Bitcoin exchange balances decline to five-year low, major outflows from Binance and Coinbase signal long-term holding strategies

Bitcoin exchange balances decline to five-year low, major outflows from Binance and Coinbase signal long-term holding strategies Onchain Highlights

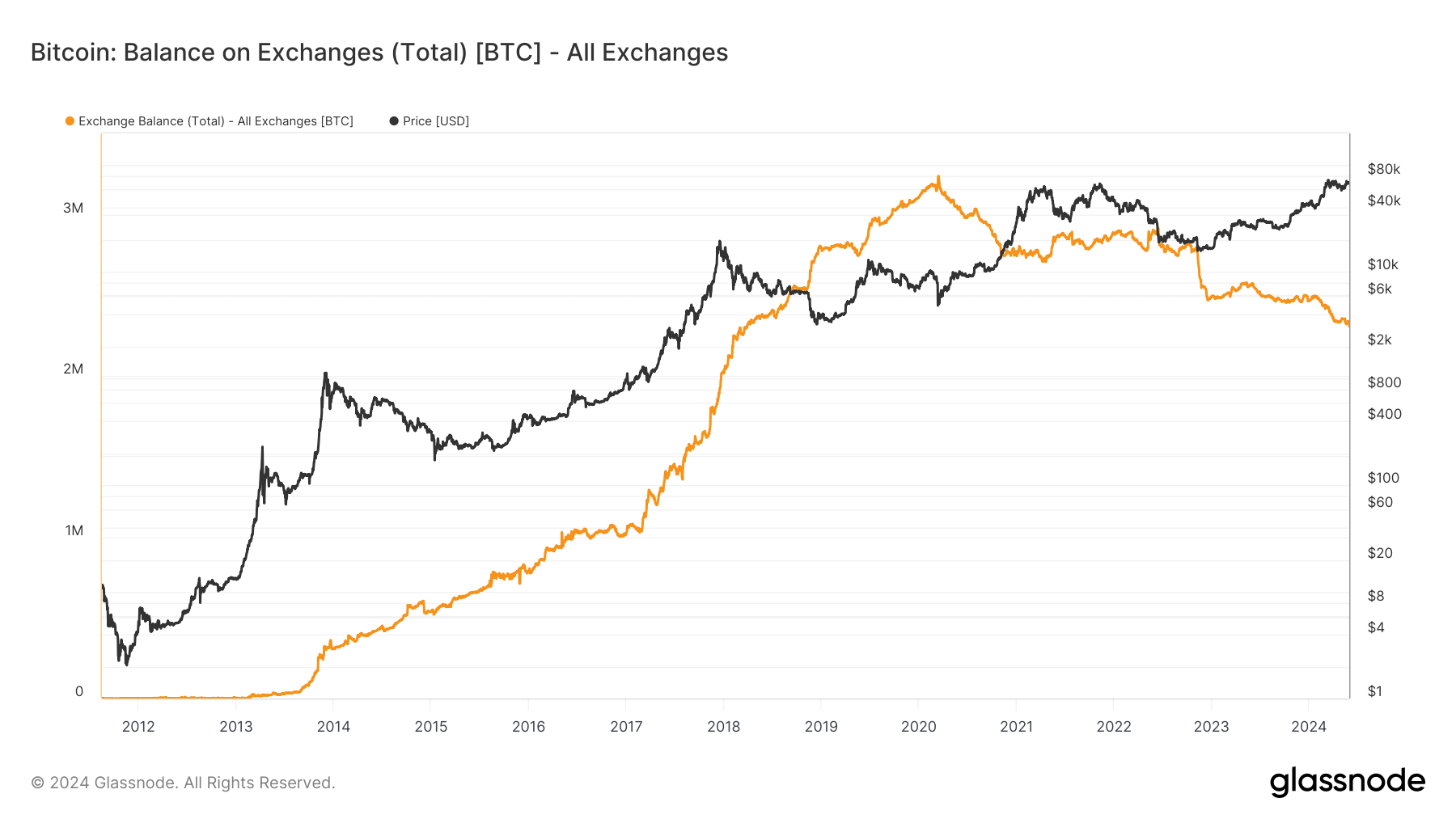

DEFINITION: Balances on exchanges are the total amount of coins held on exchange addresses.

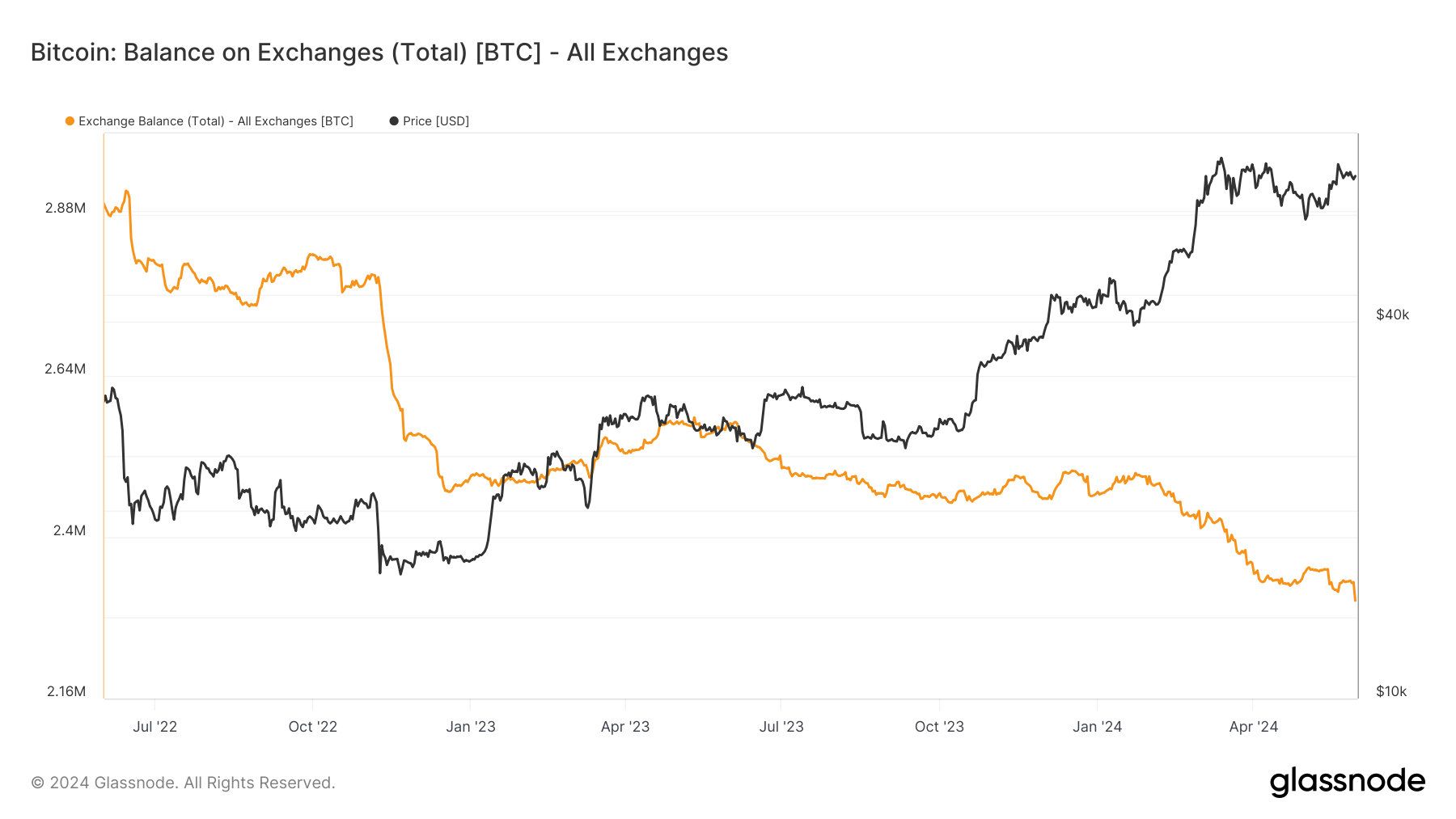

Bitcoin’s balance on exchanges has continued its downward trend, reaching a significant low. As of the latest data, the total balance on exchanges has dropped below 2.3 million BTC, a level not seen since March 2018. Substantial outflows from major exchanges like Binance and Coinbase are primarily driving this shift, signaling a possible change in investor sentiment toward long-term holding strategies.

Binance, the exchange with the largest Bitcoin reserves, has seen large withdrawals of BTC in the past twelve months. Similarly, Coinbase recorded the third-largest outflow of 2024, with nearly 16,000 BTC being moved out in a single day. This pattern of outflows suggests that large-scale holders, “whales,” are moving their assets to private wallets, possibly in anticipation of future price increases.

These trends reflect a broader market sentiment where investors might be preparing for a bullish phase in Bitcoin’s price trajectory by reducing the available supply on exchanges, which could exert upward pressure on prices in the near future.