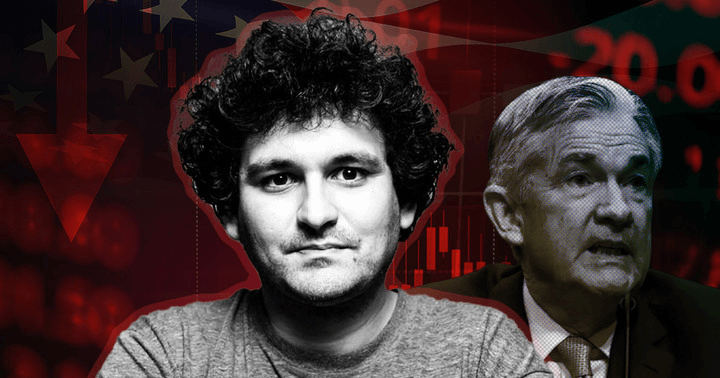

FTX CEO blames Fed Reserve for bear market, will step in to prevent ‘contagion’

FTX CEO blames Fed Reserve for bear market, will step in to prevent ‘contagion’ FTX CEO blames Fed Reserve for bear market, will step in to prevent ‘contagion’

SBF said the current downturn is a direct consequences of the Fed's decision to hike interest rates by such a high margin.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

FTX CEO and founder Sam Bankman-Fried (SBF) said the downturn in the crypto market is driven by the aggressive rate hikes introduced by the U.S. Federal Reserve to counter the rising inflation, he said during an interview with NPR.

SBF said he understands the regulator has little choice in such a difficult situation. Still, the Fed’s aggressive moves mean that the crypto market trajectory will directly depend on the watchdog’s decisions in the coming months.

The Fed raised interest rates by the largest margin in the last 28 years — 75 basis points — on June 15 after U.S. inflation hit its highest level in 40 years.

According to the crypto billionaire:

Literally, markets are scared. People with money are scared.

The overall market cap of the crypto industry has dropped from $3 trillion in 2021 to below $1 trillion. Every major digital asset like Bitcoin, Ethereum, Solana, and others has shed over 60% of its value since all-time-highs in 2021.

Meanwhile, crypto firms like Three Arrows Capital, Celsius, and Babel Finance face liquidity issues amid the current market turmoil.

Crypto platforms like Coinbase, Gemini, Crypto.com, and several others have announced intentions to downsize due to the macroeconomic situation.

SBF looks to prevent crypto contagion

Speaking on this development, SBF said that his trading firm, Alameda Research, will consider stepping in to prevent a contagion spread within the crypto sector.

SBF also used the opportunity to clear that his firm was not responsible for the severe liquidity shortage threatening some crypto companies.

However, he believes that his firms:

Have a responsibility to seriously consider stepping in, even if it is at a loss to ourselves, to stem contagion.

According to SBF, the current liquidity issue is a problem for the whole crypto industry, and companies in the space must do what is healthy for the ecosystem.

He added that the crypto industry would face more scrutiny from regulators on how leverage is used and if the companies adequately communicated the dangers.

FTX has previously provided Japanese cryptocurrency exchange Liquid with $120 million in funding in 2021 when it was short on liquidity for about $100 million, so there is precedent for such occurrences.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass