Bitcoin ETFs see $31.1 million inflows, Ethereum ETFs outflows as BTC dominance hits 56%

Bitcoin ETFs see $31.1 million inflows, Ethereum ETFs outflows as BTC dominance hits 56% On July 25, 2024, data from Farside Investors indicated varied trends for both Bitcoin and Ethereum ETFs. Bitcoin ETFs experienced a slight increase overall. Of all spot Bitcoin ETFs, only BlackRock’s IBIT saw an inflow at $70.7 million, but this gain was offset by Grayscale’s GBTC, which declined by $39.6 million. The net change for Bitcoin ETFs yesterday was a positive $31.1 million.

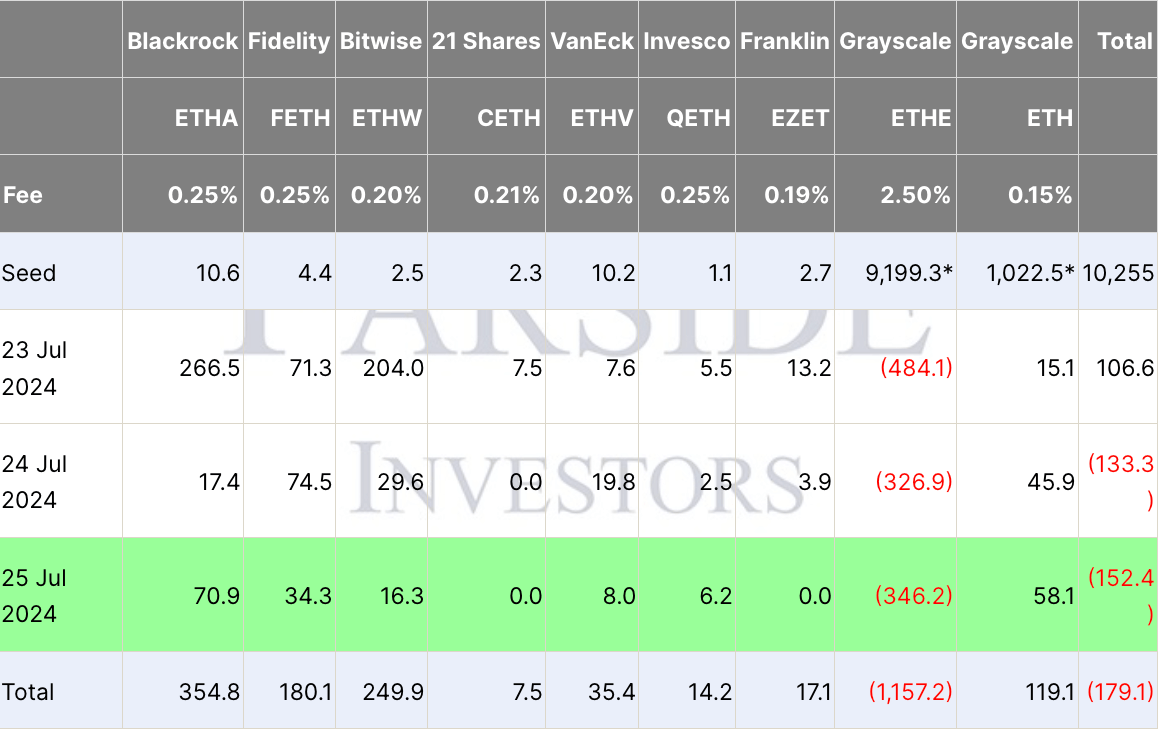

Ethereum ETFs, however, continued to show net outflows. BlackRock’s ETHA reported an inflow of $70.9 million, and Fidelity’s FETH added $34.3 million. Bitwise’s ETHW increased by $16.3 million, and VanEck’s ETHV grew by $8.0 million. Invesco’s QETH saw a smaller inflow of $6.2 million. Conversely, Grayscale’s ETHE experienced significant outflows of $346.2 million, while its Mini ETH ETF saw an inflow of $58.1 million. Overall, the net change for Ethereum ETFs decreased by $152.4 million.

While Ethereum ETFs experienced substantial outflows despite some positive inflows from other funds, Bitcoin ETFs managed a modest gain, indicating differing investor sentiment between the two major cryptocurrencies. This is reflected in the spot prices as Bitcoin saw a 3-month high in dominance at 56.6%, and the ETHBTC ratio fell to a low of 0.479 BTC.