Coinbase dominates US market with over 75% market share

Coinbase dominates US market with over 75% market share Coinbase dominates US market with over 75% market share

Binance.US and Crypto.com follow Coinbase as the second and third most dominant centralized crypto exchanges in the US.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Coinbase has become the most dominant centralized crypto exchange (CEX) in the U.S. — accounting for 76.2% of the country’s total market share, according to CoinGecko’s recent report.

Binance.US and Crypto.com follow Coinbase as the second and third most dominant CEXs, the CoinGecko data revealed.

Top 5 in the US

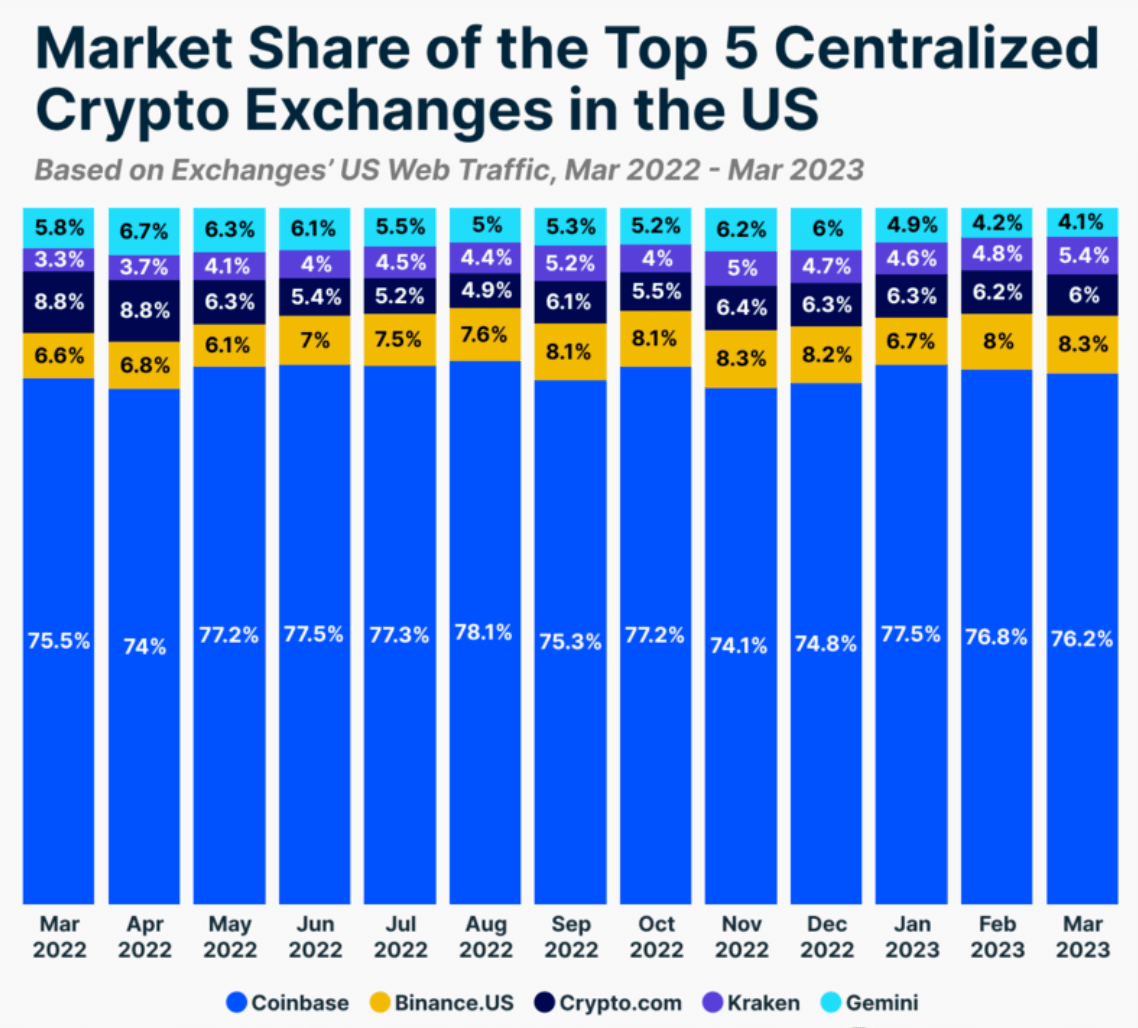

The data presented in the report starts in March 2022, revealing that Coinbase has been the major dominant CEX in the U.S. since then.

In the last 12 months, the lowest market percentage Coinbase accounted for was recorded in April 2022, at 74%. Meanwhile, the highest was recorded on August 2022, at 78.1%.

Binance.US follows Coinbase as the second most dominant CEX in the U.S. market. However, the exchange only accounted for 8.3% of the whole market share in March — reflecting some growth.

Binance.US grew its market share from around 6% through March, April, and May 2022, to over 7% in July 2022. Throughout the second half of 2022 and the beginning of 2023, Binance.US consistently expanded its dominance in the U.S. market to over 8% — except for a brief fallback recorded in January.

Meanwhile, Crypto.com is ranked as the third most dominant CEX in the U.S. market. However, the exchange’s dominance rate shrank to 6% in March, from the 8.8% recorded in March 2022.

Kraken and Gemini also made it amongst the top five largest CEXs of the past 12 months by almost equally sharing the remaining 10% market share.

Coinbase

It is worth noting that the U.S. Securities and Exchange Commission (SEC) issued a Wells notice to Coinbase on March 22. The notice indicated that the SEC had made a preliminary determination to recommend an enforcement action against Coinbase.

The exchange’s initial response was to welcome a legal process, indicating that it was ready to legally stand its ground with the SEC.

Even though Coinbase collected the crypto community’s support regarding the warning, the notice specifies that the upcoming enforcement of the SEC will likely concern parts of Coinbase’s main trading platform, Coinbase Prime and Coinbase Wallet — which could affect Coinbase’s market share within the U.S.