“I am now bullish on Bitcoin”—Bloomberg newsletter talks institutional mania

“I am now bullish on Bitcoin”—Bloomberg newsletter talks institutional mania “I am now bullish on Bitcoin”—Bloomberg newsletter talks institutional mania

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A Bloomberg newsletter described Bitcoin as a “way of disintermediating the existing financial system.” It comes as the perception of BTC as a store of value is continuing to strengthen amidst rising institutional demand.

Oh yeah, I'm bullish on Bitcoin now.https://t.co/ViCeAp2YCi pic.twitter.com/i15kDeU56j

— Tracy Alloway (@tracyalloway) November 3, 2020

Tracy Alloway, a Bloomberg financial journalist and the co-host of Odd Lots, wrote in a newsletter entitled “Five Things You Need to Know to Start Your Day:”

“I have a confession to make: I am now bullish on Bitcoin. I’m bullish on Bitcoin because I’m bullish on cognitive dissonance in a complex society, and on people’s ability to produce endless narratives for the cryptocurrency—even ones that are at times contradictory.”

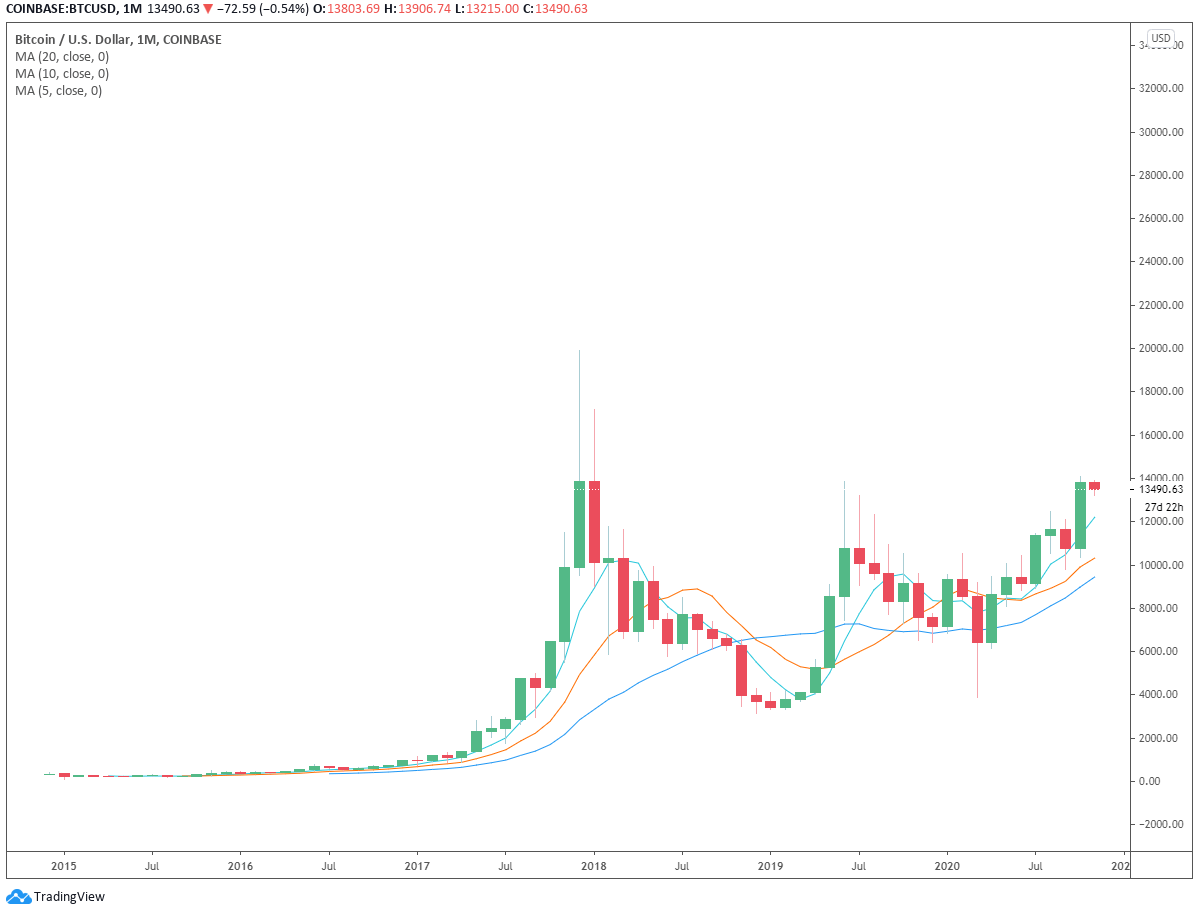

Since March, the price of Bitcoin has increased from $3,596 to over $13,600, rising by over three-fold. During that period, it has seen a noticeable spike in institutional adoption as several public companies adopted it as their primary treasury assets.

The unique value proposition of Bitcoin

Bitcoin is seen as a store of value and a currency to disintermediate the financial system. It can bank the unbanked by allowing users to transfer value between one another with a third party.

The unique value proposition of BTC is that it is a settlement network at a nascent stage. But, it can also operate as an alternative store of value or an “inflation play,” as Paul Tudor Jones previously said.

“The reason I recommended bitcoin is because it was one of the menu of inflation trades, like gold, like TIPS breakevens, like copper, like being long yield curve and I came to the conclusion that bitcoin was going to be the best inflation trade,” Tudor Jones said.

As such, Bitcoin benefits from the growing demand from financial institutions and asset managers while disrupting the financial system. Alloway explained:

“Bitcoin is a way of disintermediating the existing financial system, but it’s also something that would benefit from a flood of institutional money.”

The strength of fungibility

Alloway emphasized that the strength of Bitcoin is its wide range of use cases. Although its primary use case remains to be a store of value and a hedge against inflation, at its core, Bitcoin is a blockchain network and a computing protocol.

“The list of Bitcoin’s purported uses goes on and on, and every time an obituary for Bitcoin is written, a new use case or bull argument steps in to to take its place. I used to think this was a weakness since Bitcoin could never be all these things at once. But the more I think about it, the more I realize that it’s actually a strength.”

Over time, if the mainstream begins to utilize BTC as a currency, there are ways to secure transactional capacity to do so. Second-layer scaling solutions, for instance, Lightning, can enable individuals to transfer value with near-zero fees and quick settlement times.

Bitcoin Market Data

At the time of press 3:30 pm UTC on Nov. 3, 2020, Bitcoin is ranked #1 by market cap and the price is up 3.14% over the past 24 hours. Bitcoin has a market capitalization of $254.98 billion with a 24-hour trading volume of $30.42 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:30 pm UTC on Nov. 3, 2020, the total crypto market is valued at at $396.97 billion with a 24-hour volume of $87.67 billion. Bitcoin dominance is currently at 64.23%. Learn more about the crypto market ›

CoinGlass

CoinGlass