Research: How short-term Bitcoin holders invest differently to long-term holders according to on-chain data

Research: How short-term Bitcoin holders invest differently to long-term holders according to on-chain data Research: How short-term Bitcoin holders invest differently to long-term holders according to on-chain data

Short-term Bitcoin holders buy between $17k and $48k with elevated buying from addresses owning less than 1 BTC around the $20k level.

Glassnode and CryptoSlate

Looking at on-chain data shows apparent differences in how short-term and long-term holders invest in Bitcoin. Short-term holders have been mainly buying between the $17k – $48K levels, whereas long-term holders are strong up to $60k.

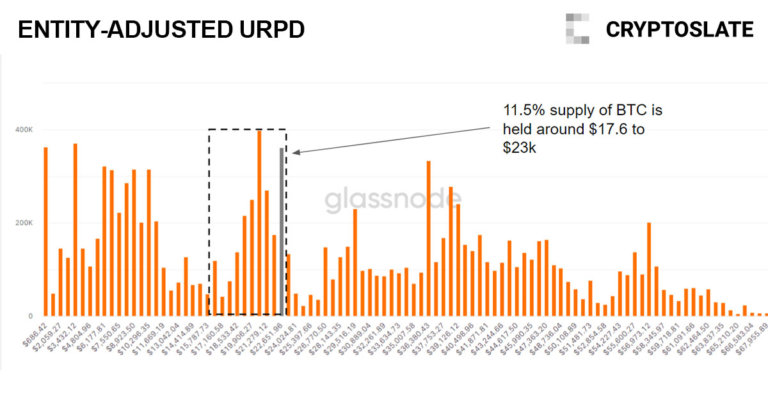

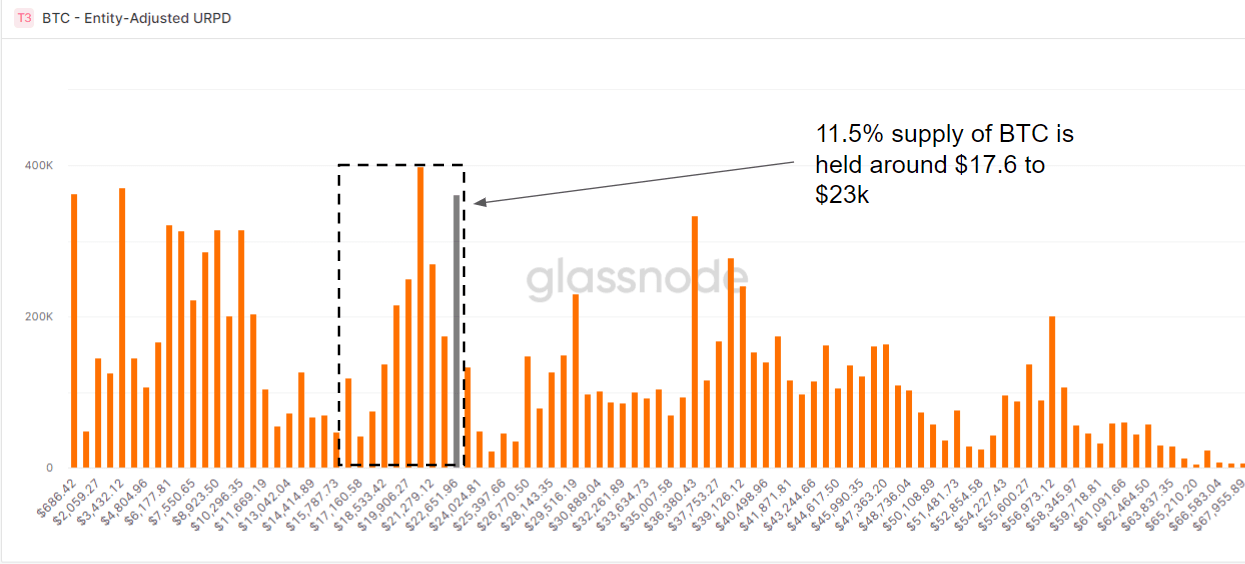

We can analyze some key graphs to understand the data better. UTXO Realized Price Distribution (URPD) shows at which prices the current set of Bitcoin UTXOs were created. Each bar indicates the number of existing bitcoins that last moved within that specified price bucket. The price specified on the x-axis refers to the lower bound of that bucket.

Following the 75% drawdown from the all-time high this year, 11.5% of the supply is currently held around the $17k price level. The increase in holdings between $17k and $24k may indicate a lot of demand has been swept up. Below $17.6k, all coins that have not moved must be defined as long-term holders, as Bitcoin has not dropped below this price since 2020. However, these investors can be considered mature long-term holders. The coins are lost or owners are unwilling to sell up to this point.

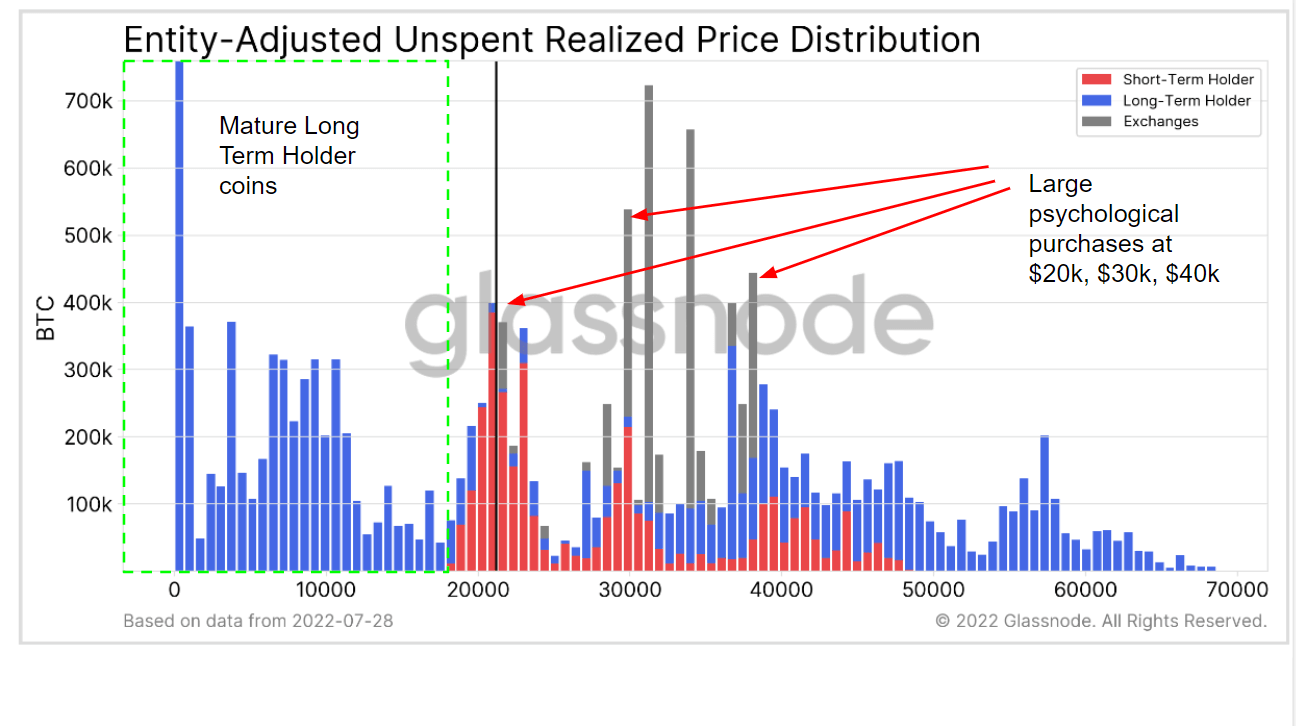

The following chart shows the type of cohorts buying at these price levels. The entity-adjusted version of the URPD Metric offers the supply segmented by Long-Term Holders (blue), Short-Term Holders (red), and Exchange balances (grey). All supply is shown in the price bucket at which the respective entity has (on average) acquired its coins.

Concerning Short Term Holders (holding BTC for less than 155 days), you can see the transfer of ownership from long to short-term holders around the $20k, from long-term holders capitulation sellers to HODLers or investors. They see value in these price ranges.

There has strong buying at psychological levels from both short and long-term holders at 20,30 and 40k. There is a lot of long-term holder supply currently underwater. It will be interesting to watch if short-term holders convert to long-term holders around the 40-50k range.

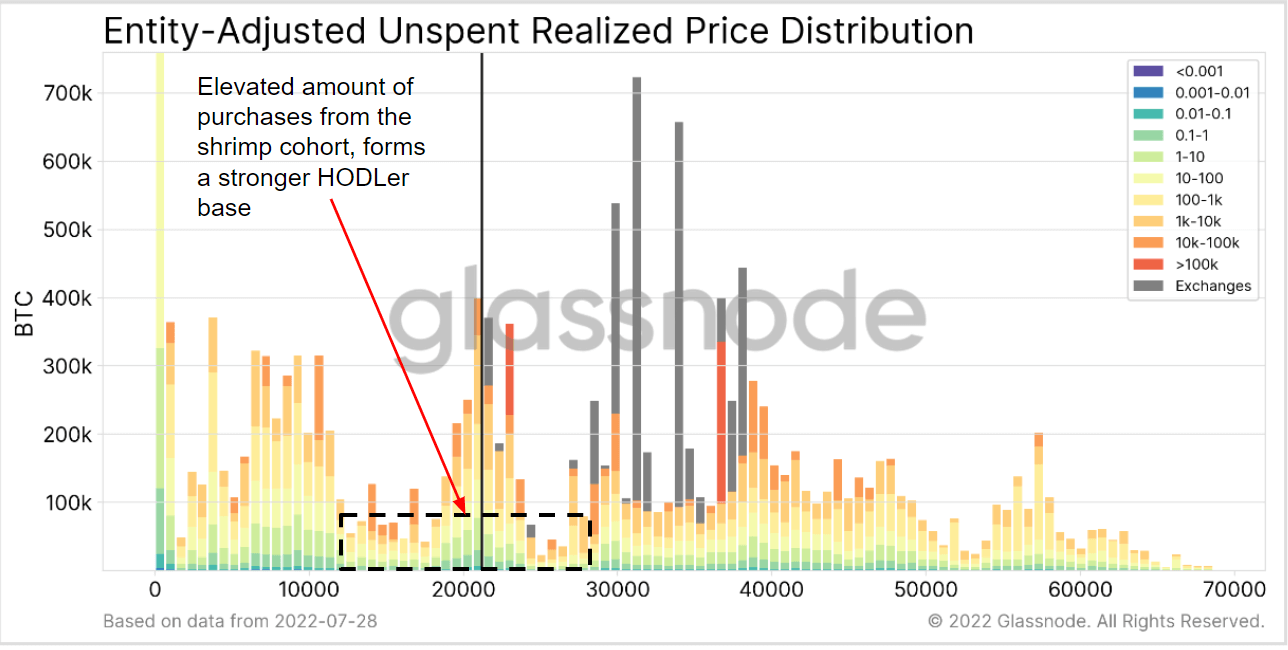

Shrimp cohorts with less than 1 Bitcoin have been stacking Sats relentlessly throughout the price ranges. Shrimps appear unfazed by price action and have purchased a significant amount of Bitcoin at current lower price levels compared to similar historical price ranges. The black vertical bar shows the market price at the chart production timestamp.

Interestingly, most exchange coins were bought between $30k and $49k with very little above, if any, above $40k. This information is crucial when assessing the liquidity of an exchange that holds Bitcoin on its balance sheet. At the current level of $23,800, exchanges are underwater by around 65% on the coins they have not sold.

There has been less buying by exchanges below $30k. However, around 350K BTC was purchased at the psychological level of $20k, totaling around $7 billion at the time of sale. Addresses with less than 10k Bitcoins primarily defended the level.

The following tweet by Prof. Chaine displays an animated version of the UDRP chart over time.

On peut aisément voir cette dynamique prendre forme et l'offre changer de propriété dès que le prix a invalidé le niveau des 20k $

Depuis, près de 2,6 millions de BTC, soit 13,9% de l'offre en circulation ont été échangés entre 17,8k $ et 22,5k $ pic.twitter.com/zIDsJWhCpz

— Prof. Chaîne (@profchaine) July 28, 2022