BlackRock’s spot BTC ETF tops $720M in daily volume, marking highest level to date

BlackRock’s spot BTC ETF tops $720M in daily volume, marking highest level to date BlackRock’s spot BTC ETF tops $720M in daily volume, marking highest level to date

BlackRock's total inflows are set to surpass $5 billion once trading closes for the day, bringing its Bitcoin hoard to a little over 96,669 BTC.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

BlackRock’s spot Bitcoin ETF — the iShares Bitcoin Trust (IBIT) — surpassed a record high of $720 million in daily volume on Feb. 14 to take the number one spot in terms of volume, according to data from Coinglass.

Commenting on IBIT’s more than $700 million in volume on Feb. 14, Bloomberg ETF analyst Eric Balchunas described the trend as a “more unusual second wind strength” for the fund. He explained:

“[The] reason this is interesting and unusual is [because] early on IBIT’s volume was correllated [with] GBTC outflows and perhaps to any ‘lined up’ cash [BlackRock] had. Thought all that would wind down a bit in unison, and it started too, but then IBIT broke the [f—] loose.”

IBIT cements lead

Balchunas noted that volume for the “Newborn Nine” usually indicates inflows as there aren’t many existing investors looking to sell, compared to a fund like GBTC that was converted into an ETF and had pre-existing holders.

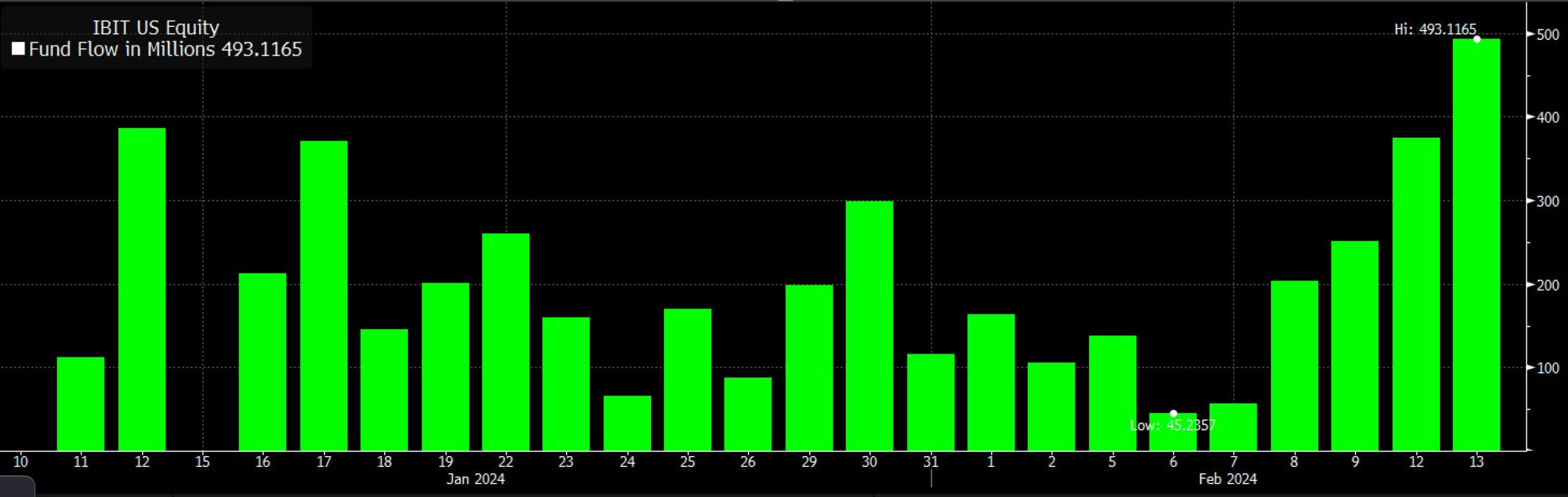

IBIT reached $493 million in daily volume on Feb. 13, with the entirety being inflows, based on Farside Investors’ data, which shows that IBIT’s volume has been rising consistently after hitting a record low on Feb. 6.

Comparatively, Grayscale Bitcoin Trust (GBTC) recorded $72.8 million in outflows on Feb. 13, indicating a significant slowdown in sell pressure compared to last month. The fund’s outflows have remained under the $100 million level for the most part over the past week.

At 9:27 pm UTC on Feb. 14, Coinglass showed that GBTC was reporting $681 million in volume, while the Fidelity Wise Origin Bitcoin Fund (FBTC) was at $455 million. The market’s seven other spot Bitcoin ETFs had less than $200 million in volume each.

BlackRock’s total inflows are set to surpass $5 billion once trading closes for the day, bringing its Bitcoin hoard to a little over 96,669 BTC.

Meanwhile, FBTC is close on its heels with total inflows of just under $4 billion.

Top 7%

BlackRock’s IBIT is also the second largest spot Bitcoin ETF when ranked by market cap and is competing with some of the biggest traditional funds in daily volume.

Grayscale’s GBTC, which existed as a non-exchange traded fund before it was converted to an ETF in January, has a significantly higher market cap of $24 billion but also has more significant outflows.

When ranked among all non-cryptocurrency ETFs, IBIT’s current market cap places it among the 250 largest funds based on rankings from 8marketcap.

Balchunas noted:

“[$5 billion AUM] puts it in Top 7% of all ETFs by size in just 23 trading days. “

Roughly 3,100 ETFs exist in the US at present.