for the crypto market.

Concurrently, gold, often seen as a safe-haven asset, is teetering on the brink of its all-time high, having recently surpassed $2,060. This simultaneous surge in Bitcoin and gold underlines the intricate interplay between traditional and digital assets, a relationship likely influenced by anticipated macroeconomic shifts.