As Bitcoin approaches halving, diminishing returns theory faces critical test

As Bitcoin approaches halving, diminishing returns theory faces critical test Quick Take

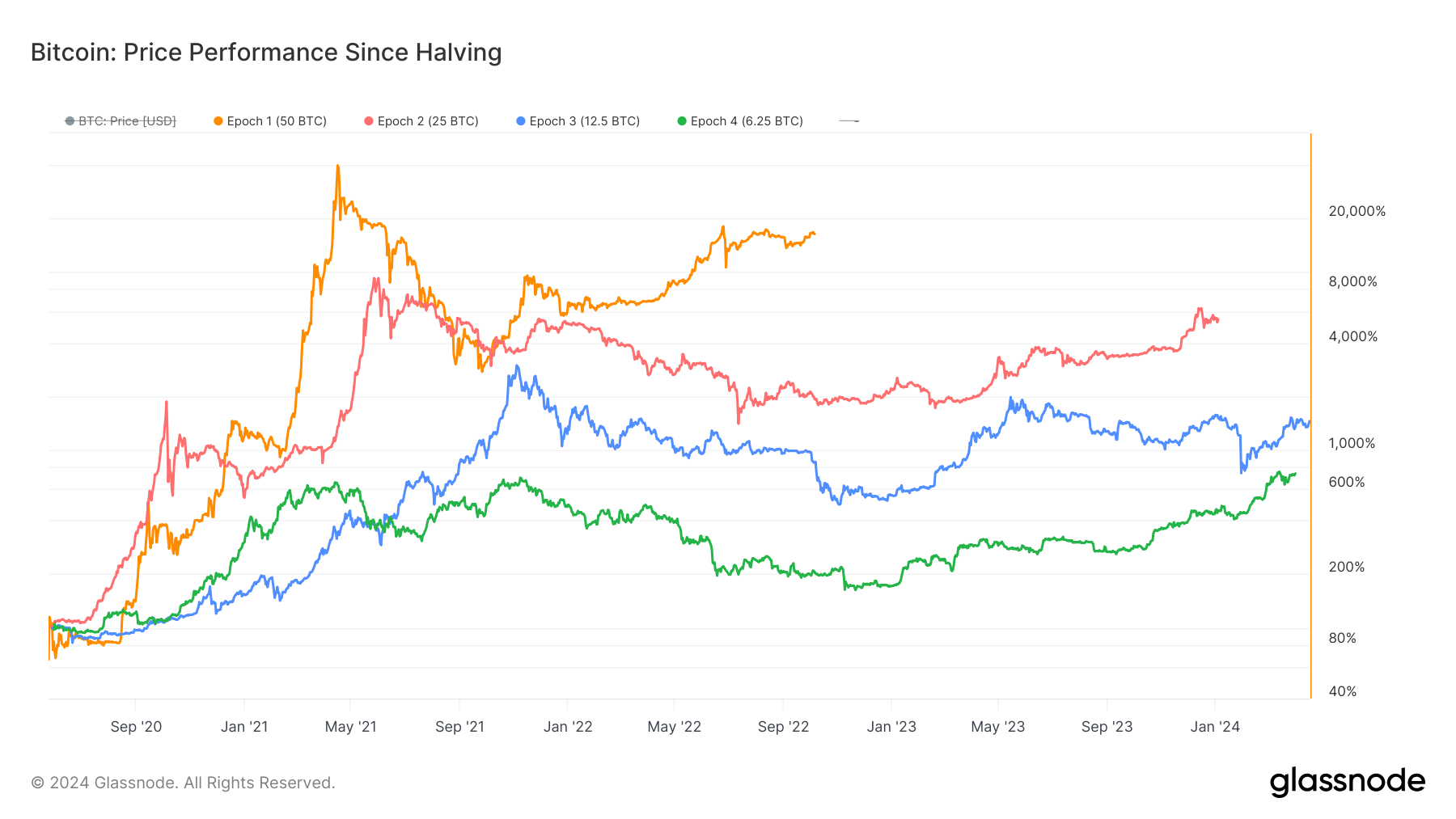

As the highly anticipated Bitcoin halving event draws closer on Apr. 20, the digital assets community is keenly observing Bitcoin’s price movements throughout various halving cycles. While an examination of returns from cycle lows and highs suggests that the diminishing returns theory may not align, a deeper analysis of price performance between successive halving events presents a distinct trend.

Despite Bitcoin’s remarkable surge of roughly 620% from around $8,500 at the onset of the current halving cycle on May 11, 2020, to its current value of approximately $70,000, returns have exhibited a diminishing trend with each successive cycle when assessed from one halving event to the subsequent one. Notably, the previous halving cycle, spanning from July 2016 to May 2020, witnessed a remarkable 1,336% return.

To match or surpass the returns of the preceding halving cycle, Bitcoin’s price would need to attain approximately $120,000—a significant milestone. As anticipation builds around the halving event, attention is focused on Bitcoin’s price trajectory to ascertain whether it can challenge the notion of diminishing returns and sustain its impressive growth.