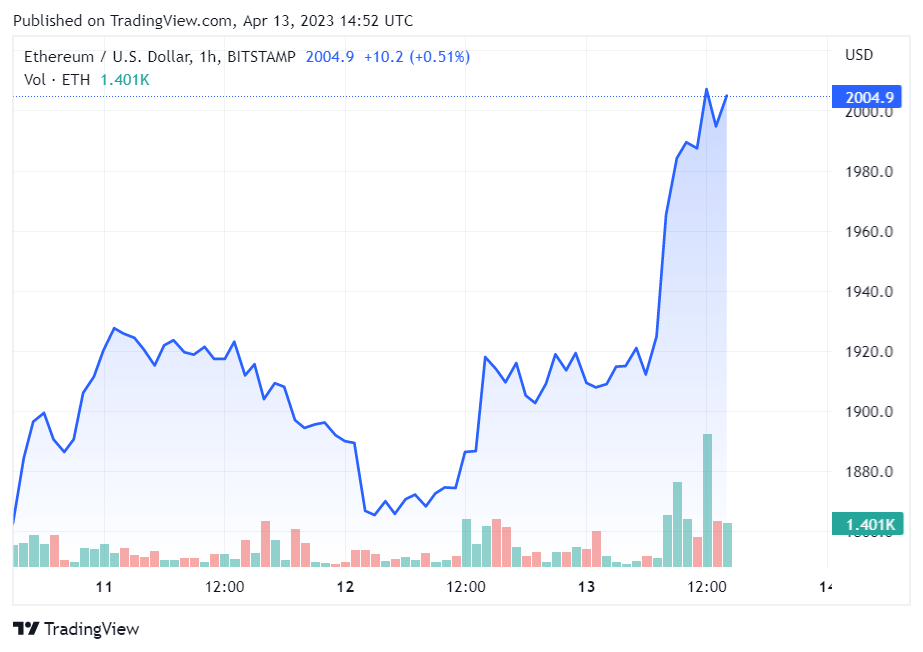

Ethereum trades above $2K for the first time in almost a year

Ethereum trades above $2K for the first time in almost a year Ethereum trades above $2K for the first time in almost a year

Coinglass data showed that Ethereum's positive performance liquidated almost $40 million in short positions within the last 24 hours.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum traded above $2,000 for the first time since May 2022 after the successful Shappella upgrade.

According to CryptoSlate’s data, ETH rose more than 6% in the last 24 hours to trade as high as $2,007. The digital asset has since retraced to $2,001 at the time of writing.

During the period, Ether outperformed Bitcoin’s price performance which only rose by less than 1%.

Coinglass data showed that ETH’s positive performance liquidated almost $40 million in short positions within the last 24 hours.

Meanwhile, Bitcoin and Ethereum are up over 81% and 60% year-to-date, respectively.

The success of the Shappela upgrade mostly influenced ETH’s positive price movement. The Shappella upgrade is the first major Ethereum network update since the Merge and will enable validators to withdraw their staked ETH.

While some analysts predicted that the unlock would place more selling pressure on ETH, the asset’s current performance showed that their fears were unfounded.

Data from Token Unlocks showed validators had withdrawn over 130,000 Ethereum at the time of press. The data further shows that roughly $1.8 billion worth of ETH is pending withdrawals.

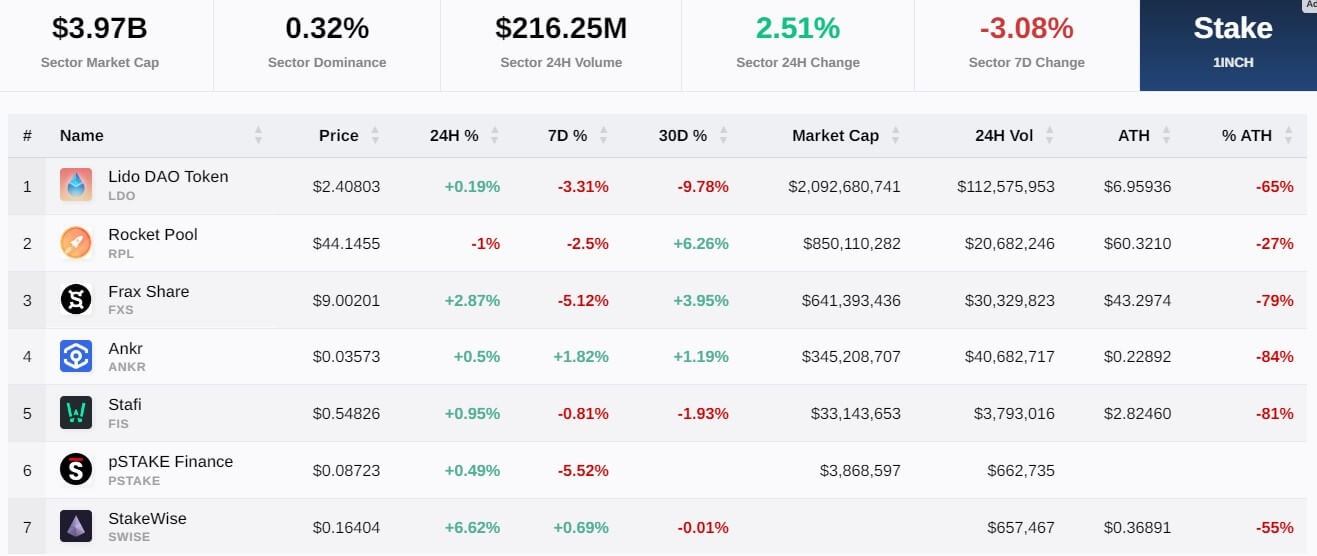

Liquid staking tokens rally

Liquid staking tokens have risen by roughly 3% in the last 24 hours, according to CryptoSlate’s data.

Except for Rocket Pool (RPL), the other cryptocurrencies in the sector gained all recorded gains during the reporting period.

According to the data, StakeWise (SWISE) gained 6.62%, while Frax Share’s FXS rose by roughly 3%.

Other protocols like Lido (LDO), ANKR, pStake Finance (PSTAKE), and Stafi (FIS) posted gains of less than 1%, respectively. Overall, the market cap of the crypto tokens in this sector sits at $3.97 billion as of press time.

In the last 24 hours, DeFillama data shows that the total value of assets locked (TVL) on the top liquid staking protocols rose by an average of 4%. According to the data, over 8 million ETH tokens — worth $16.03 billion — are staked through these platforms.