Consumer confidence in crypto remains high despite fallout from FTX

Consumer confidence in crypto remains high despite fallout from FTX Consumer confidence in crypto remains high despite fallout from FTX

The study found that 89% of respondents were still comfortable holding their crypto on centralized exchanges.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A new study by the blockchain infrastructure company Paxos shows that crypto owners see cryptocurrency as an investment and desire mainstream financial service providers to offer products and services that support it.

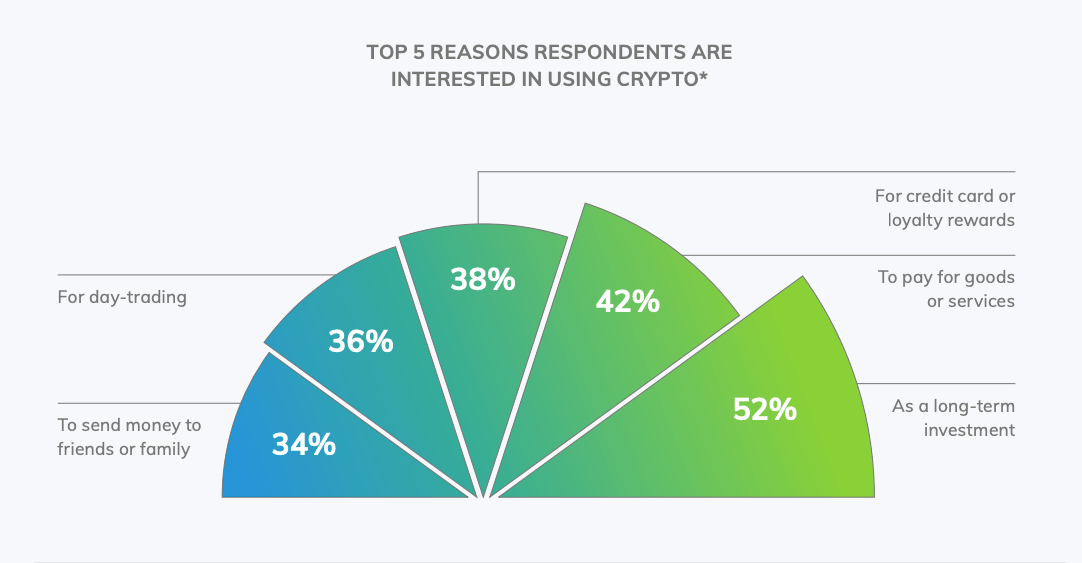

Top 5 Reasons Respondents are Interested in Crypto

According to the survey released on March 7, three of the top five most desired use cases for crypto involve everyday financial transactions, such as payments and remittances.

The top 5 reasons respondents said they are interested in crypto are for remittances (34%), day trading (36%), credit card and/or loyalty rewards (38%), to pay for goods or services (42%), and as a long-term investment (52%).

40% of respondents noted that they would be motivated to invest more in crypto if more merchants accepted it as payment.

The study found that card companies like Visa and Mastercard also have the potential to benefit from crypto’s widespread adoption, as respondents expressed a keen interest in earning credit card or loyalty rewards in crypto.

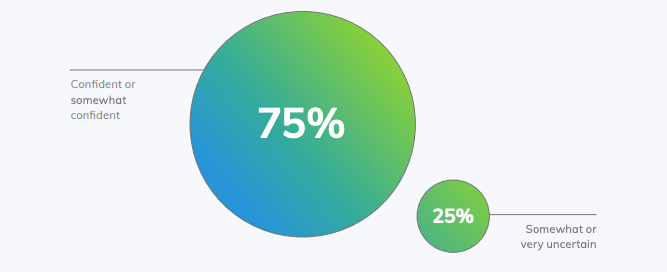

Confidence in Crypto Remains High, Perhaps Too High

Even after the institutional and retail funds worth billions were wiped out overnight during the FTX and Alameda fallout, 89% of respondents in the survey stated that they trust banks, crypto exchanges, and/or mobile payment apps to hold their crypto.

Interestingly, 27% of respondents purchased crypto for the first time in the last year, indicating that despite the 2022 crypto winter, interest in crypto remained strong and new users continued to enter the market. Moreover, 72% of respondents reported being only slightly or not at all worried about the volatility of crypto markets over the past year, further highlighting this positive sentiment towards the crypto industry.

Crypto Consumers Demand Banks to Join Crypto Ecosystem, Survey Finds

The latest survey shows that crypto owners want their banks and other financial institutions to enter the crypto market and support crypto purchases. The survey found that 75% of respondents are likely or very likely to buy crypto from their primary bank if it were offered, and 45% would invest more in crypto if banks and other financial institutions fully embraced digital assets. The survey also reveals that banks have a significant opportunity to meet the needs of existing customers and expand their offerings to support digital assets, given that two of the top three platforms for buying crypto are non-crypto-focused fintech companies.

- Two of the three top platforms crypto owners use to purchase crypto are non-crypto-focused fintech companies: PayPal (31%) and Robinhood (26%)

- Of survey respondents who purchased crypto in the past year, 68% made purchases at least 1-2 times per month

A total of 5,000 participants were enlisted to take part in Paxos’s online survey from January 5, 2023, to January 6, 2023. The full findings are based on unweighted aggregations of the survey responses and made available on Paxos’s website.