URPD analysis: 7% of Bitcoin’s supply locked in $60,000 to $65,000 price range

URPD analysis: 7% of Bitcoin’s supply locked in $60,000 to $65,000 price range Quick Take

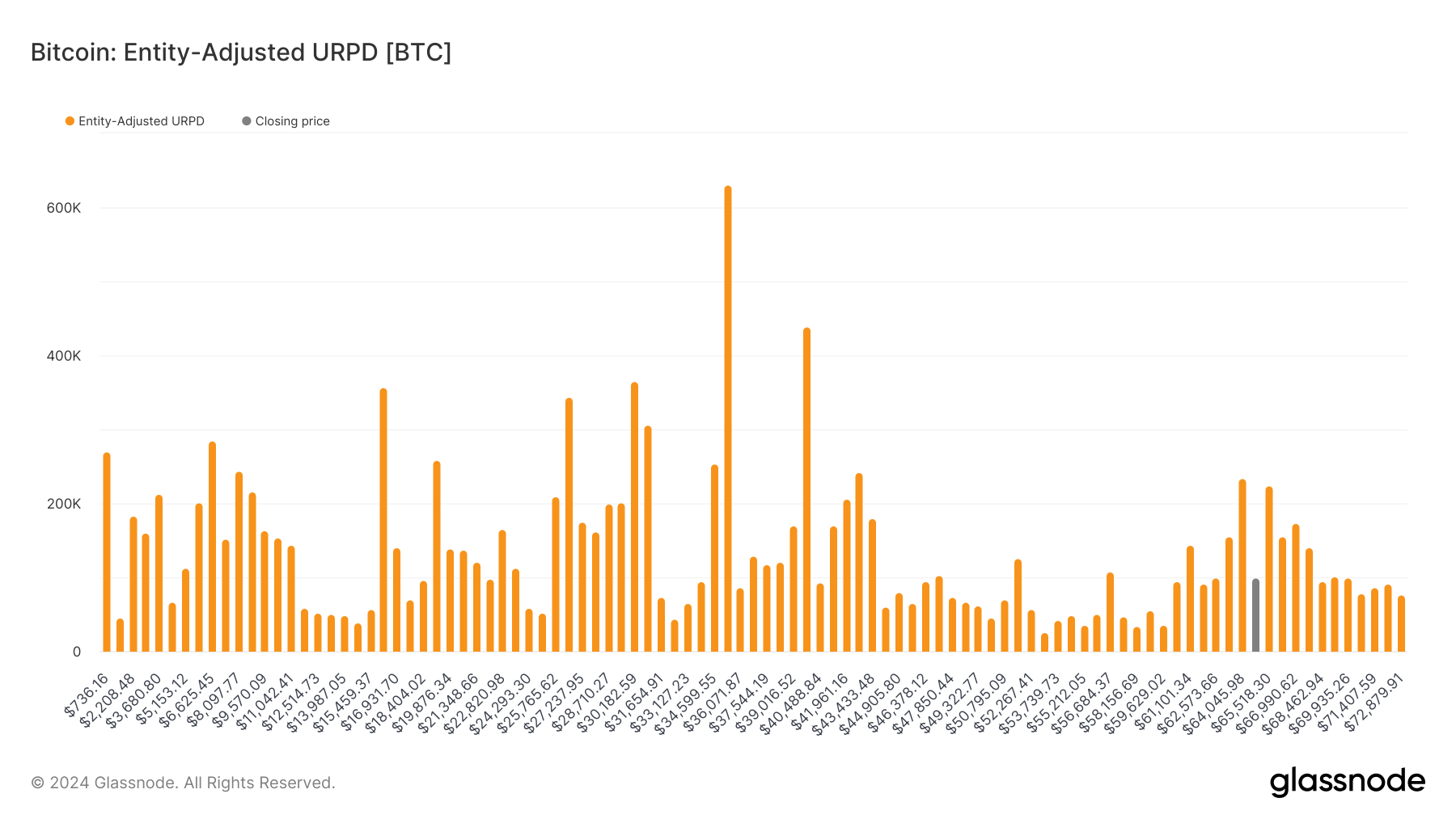

The URPD metric by Glassnode provides insights into the distribution of Bitcoin unspent transaction outputs (UTXOs) based on their creation prices. Each bar in the chart represents the quantity of existing Bitcoins that were last moved within a specified price range.

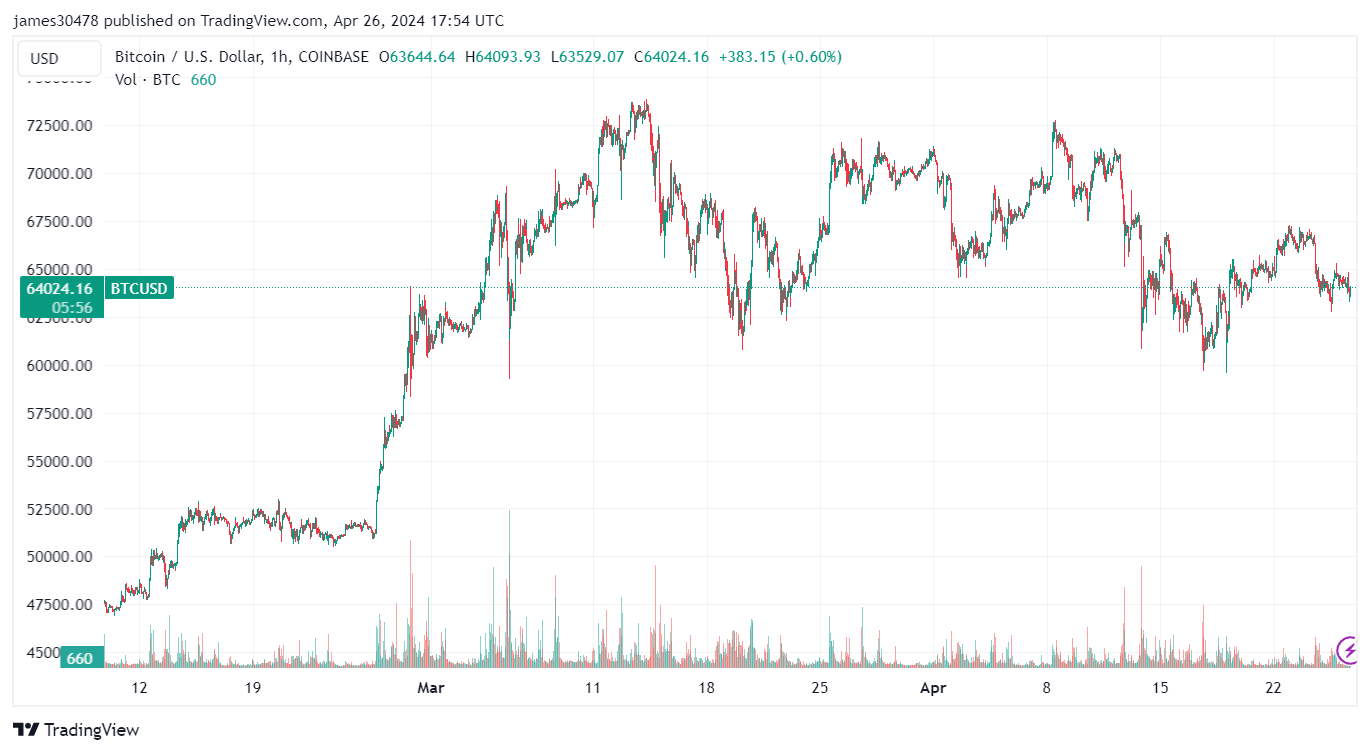

Bitcoin has maintained a price above $60,000 since Feb. 28, briefly dipping below the level only twice — once on March 5 and during a brief period between April 17 and April 19.

Although Bitcoin briefly surpassed $70,000 multiple times in March and April, the URPD metric reveals a significant accumulation of supply between $60,000 and $65,000 — with BTC trading within this range for the past two weeks.

Approximately 7% of the total supply is concentrated within this range as of April 26, based on Glassnode data.

CryptoSlate’s analysis has identified a lack of supply below $60,000. Markets could enter a bearish trend if Bitcoin decisively breaks below this crucial mark.