Bitcoin, Ethereum up 37% and 35% year to date

Bitcoin, Ethereum up 37% and 35% year to date Quick Take

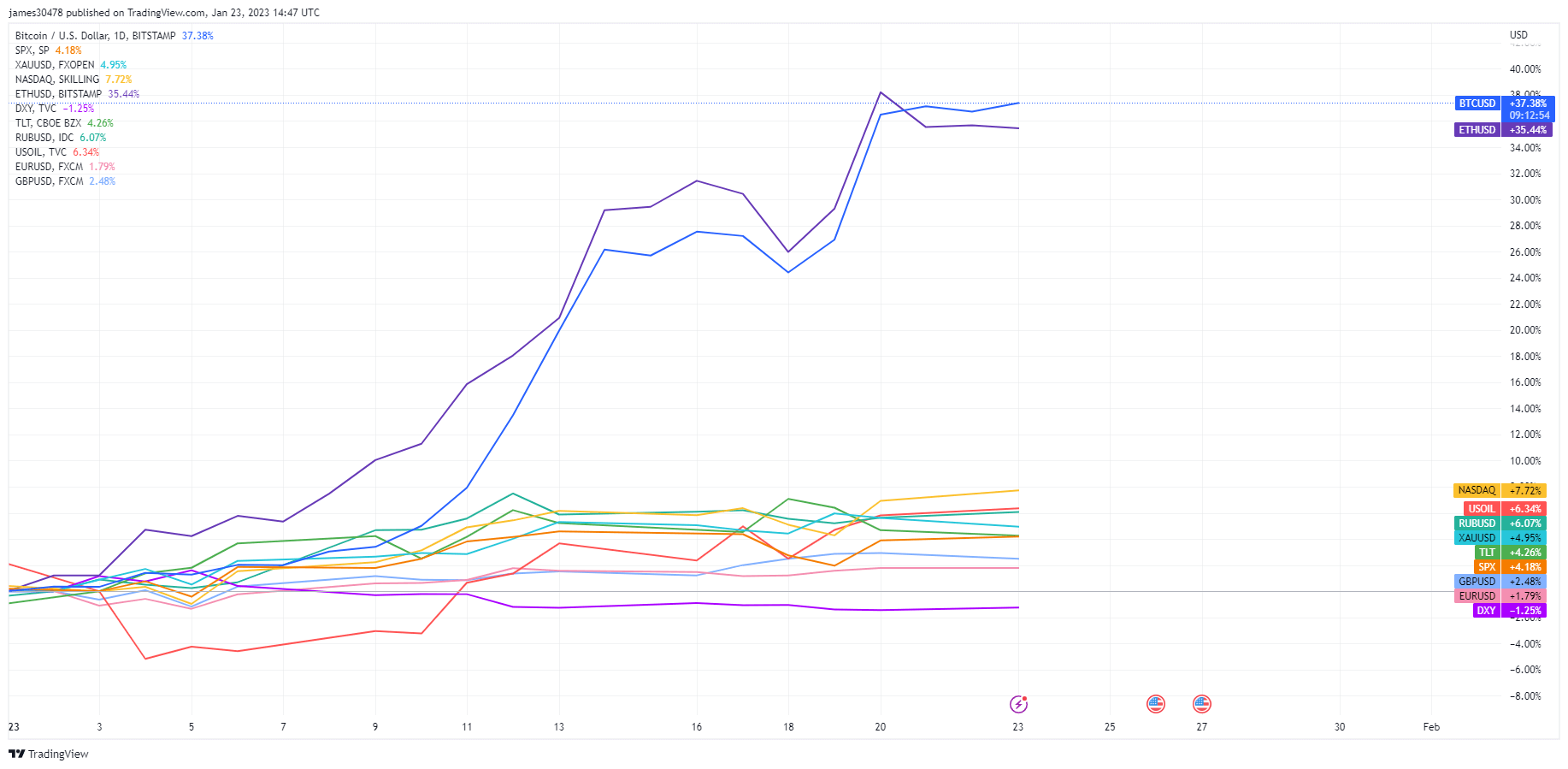

- So far in 2023, risk-on assets have blown expectations out of the water, as Bitcoin and Ethereum have increased over 35% since the start of the year.

- January has seen financial markets shift expectations that interest rate policy could ease with inflation softening.

- In 2022, risk assets got crushed due to rate hikes increasing at the fastest pace ever.

- Nasdaq, S&P 500, Gold, and TLT are all up year to date.

- Significant currencies such as the euro, pound sterling, and Russian ruble are all up on DXY year-to-date.