Expect volatility: Bitcoin futures open interest surges to new all-time high

Expect volatility: Bitcoin futures open interest surges to new all-time high Expect volatility: Bitcoin futures open interest surges to new all-time high

Photo by Will Myers on Unsplash

Bitcoin has been seeing relatively quiet price action throughout the past few weeks, with the cryptocurrency primarily trading within the upper-$11,000 region as its bulls and bears reach an impasse.

During this consolidation phase, futures traders have been opening up a significant quantity of positions, signaling that they anticipate the benchmark crypto to make a large movement in the near-term.

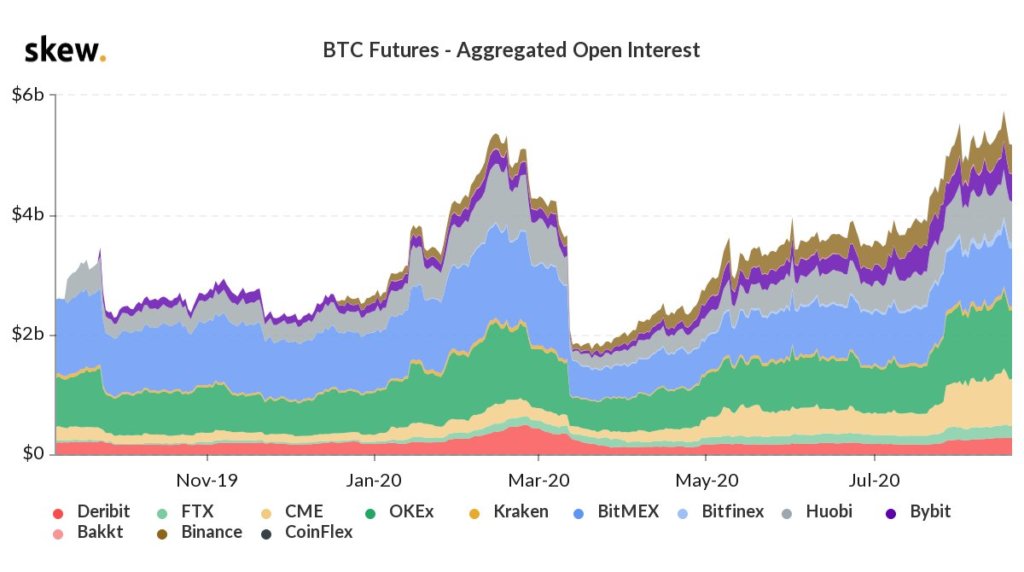

This has driven Bitcoin futures open interest to a fresh all-time high of over $5 billion, marking a full recovery from the massive hit that it took following the mid-March meltdown.

Typically, when futures open interest sees growth of this magnitude, it means that volatility is imminent for the underlying asset.

As for which side this volatility will favor, Bitcoin’s strong weekly close posted yesterday seems to indicate that bulls will ultimately prevail over bears.

Bitcoin futures open interest passes pre-March meltdown highs

Bitcoin’s price action over the past few weeks hasn’t been too exciting, as the cryptocurrency has been largely ranging between $11,000 and $12,000.

Each break above the upper boundary of this trading range has proven to be fleeting, with the selling pressure seen throughout the mid-$12,000 region being insurmountable.

This lackluster price action may soon come to an end, however, as the massive growth seen by Bitcoin future’s open interest suggests that volatility could be imminent.

According to analytics platform Skew, OI for BTC futures is now sitting at an all-time high of roughly $5 billion, which is just a hair above where it was when BTC peaked in late-February.

It also marks a massive recovery from its mid-March lows of under $2 billion.

“Bitcoin futures open interest is sitting at all-time-high at $5bln. Market has been quiet this week but there are a lot of open positions.”

Will BTC’s next movement favor buyers?

The massive amount of outstanding open interest suggests that the next movement will be quite large.

As for whether it will favor bulls or bears, the strong weekly candle close posted by BTC yesterday does seem to indicate that upside is imminent.

Josh Rager – a respected analyst – spoke about this weekly close in a recent tweet, explaining that he is anticipating further upside.

“Happy with this weekly close – prior resistance that held for multiple years. Now holding as support so far. If the daily can stay above $10,500 and weekly about $11,500 – should be a continuation to upside if so.”

The longer the ongoing consolidation phase persists, the larger the subsequent movement will likely be due to Bitcoin futures rapidly climbing open interest.

Bitcoin Market Data

At the time of press 8:06 am UTC on Aug. 26, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.53% over the past 24 hours. Bitcoin has a market capitalization of $209.63 billion with a 24-hour trading volume of $26.48 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:06 am UTC on Aug. 26, 2020, the total crypto market is valued at at $354.43 billion with a 24-hour volume of $111.13 billion. Bitcoin dominance is currently at 59.17%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)