A trend that is playing out to defend the BNB $220 liquidation level

A trend that is playing out to defend the BNB $220 liquidation level Quick Take

- CryptoSlate reported that if the price of the token BNB were to fall past $220, this could create a $200 million liquidation.

- In the past month, BNB has dropped 20%, fell as low as $224, but is now back up around $247.

- Reports from the Twitter account Skew suggest that a trend has emerged since 27 May.

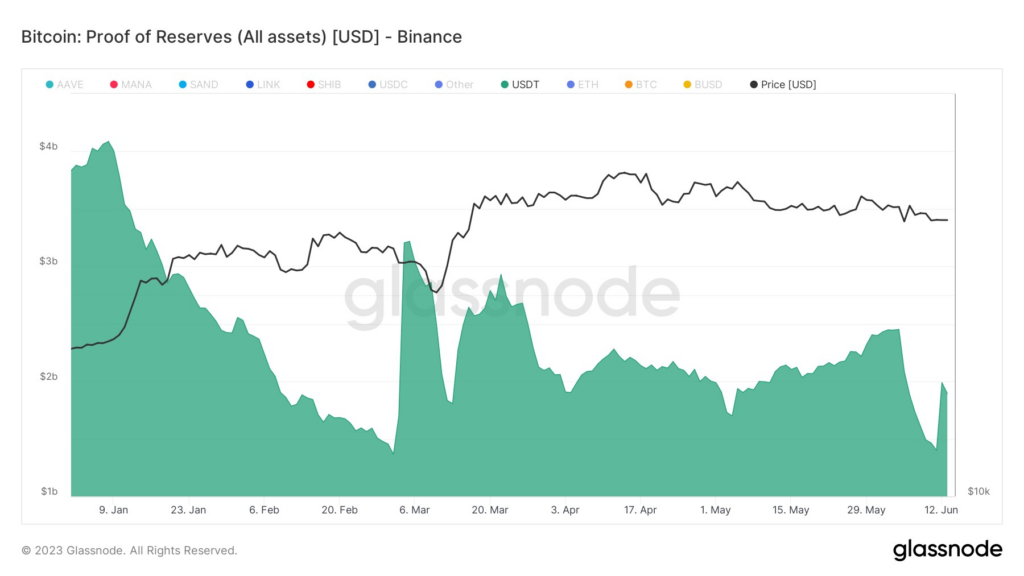

- Bitcoin is being sold off for USDT.

- USDT has been used to purchase BNB aggressively since 27th May.

- BNB is also being sold for BUSD, which suppresses the volatility in BTC.

- Finally, BUSD is being traded into BTC, suppressing downside volatility, meaning BTC can be swapped out for USDT, completing the cycle.

- Therefore, the Bitcoin selling pressure seems to be coming from the Binance exchange, though whether a single entity is behind any of the mentioned trades is unclear.

- CZ has denied the claims that Binance has sold BTC or BNB, as per community concerns.