Bitcoin futures volume peaks in March, declines in sync with price drop

Bitcoin futures volume peaks in March, declines in sync with price drop On-chain Highlights

DEFINITION: The total volume traded in futures contracts in the last 24 hours

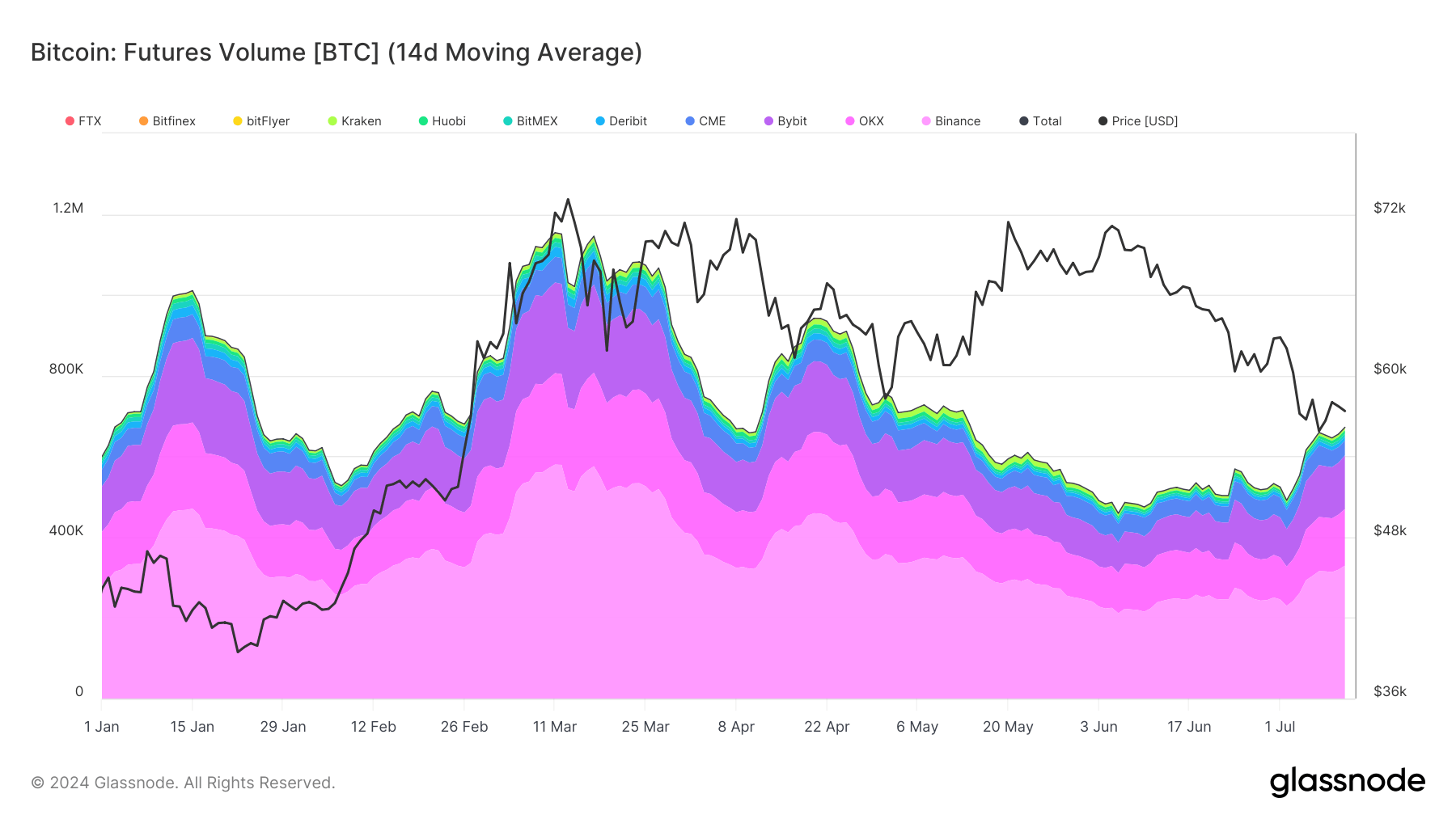

Bitcoin futures volume on major exchanges shows varied trends throughout 2024. The Glassnode charts illustrate a significant shift in futures trading activity. From the start of the year, the volume fluctuated, peaking in early March with almost 1.2 million BTC traded daily.

This peak coincided with Bitcoin’s price reaching over $70,000, suggesting a strong correlation between trading volume and price movements at the time. However, the volume declined sharply post-March, ignoring Bitcoin’s rally in June and following the descent to around $55,000 by mid-year.

Since the start of July futures volume started to increase again prior to Bitcoin’s weekend rally to $63,000.

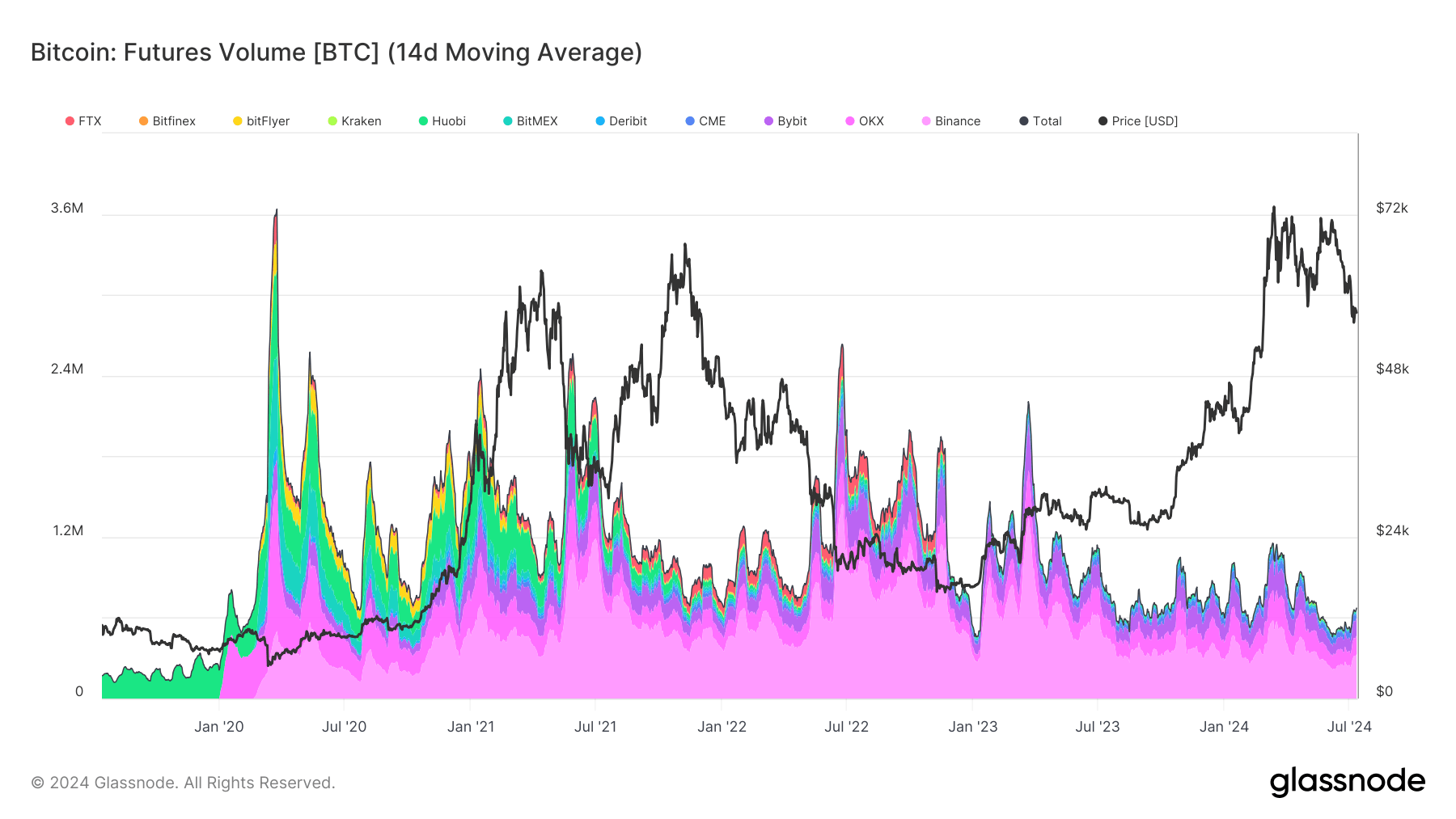

The long-term view highlights the evolution of futures trading since 2020, showcasing periods of intense activity before and after market rallies, particularly in 2021 and early 2023. This historical context emphasizes the cyclical nature of Bitcoin futures trading, heavily influenced by price volatility and market sentiment. As Bitcoin’s price steeply increased to $72,000 before halving in April 2024, the subsequent decline in price and futures volume indicates a market adjustment phase.

Per the chart, Binance remains the dominant platform for futures trading, consistently holding a significant share of the total volume.