Three Arrows Capital insolvency rumors draw questions over soundness of DeFi

Three Arrows Capital insolvency rumors draw questions over soundness of DeFi Three Arrows Capital insolvency rumors draw questions over soundness of DeFi

Rumors on social media allege that Singapore-based crypto hedge fund manager Three Arrows Capital is on the verge of insolvency.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Rumors that Singapore-based crypto hedge fund managers Three Arrows Capital (3AC) may be insolvent are doing the rounds on social media.

Three Arrows Capital crypto hedge fund may be insolvent

June 14, 2022https://t.co/z4wtQX9LsO pic.twitter.com/BKmB1ebAw8

— web3 is going just great (@web3isgreat) June 15, 2022

The firm is widely regarded as a major player in the cryptocurrency world. Its most recent investment activities were a $20 million capital raise in the DEX platform Orderly Network on June 9 and a $2.5 million capital injection in data analytics firm Laevitas as its lead investor.

However, rumors are that the recent market turmoil may have left the firm over-exposed. With so many tentacles across many different crypto projects, the question arises: which counterparties may also be significantly affected?

Is 3AC dumping assets?

The rumors began as on-chain analysis showed 3AC had withdrawn on-deposit stETH from DeFi protocol Aave on Tuesday. According to Defiant, it sold the funds across several transactions totaling around $40 million.

stETH, or Staked Ether, represents Ethereum locked into the Beacon Chain staking contract (which cannot be withdrawn until the mainnet Merge rolls out). stETH acts as collateral to borrow more ETH on DeFi platforms. In other words, it’s a “workaround” that frees value from tokens locked in the Beacon Chain staking contract.

Twitter user @MoonOverlord, taking into account the social media activity of Three Arrows Capital co-founders Kyle Davies and Su Zhu, put two and two together to make insolvency claims.

3AC in trouble? rumors swirling

– Kyle and Zhu havent tweeted or liked anything in days

– Zhu took every coin and # tag out of his bio

– Zhu deleted his instagram

– an hour ago they dumped 30k stETH and reduced all AAVE positions— moon (@MoonOverlord) June 14, 2022

Further analysis by @MoonOverlord led him to surmise that 3AC’s stETH “dumping” was to pay for debt obligations.

people think Celsius is the biggest stETH dumper but its 3AC and it isnt relatively close, they are dumping on every account and seed round address they have, most looks like its going to payback debts and outstanding borrows they have pic.twitter.com/9bZnmTXQzj

— moon (@MoonOverlord) June 14, 2022

Will stETH be the straw that broke the camel’s back?

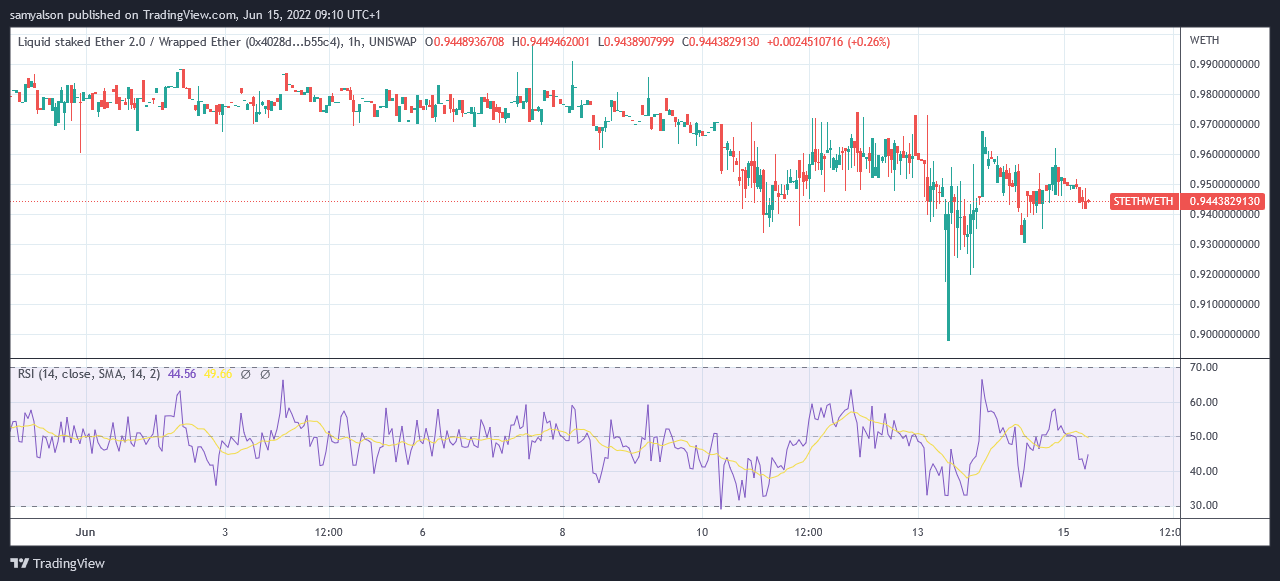

stETH is supposed to trade in 1:1 parity with Ethereum as the derivative token is redeemable for Ethereum once the mainnet Merge happens.

However, since June 9, that “peg” has shown signs of slipping. June 13 saw stETH dip as low as 0.89 against ETH.

The following day from the first sign of slipping, stETH token issuer Lido tweeted that DEX prices do not impact a holder’s ability to redeem ETH on a 1:1 basis.

Staked ETH issued by Lido is backed 1:1 with ETH staking deposits.

The exchange rate between stETH:ETH does not reflect the underlying backing of your staked ETH, but rather a fluctuating secondary market price.

— Lido (@LidoFinance) June 10, 2022

Nonetheless, stETH holders who want to exit their position will still sell at a discounted rate. All of which points to the fragility of DeFi in withstanding volatility.

Zhu posted an ambiguous tweet on Wednesday suggesting things at Three Arrows Capital are not okay and “relevant parties” are affected.

We are in the process of communicating with relevant parties and fully committed to working this out

— Zhu Su 🔺 (@zhusu) June 15, 2022

More will follow as the situation develops.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass