Congressman advances legislation to fire Gary Gensler, downgrade position

Congressman advances legislation to fire Gary Gensler, downgrade position Congressman advances legislation to fire Gary Gensler, downgrade position

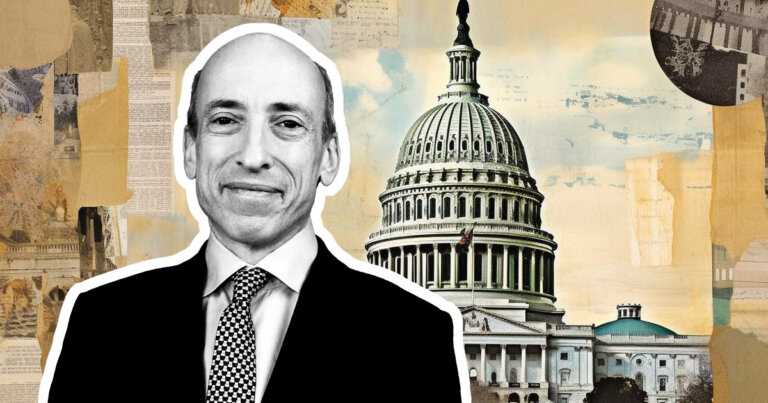

Gensler's SEC leadership has attracted controversy from the crypto industry.

SEC.gov. Remixed by CryptoSlate

Rep. Warren Davidson (R-Ohio) announced legislation to remove Securities and Exchange Commission (SEC) chair Gary Gensler in a tweet on April 16.

Davidson announces anti-Gensler legislation

On Twitter, Davidson wrote:

“To correct a long series of abuses, I am introducing legislation that removes the Chairman of the [SEC] and replaces the role with an Executive Director that reports to the Board (where authority resides).”

Davidson also said that former SEC chairs are “ineligible” for the downgraded position. If the legislation were to succeed, Gensler would no longer be able to serve in a leadership capacity at the Commission but presumably could serve in another role.

Davidson announced the legislation in response to Coinbase CLO Paul Grewal, whose original tweet concerned the SEC’s pursuit of a broadened definition of “exchange.” That broadened definition could impact DeFi platforms and other services not typically considered exchanges — a possibility that the SEC itself has observed.

Davidson appears to be acting in response to a Twitter campaign urging for Gensler’s removal. In late March, he wrote: “Let’s make the #FireGary movement bipartisan!”

Gensler, SEC face longstanding criticism

Davidson has criticized Gensler and the SEC in the past. In November 2022, he accused Gensler and the SEC of selective enforcement following the collapse of FTX.

In October 2022, he criticized the SEC’s decision to fine Kim Kardashian over her cryptocurrency promotions. At that time, Davidson wrote that the SEC’s “incoherent” and “inconsistent” enforcement policies would force crypto innovation overseas.

In February 2023, he accused the SEC of regulating by enforcement when it sued Kraken over its staking services. The SEC also forced Kraken to discontinue staking in the U.S.

The SEC’s board of commissioners currently has five members. Two commissioners — Hester Peirce and Mark Uyeda — have regularly dissented from the regulator’s strict decisions around crypto policy, including some of the above issues.