Binance and CME are in a neck-and-neck race for dominance in Bitcoin futures

Binance and CME are in a neck-and-neck race for dominance in Bitcoin futures Quick Take

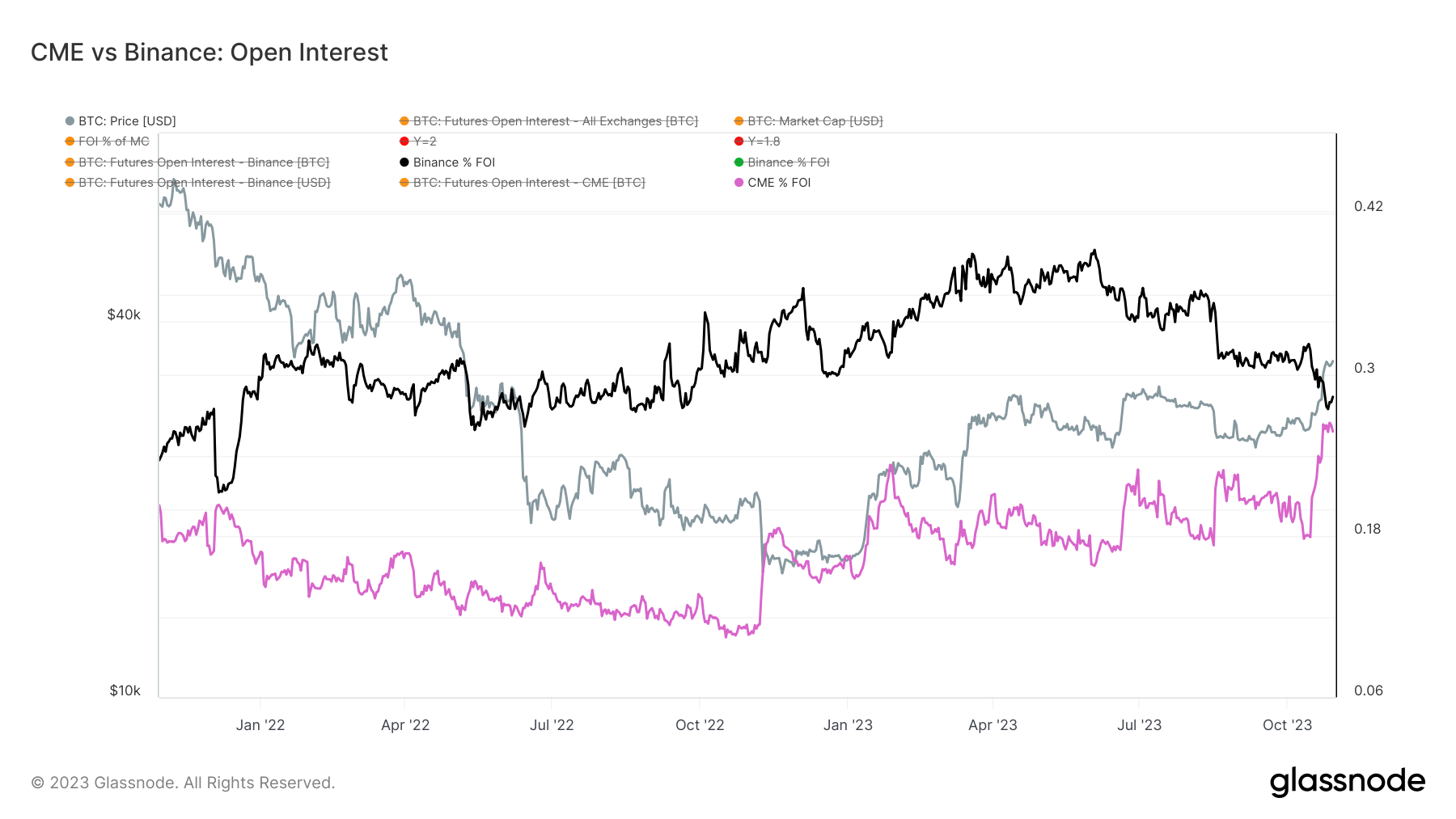

The dynamics of Bitcoin futures open interest unveils an intriguing interplay between major exchange platforms, Binance and CME. The former, a global cryptocurrency exchange with a wide reach, currently holds a slightly larger piece of the pie at just over 28%. CME, primarily known for institutional trading, accounts for 26% of all futures open interest.

In numeric terms, the total amount invested in open futures contracts equates to 400,000 Bitcoin. Of this, CME has recently reached new heights, with 103,075 Bitcoin in open interest. Meanwhile, Binance maintains a lead, albeit a narrow one, with 113,419 Bitcoin. The small difference between the two exchanges portrays tight competition within the cryptocurrency futures market.

This analysis underpins the evolving dynamics of the cryptocurrency market as more institutional traders get involved. The tight gap between Binance and CME could reflect increasing institutional interest in Bitcoin futures, a significant shift from the previously retail-driven market.