DeFi total value locked blasts through $6.4 billion, causing YFI, REN to rocket

DeFi total value locked blasts through $6.4 billion, causing YFI, REN to rocket DeFi total value locked blasts through $6.4 billion, causing YFI, REN to rocket

Photo by Clint McKoy on Unsplash

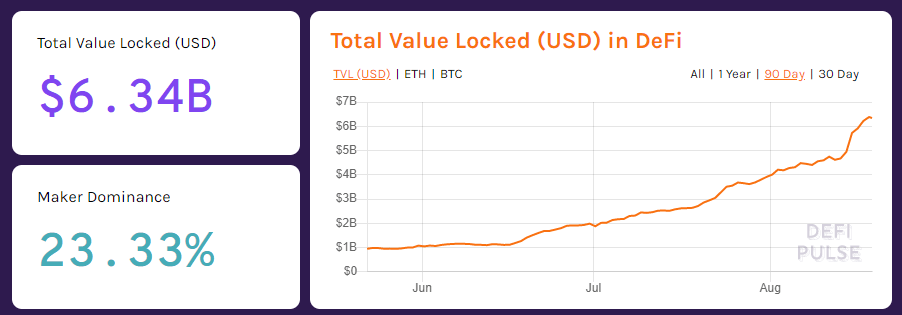

The total value locked of the Decentralized Finance (DeFi) market surpassed $6.4 billion for the first time. In doing so, it caused the valuation of leading tokens, like YFI and REN, to surge.

YFI and REN, the native tokens of protocols Yearn Finance and Ren Protocol, surged by 53 percent and 16 percent, respectively.

Demand for DeFi continues to explode

Analysts attribute the usability and the incentives of DeFi protocols as the primary catalyst for the resurgence of the sector.

Julien Bouteloup, a blockchain researcher, pinpointed that the top three DeFi protocols focused on utility over user interface.

Yearn Finance, Curve Protocol, and Aave all have rather simplistic user interfaces. But they have $600 million, $1 billion, and $1.12 billion in total value locked, respectively. He noted:

“Top 3 biggest DeFi projects: $CRV, $YFI and $LEND They focus on tech + utility rather than b*llshit UI templates. And still people find time to complain about UI in DeFi in general and want good looking Matcha Café yolo bozo designs face with tears of joy. Value vs hot air.”

Atop the growing user activity in the DeFi space, rapidly-growing DeFi projects have also started to build new technologies.

For instance, Yearn Finance introduced yinsure.finance, a new tokenized insurance system for the DeFi market. Yearn Finance’s announcement reads:

“Over the next few weeks we will systematically be releasing yinsure.finance, a prototype for a new kind of tokenized insurance. This post is a draft in detailing the architecture and how a decentralized insurance mechanism can be created.”

Investors, like Fred Ehrsam at Paradigm and Kelvin Koh at Spartan Black, said throughout 2020 that DeFi insurance would likely be the next big market.

“The insurance space is massive and largely virgin territory. More players will bring better products which will create greater demand. Win win,” Koh said.

The emergence of new technologies, solutions, and an overall increase in inflow into DeFi protocols are causing the market to expand.

Variables that could affect the market in the long-term

In the long-term, as DeFi continues to see fast growth, some experts say that a potential regulatory action against a major project could become a variable.

Attorney Collins Belton explained:

“DeFi hasn’t had its ‘regulatory debut’, but when it does, I suspect the types of players I mentioned above are more vulnerable than some ‘YOLO’ projects b/c they are easier targets or can indirectly curtail the rest of #DeFi without regulators having to risk bad precedent.”

In the near-term, the momentum of the market remains strong, with major venture capital firms, primarily based in Asia, optimistic about the sector.