Data shows that the ongoing crypto rally could be highly sustainable

Data shows that the ongoing crypto rally could be highly sustainable Data shows that the ongoing crypto rally could be highly sustainable

Photo by Isaac Wendland on Unsplash

Bitcoin saw a technically significant uptrend today that allowed it to erase virtually all of the losses resulting from the meltdown it faced in mid-March. Its $1,000 climb today sent shockwaves throughout the crypto market, leading many altcoins to post notable gains.

This uptrend comes after what appears to be a month-long bout of extreme accumulation from investors, signaling that this uptrend has been driven primarily by retail investors.

Data surrounding the number of wallets with a non-zero balance, as well as Bitcoin’s dwindling open interest, both seem to confirm this notion.

Bitcoin’s uptrend reaches a boiling point as retail investors drive massive movement

This latest uptrend appears to have been driven by significant buying pressure from retail investors, who met bears with enough strength to catalyze and intense rally that led BTC from lows of $3,800 to highs of just under $9,000 that were set today.

There may be some fundamental factors playing into this movement as well, with Bitcoin’s upcoming mining rewards halving coupled with the ongoing recovery seen throughout the traditional markets both playing in the favor of bulls.

The cryptocurrency’s ongoing recovery may also prove to be more stable than those seen in years past, as data regarding crypto investor’s profitability signals that they widely engaged in “dip buying” throughout the past several weeks.

Blockchain analytics platform Glassnode spoke about this phenomenon in a recent post, explaining that the profitability of circulating BTC has increased by 9 percent from the last time it was trading at this price.

“The overall Bitcoin market is now in a more profitable state than it was prior to the crash – indicating investors bought the dip. As BTC breaks past $8300, 73% of circulating BTC is in a state of profit – 9% more than the last time we saw this price.”

On-chain metrics point to notable retail investor-base growth

While looking towards data regarding who has been heavily participating within the crypto market in recent times, it grows clear that retail investors played a prominent role in this movement.skew

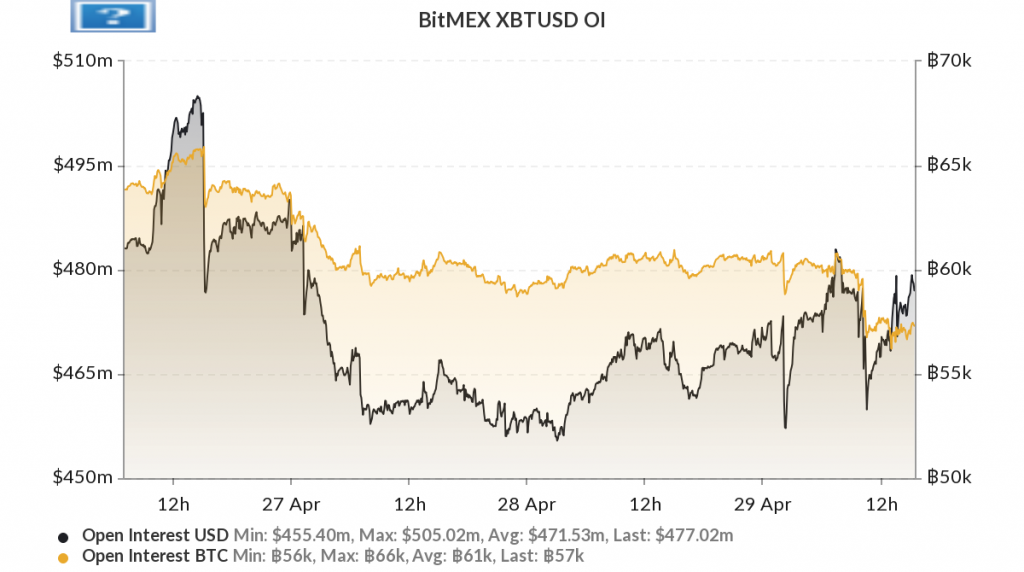

Data from blockchain intelligence platform Skew shows that open interest on popular crypto trading platform Bitmex has been dwindling in recent times, plunging today as a result of the extensive short-position liquidations.

This suggests a lack of engagement from active crypto traders.

Couple this with the massive growth of BTC wallets with non-zero balances – per data from Glassnode – and it grows clear that retail traders were the primary suspect behind this rally.

Passive investors driving this movement does bolster Bitcoin’s mid-term outlook, as it suggests that this uptrend may be more sustainable than those driven by margin traders.

Bitcoin Market Data

At the time of press 10:35 pm UTC on May. 1, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.32% over the past 24 hours. Bitcoin has a market capitalization of $161.24 billion with a 24-hour trading volume of $44.98 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:35 pm UTC on May. 1, 2020, the total crypto market is valued at at $246.7 billion with a 24-hour volume of $155.27 billion. Bitcoin dominance is currently at 65.38%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)