Binance’s market dominance wanes with regulatory woes and futures market shifts

Binance’s market dominance wanes with regulatory woes and futures market shifts Quick Take

Binance, a dominant player in the cryptocurrency exchange market, has seen a notable downturn in its transaction volume over the past year.

In November 2022, the exchange handled approximately $500 billion in monthly volume. However, according to The Block, by November 2023, this number has fallen sharply to $230 billion. Regulatory pressures have intensified, with the Department of Justice imposing a multi-billion dollar fine, prompting Binance to employ a three-year monitor to oversee compliance.

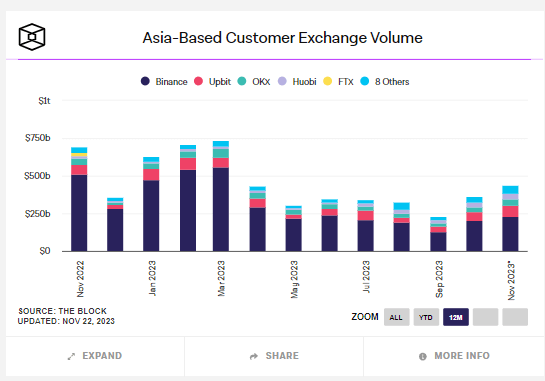

This downward trend also extends to Asia-based volume, where Binance has seen its numbers halved, with competitors such as Upbit and OKX closing in.

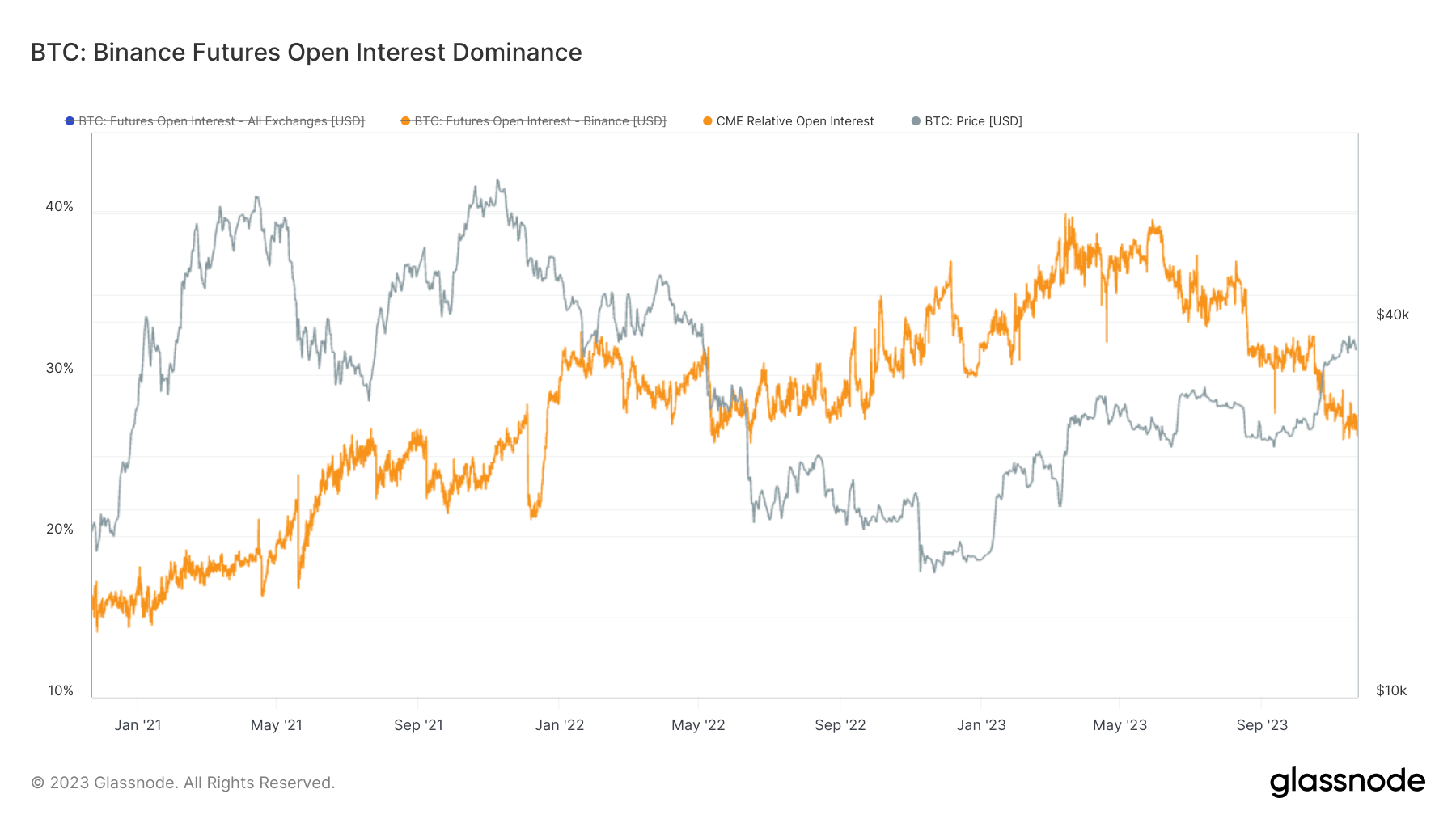

Furthermore, Binance’s share of the futures market has equally suffered a blow, with the Chicago Mercantile Exchange (CME) taking the lead. Binance currently holds 26% of the market share, marking its lowest point since December 2021.

These developments suggest a further contraction in Binance’s market share, potentially exacerbated by the recent fines and compliance demands. This shift may have broader implications for the distribution of cryptocurrency transactions among major exchanges.