Feds consolidate 40k BTC, prompting fears of imminent sell-off

Feds consolidate 40k BTC, prompting fears of imminent sell-off Feds consolidate 40k BTC, prompting fears of imminent sell-off

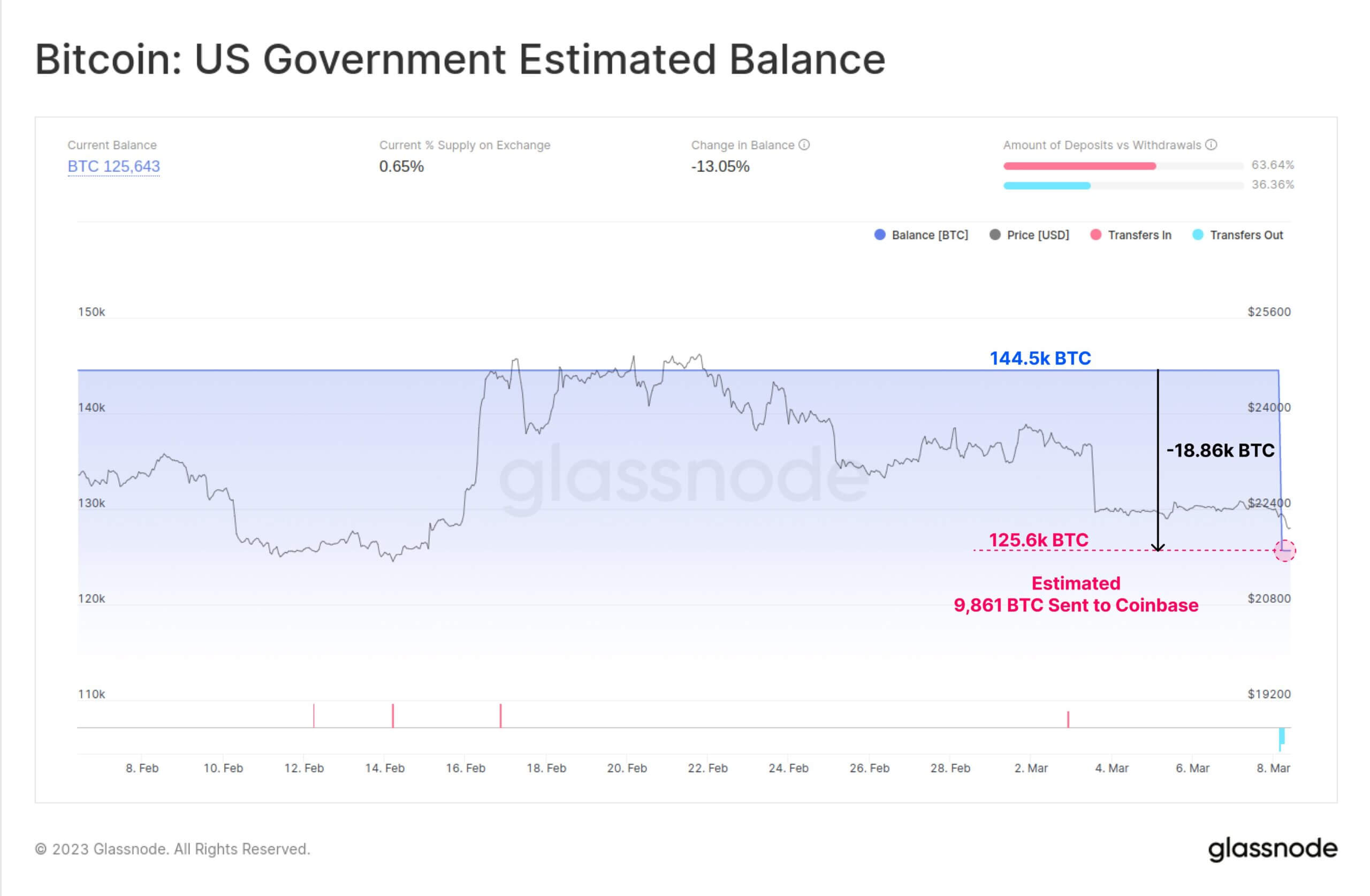

A new Glassnode chart reveals updated US government estimated crypto balance, raising fears of a BTC sell-off.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It seems that around 40,000 Bitcoin held in wallets linked to law enforcement seizures in the United States are currently being transferred, according to new data by Glassnode, a blockchain analytics firm.

At present, most of these transactions appear to be internal transfers.

Of the seized Bitcoin, 9,861 were seized from the Silk Road hacker and sent to a Coinbase cluster, on-chain data show.

PeckShield, another on-chain security firm, confirmed in a tweet that the roughly 40,000 BTC had been consolidated into two wallets controlled by the US government.

US government crypto is on the move

The movement of $1 billion worth of Bitcoin between U.S. government wallets, including a transfer of $217 million to Coinbase, has raised concerns within the cryptocurrency community about a potential sell-off that could drive down BTC prices.

The seized tokens stem from the 2013 raid of the illegal goods and services marketplace the Silk Road in 2013. By the end of that year, the FBI had become the 10th largest holder of Bitcoin in the world, amassing over 144k tokens across various seizures.

Silk Road was an online marketplace founded by Ross Ulbrict that facilitated the sale and transfer of illicit goods through a combination of VPNs and cryptocurrency.

From time to time, the Feds also sell the seized illicit crypto gains. In 2021, the Department of Justice announced they had sold $56 million worth of seized cryptocurrency as restitution to victims of the BitConnect fraud scheme.

Impact of potential sell-off on short-term BTC market

Fears are mounting that a sell-off of potentially 40k Bitcoin could put downward pressure on the price of the cryptocurrency. Moreover, with Bitcoin down over 9% in the last week, it remains to be seen what kind of support there is at the sub-$21k level, indicating that more short-term losses may be on the horizon.