Bitcoin ETFs see smallest net inflow on record, Grayscale mini BTC positive

Bitcoin ETFs see smallest net inflow on record, Grayscale mini BTC positive Quick Take

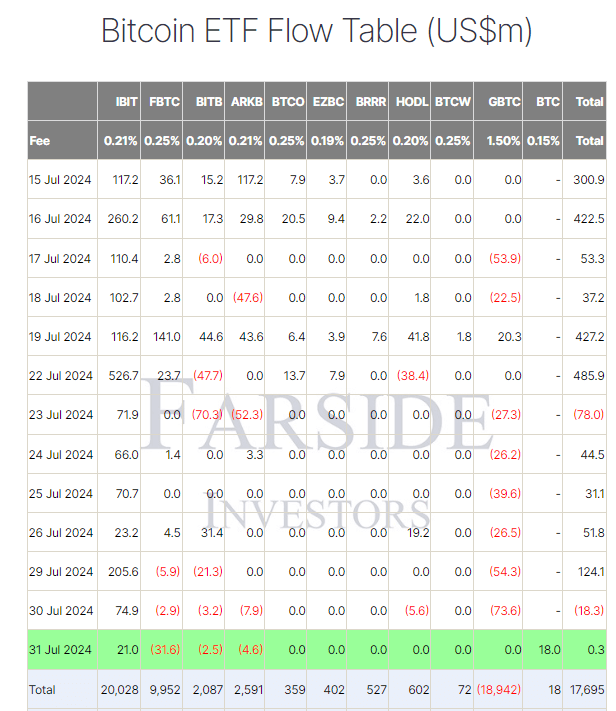

Farside data reveals that Bitcoin exchange-traded funds (ETFs) experienced a minimal net inflow of just $0.3 million, marking the most negligible net inflow since these ETFs began trading on Jan. 11. BlackRock’s IBIT continued to attract investments with a $21.0 million inflow. However, three out of the top four issuers faced outflows once again: Fidelity’s FBTC recorded a $31.6 million outflow, Bitwise’s BITB saw a $2.5 million outflow, and ARK’s ARKB had a $4.6 million outflow.

A notable development came from Grayscale, GBTC, which experienced no outflows. July 31 marked the inaugural trading day for Grayscale’s new mini trust BTC, which attracted an $18.0 million inflow; the fund was initially provided with 10% of GBTC’s Bitcoin assets. This mini trust launched with the lowest fees among all ETFs at just 15 basis points and saw $27 million in trading volume, ranking it sixth among ETFs in volume traded according to Soso Value. Overall, ETF inflows have reached $17.7 billion.

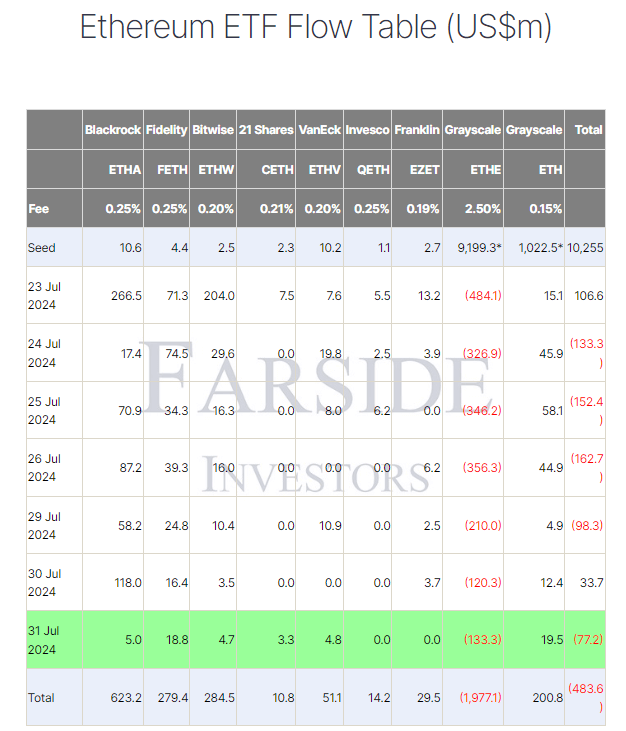

In contrast, Ethereum ETFs continued to see outflows totaling $77.2 million on July 31. Grayscale’s ETHE contributed significantly with an additional $133.3 million outflow, bringing its total outflows to $2.0 billion. Inflows remain muted, with total outflows now amounting to $483.6 million.