How AdaSwap plans to raise the bar for Cardano DEXs

How AdaSwap plans to raise the bar for Cardano DEXs How AdaSwap plans to raise the bar for Cardano DEXs

CryptoSlate interviews AdaSwap COO and co-founder Aaron Tait to discover more about how the project intends to shake up the DEX market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Dubbed the “next-gen DEX,” AdaSwap has high hopes of making a significant impact on the growing Cardano DeFi market.

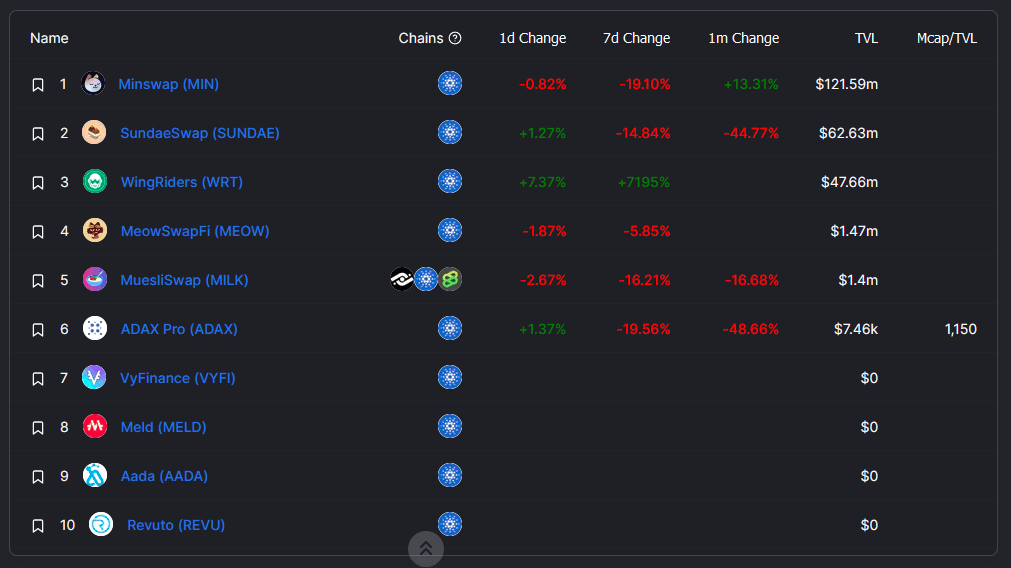

DeFi Llama currently shows ten DeFi projects listed for Cardano, of which four are inactive. A notable new entry is WingRiders, which Input Output CEO Charles Hoskinson called:

“one of the most exciting new DEXes to launch.”

With competing protocols trickling into the market, and a flood expected by Q3, when AdaSwap plans to launch, the project has its work cut out to catch up.

But what separates AdaSwap from the competition?

AdaSwap is a multifaceted DEX

AdaSwap bills itself as a cheaper and fairer Automatic Market Maker (AMM) than its competitors. It aims to build a micro-ecosystem that will draw the world into the Cardano blockchain.

Ultimately, the team’s mission is to onboard the next wave of DeFi users through a range of use cases including the provision of liquidity pools, farming, swapping, a new token launchpad, and an NFT marketplace.

“Our main goal is to develop tools for creators and users, as well as bringing high-yield staking pools and NFT content through our launchpads and marketplaces.”

To find out more, CryptoSlate interviewed AdaSwap COO and co-founder Aaron Tait.

Q&As with AdaSwap COO Aaron Tait

CryptoSlate: With many layer 1s to pick from, what inspired you to want to build on Cardano?

Aaron Tait: Cardano has set itself as one of the biggest ecosystems in the blockchain space and the first peer-reviewed blockchain project. Through this, Cardano has been able to cultivate an amazing community that has supported and help build the blockchain over the last several years. We are very privileged to tap into this community.

More than that, smart contracts went live on Cardano in September 2021, and we were very excited to be one of the first market movers to help ignite DeFi in this ecosystem.

CryptoSlate: It was announced last month that AdaSwap had secured a $2.6 million capital raise. Can you tell us more about how these funds will be spent?

Aaron Tait: As a startup and software company, AdaSwap faces all the same expenses that a startup will face such as customer acquisition, operational expenses, staffing, branding, legal, marketing, etc.

The goal of the raise was to give us space for burn rate before generating positive cash flow from operations to ensure the product and brand can adequately be deployed and protect the token.

CryptoSlate: Cardano’s Unspent Transaction Output (UTXO) model came under fire last year as some said a one transaction/user per block capacity would hamper throughput.

While this was later dismissed as FUD resulting from looking at the model through an Ethereum accounting model lens, as someone who’s hands-on with Cardano at the protocol level, can you share your insights on the UTXO model?

Aaron Tait: Developing on a new platform is always a challenge, with that said, we view this as a design challenge that must be addressed while developing on the Cardano network, current EVM DEXs on other blockchains are working different and it isn’t a straightforward process to deploy them on Cardano.

To overcome the issue, until an efficient enough solution is available for Cardano, we have decided to deploy our DEX on a layer 2 solution called Milkomeda, while still developing our Cardano DEX in the shadows.

CryptoSlate: A flood of Cardano DEXs have either launched or are soon to launch. How does AdaSwap separate itself from the competition?

Aaron Tait: The current market competitors are focused on utilizing Cardano believers and fail to look towards other blockchains for attracting volume. AdaSwap was launched as a cross-chain token to create a higher level of trade volume and bring these cross-chain buyers over to Cardano with appealing incentives and great utilities.

We also offer protocols to drive participation such as our Free Financial Model, where no transaction fees are charged on ASW-based transactions. While our stake and forget protocol will automatically create an airdrop system through staking pools to help users diversify their portfolios without lifting a finger.

CryptoSlate: Can you expand on Free Financial Model and the 0% fee structure?

Aaron Tait: The Free Financial Model will only be used on ASW token trades to incentivize the use of our native token. Fees will still be charged for regular trades on the DEX between tokens other than ASW.

CryptoSlate: Your roadmap states a Q3 rollout; given that delays are part and parcel of blockchain development, are you confident you’ll launch on time?

Aaron Tait: No project is without setbacks, we were delighted with the launch of ADANFT, and we are on track for our Q3 launch of the DEX.

CryptoSlate: Are there plans for an ASW token airdrop? If so, what details can you give at this time?

Aaron Tait: We run airdrops frequently through our market partners on events such as AMAs or project milestones. Please keep an eye out for our next airdrop!