Hong Kong Chief Executive proposes statutory licensing for VASPs in his policy address

Hong Kong Chief Executive proposes statutory licensing for VASPs in his policy address Hong Kong Chief Executive proposes statutory licensing for VASPs in his policy address

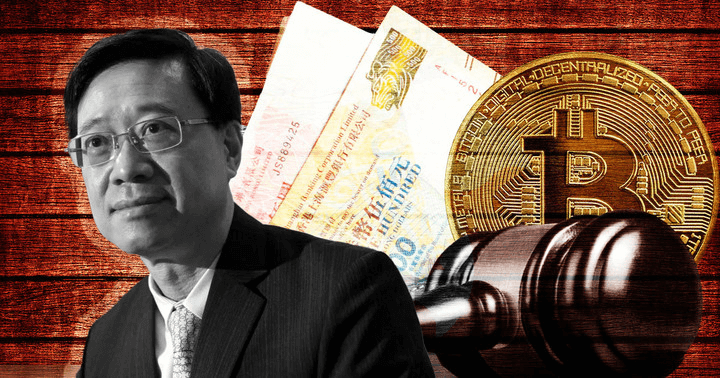

Chief Executive HKSAR John Lee mentions a bill for statutory licensing for VASPs and the city's progress in developing its CBDC in his first policy address delivered on Oct.19.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Chief Executive of the Hong Kong Special Administrative Region, John Lee, mentioned a bill to propose establishing a statutory licensing regime for virtual asset providers in his 2022 policy address delivered on Oct.19.

The policy address also mentions The Hong Kong Monetary Authority’s (HKMA), the city’s de-facto central bank, efforts towards carrying out market consultations on the regulation of stablecoins and plans to align international regulatory standards and local context with the upcoming regulatory regime.

The policy address also acknowledged the HKMA laying the groundwork for the future launch of the city’s retail central bank digital currency (CBDC), “e-HKD,” and collaborating with Mainland stakeholders to expand the testing of China’s CBDC, “e-CNY.”

HKMA’s progress

So far, the HKMA has already conducted two out of the three rounds of market consultation. The feedback has registered support among its participants, who also pointed out concerns regarding privacy, legal considerations, and use cases of e-HKD, according to a blog post published by the de-facto central bank on Sept. 20.

The HKMA said it will adopt a three-rail approach to integrate market feedback into the development of e-HKD. Rail 1 will involve laying the legal and technological foundations for creating the wholesale layer of the two-tier e-HKD system. Rail 2, which runs in parallel with Rail 1, will cover the use cases and application, implementation, and design via a series of test pilots, while Rail 3 will see the launch of the e-HKD.

The HKMA has not issued a launch date or time frame for the e-HKD. However, it estimates it will take two to three years to build the wholesale system and expects to deliver the work plan for the wholesale layer in June 2023.

Hong Kong will also continue experimenting with connecting e-CNY with its domestic payments network since June. This latest trial will explore ways Hong Kong citizens can top up an e-CNY digital wallet using the city’s faster payment system via mobile phones.

The HKMA has also concluded an inter-government cross-border CBDC project, titled the Multiple CBDC Bridge (mBridge), with the Bank of International Settlements, the central banks of Thailand, China, and the United Arab Emirates.

On Oct. 4, 2021, the HKMA released a whitepaper titled “e-HKD: A technical perspective” to explore potential technical design options for issuing and distributing retail CBDCs.