Growing interest in BTC, Bitcoin transaction fees up over 500%

Growing interest in BTC, Bitcoin transaction fees up over 500% Growing interest in BTC, Bitcoin transaction fees up over 500%

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

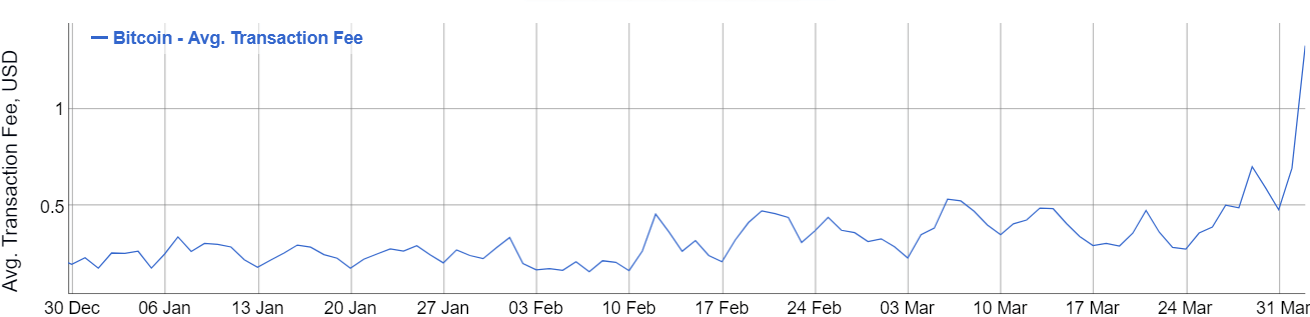

The explosion in BTC trading has caused transaction fees for the cryptocurrency to skyrocket. The latest blockchain data shows that Bitcoin transaction fees have increased over 500 percent since the start of the year, with many lower-fee transactions taking hours before being finalized.

Bitcoin Transaction Fees on the Rise

In the crypto industry, transaction speeds can make or break a project. The speed and throughput of a blockchain have a large impact on the transaction fees on these networks, and in many cases its success. Bitcoin is the exception.

In light of the recent buying frenzy, trading fees have skyrocketed. On Jan. 1st, a bitcoin transaction cost $0.18. Today, each transaction costs over $1.3. Even when accounting for the price change in Bitcoin, in absolute terms the cost to have a transaction added to the blockchain (within 6 blocks) has increased from 3 satoshis per byte to 80 satoshis per byte, a 26-fold increase (with an average transaction consuming 270 or more bytes of data, for reference).

The sudden increase has once again sparked debate as to whether these large fees run counterintuitive to bitcoin’s purpose as a ‘currency,’ as opposed to an alternative asset. However, in the short-run, these high fees seem unlikely to put a damper on bitcoin’s upwards price movement.

Traders see rising fees as a mixed signal. Spikes in the price of adding transactions to the blockchain are said to sometimes follow a market crash. Yet, higher fees also serve as an indicator for growing interest in bitcoin. As with most things around the cryptocurrency, it’s hard to know with certainty whether factors such as transaction fees will impact its price in the short-term.

Simply put, fees go up as more Bitcoin is moved across the network. And so far, the sharp rise in transaction fees doesn’t seem to have stopped bitcoin from breaking above $5,000.

Bitcoin Market Data

At the time of press 2:53 am UTC on Nov. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 1.13% over the past 24 hours. Bitcoin has a market capitalization of $88.29 billion with a 24-hour trading volume of $22.47 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:53 am UTC on Nov. 7, 2019, the total crypto market is valued at at $173.85 billion with a 24-hour volume of $84.52 billion. Bitcoin dominance is currently at 50.81%. Learn more about the crypto market ›