Grayscale continues to challenge SEC for spot Bitcoin ETF conversion

Grayscale continues to challenge SEC for spot Bitcoin ETF conversion Grayscale continues to challenge SEC for spot Bitcoin ETF conversion

Oral arguments for Grayscale's case against the SEC is penned for March 7.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

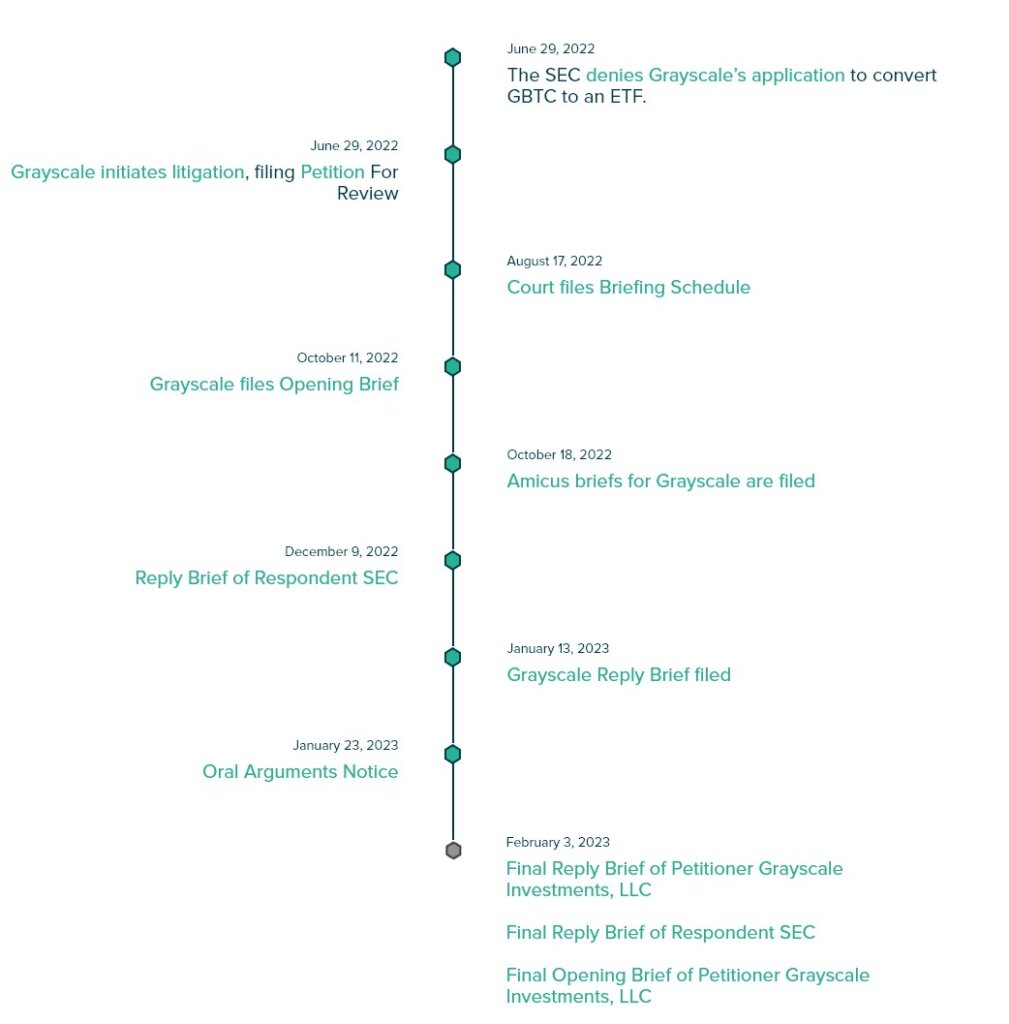

Grayscale announced that it had filed its final briefs in its litigation against the SEC to challenge the decision to deny the conversion of the Grayscale Bitcoin Trust into a spot Bitcoin ETF on Feb. 7.

The company disclosed that it filed documents “essentially identical” to those sent previously, but it required additional “citations and references” to appease the judges.

“These are essentially identical to other briefs that were filed previously, but with additional citations and references. It’s a necessary requirement to prepare the briefs to be read by a panel of D.C. Circuit judges.”

The SEC has repeatedly denied all applications for a spot Bitcoin ETF while allowing derivative alternatives such as ProShares Bitcoin Strategy (BITO) and Valkyrie Bitcoin Strategy ETF (BTF).

Since their inception, Bitcoin Futures ETFs have acquired over $700 million in assets under management. However, the SEC has previously cited Bitcoin’s volatility as a significant concern for allowing a spot Bitcoin ETF.

A detailed timeline of the dispute, which began in June 2022, is documented on the Grayscale website, including a breakdown of all filings.

The case’s oral arguments are scheduled for Mar. 7 in the District of Columbia. A pivotal point to be debated is Grayscale’s assessment of the SEC’s framework for allowing a spot Bitcoin ETF. The final brief submitted by Grayscale calls the SEC’s approach “fundamentally unreasonable.”

“The Commission’s approach is fundamentally unreasonable—as underscored by the fact that the Commission has made it impossible for any spot bitcoin ETP to satisfy the significant-market test, since there is no spot bitcoin market that the Commission considers “significant.””