Glassnode data reveals bullish trends for Bitcoin amidst latest rally

Glassnode data reveals bullish trends for Bitcoin amidst latest rally Glassnode data reveals bullish trends for Bitcoin amidst latest rally

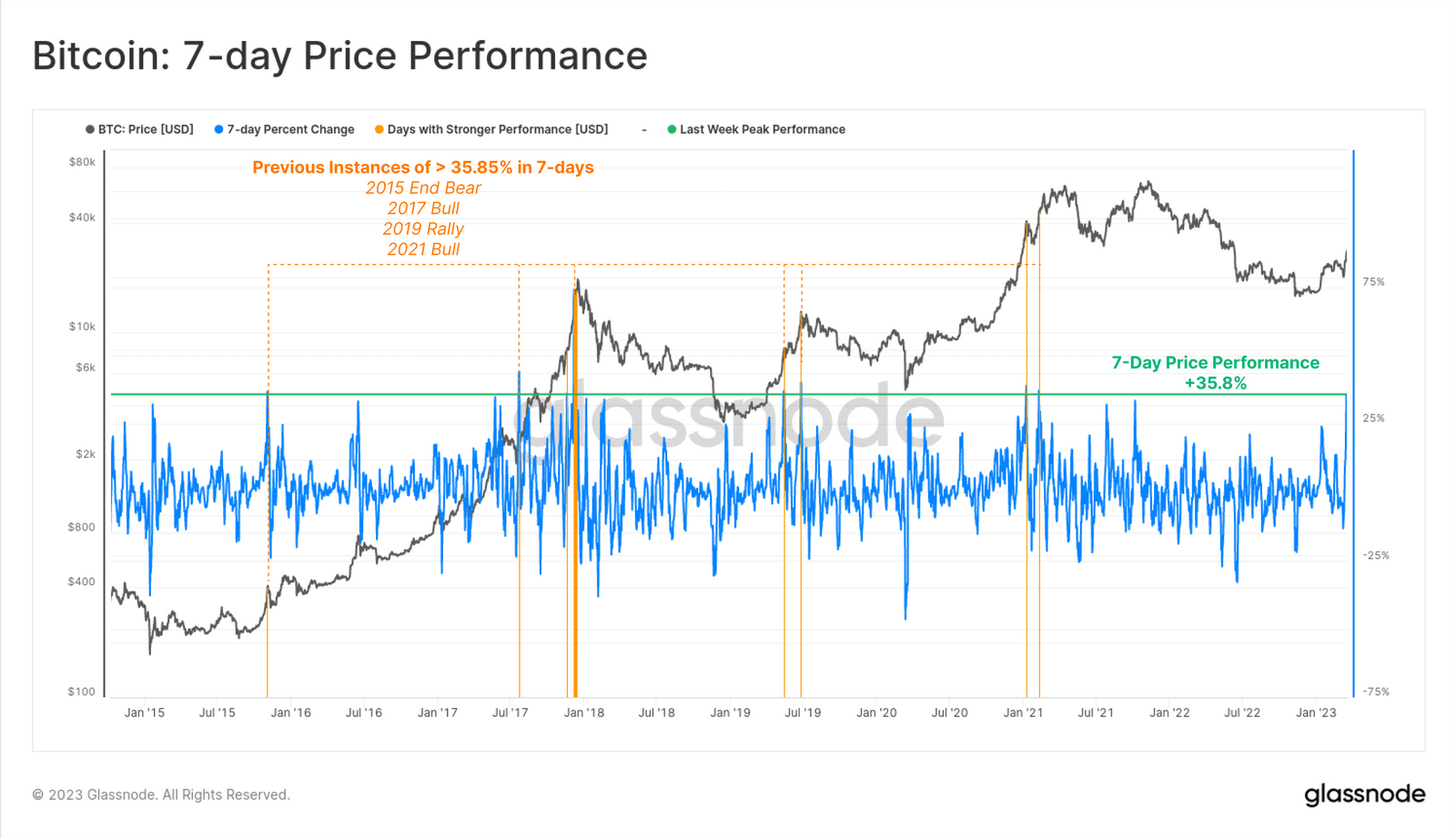

With Bitcoin hitting one of the best weeks in history, closing the week up 35.8%, several notable trends may indicate a bull market ahead.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has had one of its best weeks in history, with a closing increase of 35.8%.

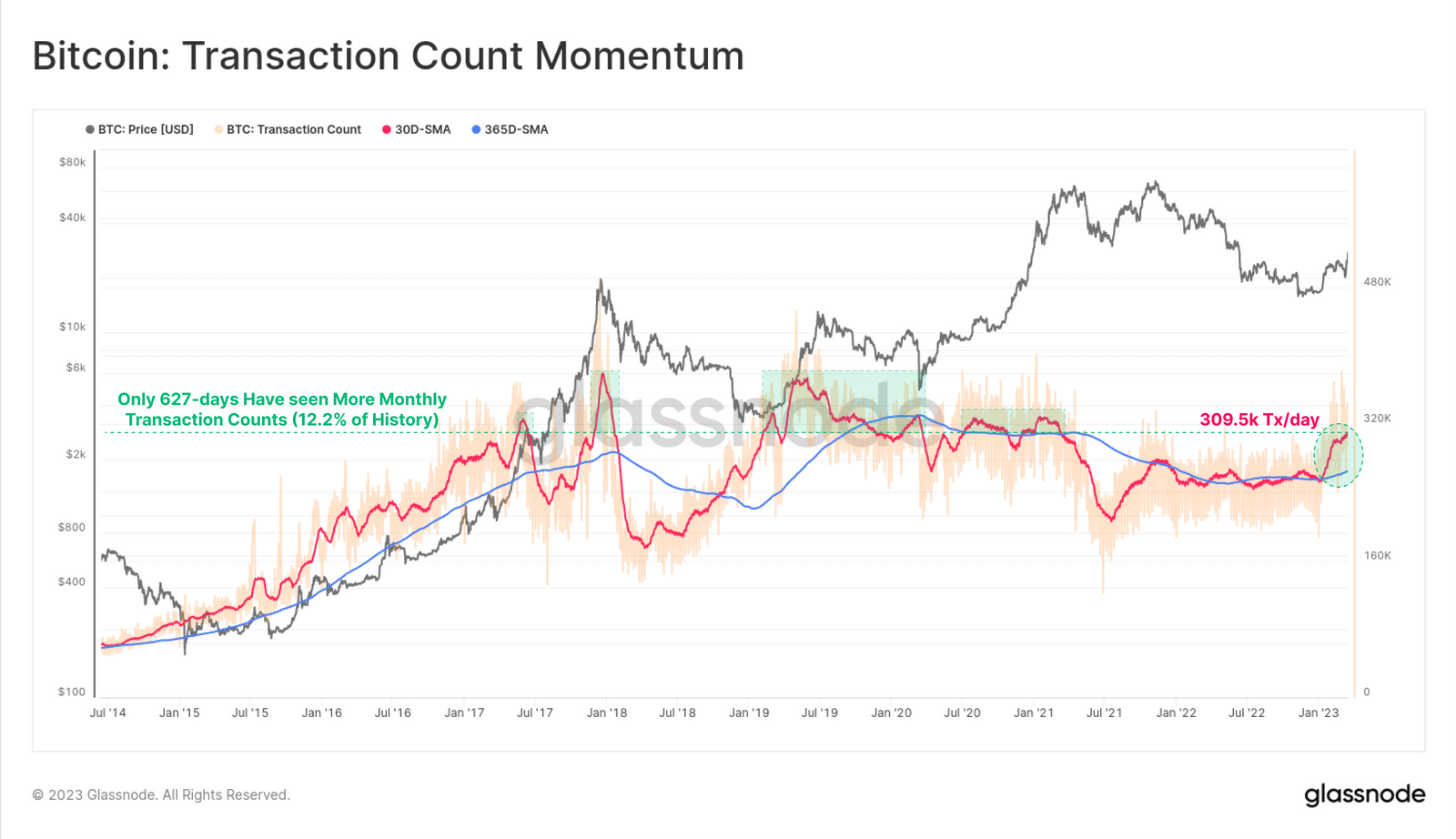

Bitcoin’s monthly average transaction count has hit 309.5k per day — the highest level since April 2021, according to on-chain analytics firm Glassnode. Despite the high price performance, the proportion of ‘hot coins’ is still close to cycle lows — indicating that most owners of older coins are not motivated to take profits.

But with Bitcoin’s price now appearing to shift towards the $30,000-32,000 range, does the latest rally mean we are out of bear market territory?

Glassnode data appears bullish

On the week of March 20, the monthly average of transaction counts reached 309.5k per day — the highest level since April 2021 and significantly above the yearly average. Less than 12.2% of all days have seen higher transaction activity for Bitcoin — a positive indication as this metric is typically linked with rising adoption rates, network effects, and investor activity.

Glass Node approximates that the number of distinct new entities operating on the blockchain as the best measure for unique new users. Their analysis shows that this metric has hit 122k new entities per day, but only 10.2% of days have had higher adoption rates for new users — which took place during the 2017 peak and the 2020-21 bull run.

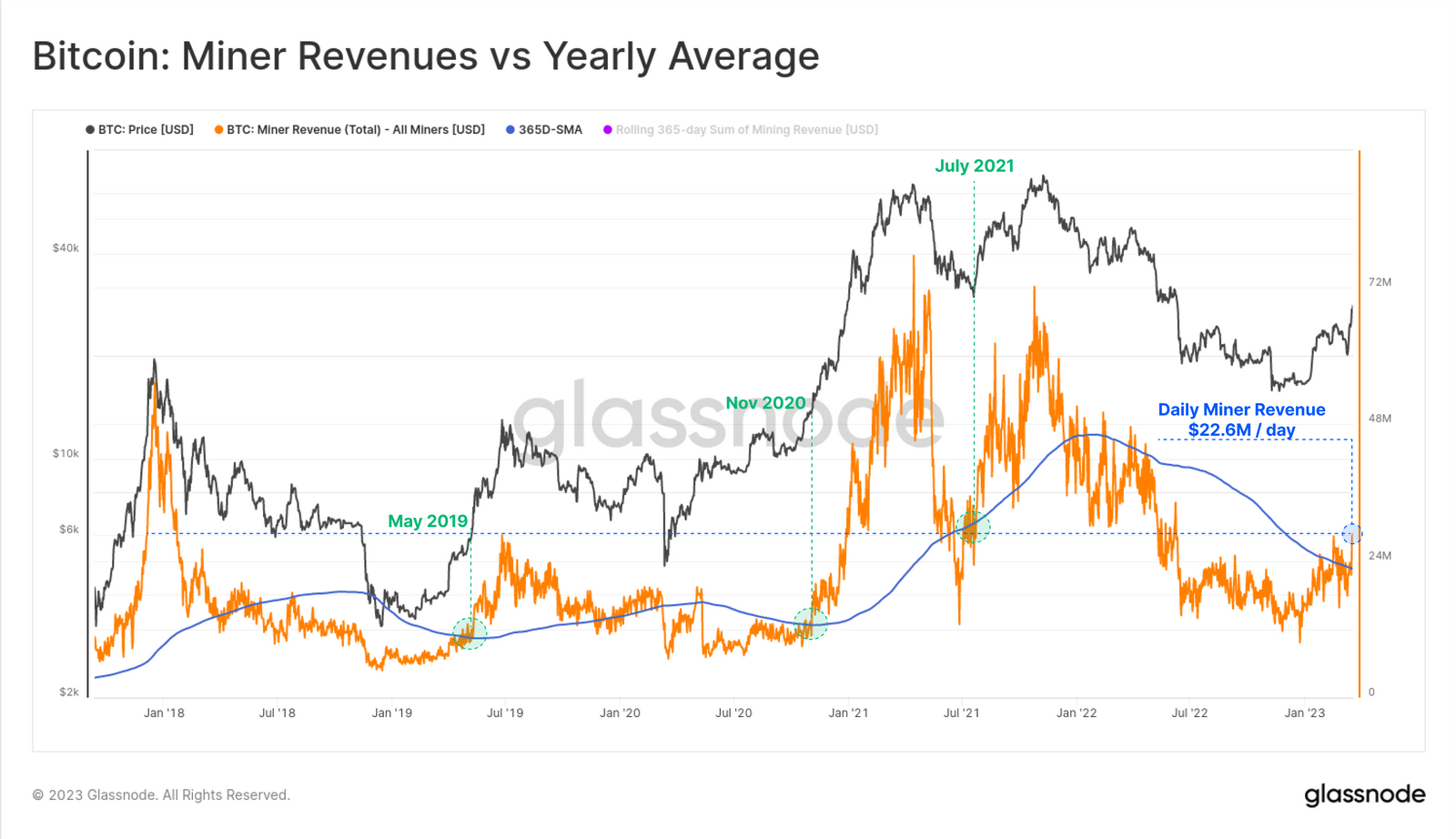

Bitcoin Miners also seeing influx

Miners are among the primary beneficiaries of this influx, with their total revenue surging up to $22.6 million per day. On the week of March 20, miner revenues have risen to their highest level since June 2022 — firmly surpassing the yearly average.

Similar to the activity models mentioned earlier, this trend is commonly seen during transition points towards a more favorable market.

Mining revenue in the green

Miners are without a doubt one of the lifelines of the crypto ecosystem. However, rising mining activity also leads to network congestion and gas fees, which are typical precursors to more constructive markets.

While high network fees can make small transactions more costly, they benefit miners who receive those fees for securing the blockchain.

According to on-chain data, miner revenue has returned to its highest point since June 2022 at $22.6 million/day — indicating that Bitcoin is back in bull territory, Glassnode says. Despite the strong price performance, the proportion of ‘hot coins’ is still close to cycle lows — indicating that most owners of older coins are not motivated to take profits.

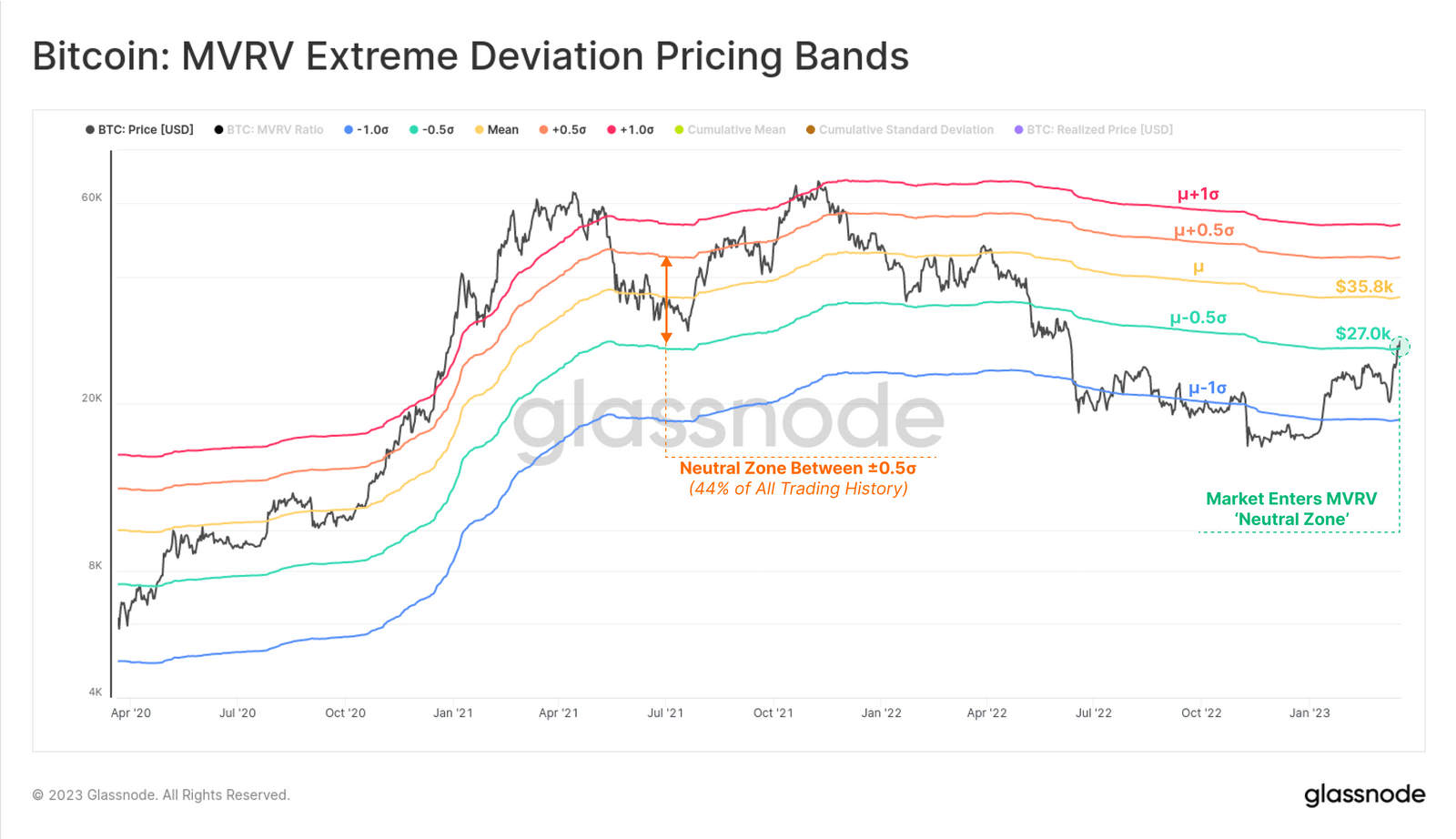

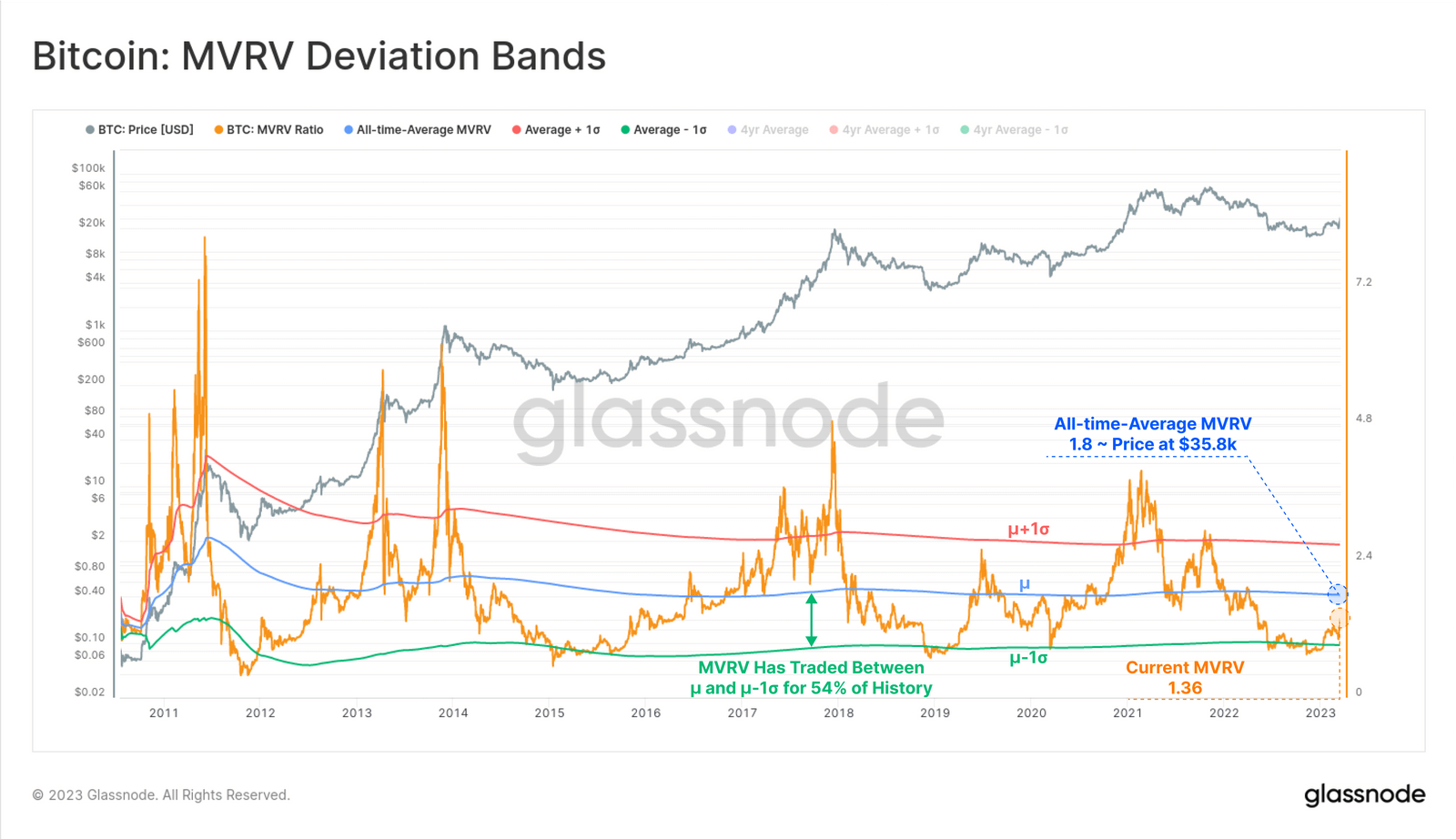

Glassnode’s report also analyzed Bitcoin’s MVRV (market-value-to-realized-value) ratio — which measures the unrealized profit multiple within the coin supply. The ratio has increased to 1.36 after surpassing $27,000 this week and has returned to its “neutral zone.” This suggests that prices are no longer heavily discounted in comparison to the average on-chain market cost basis.

Ultimately, Glassnode concludes that the future looks bright for Bitcoin:

“Bitcoin investors have experienced one of the strongest one-week gains on record, amidst a backdrop of stress, consolidation, and liquidity injections across the global banking system. Several on-chain indicators suggest that the Bitcoin market is transitioning out of conditions historically associated with deep bear markets, and back towards and greener pastures.”