Bitcoin trades at premium on Binance US as liquidity dries up

Bitcoin trades at premium on Binance US as liquidity dries up Bitcoin trades at premium on Binance US as liquidity dries up

Binance US has seen its trading activities drop to record lows following the SEC's lawsuit against the firm.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

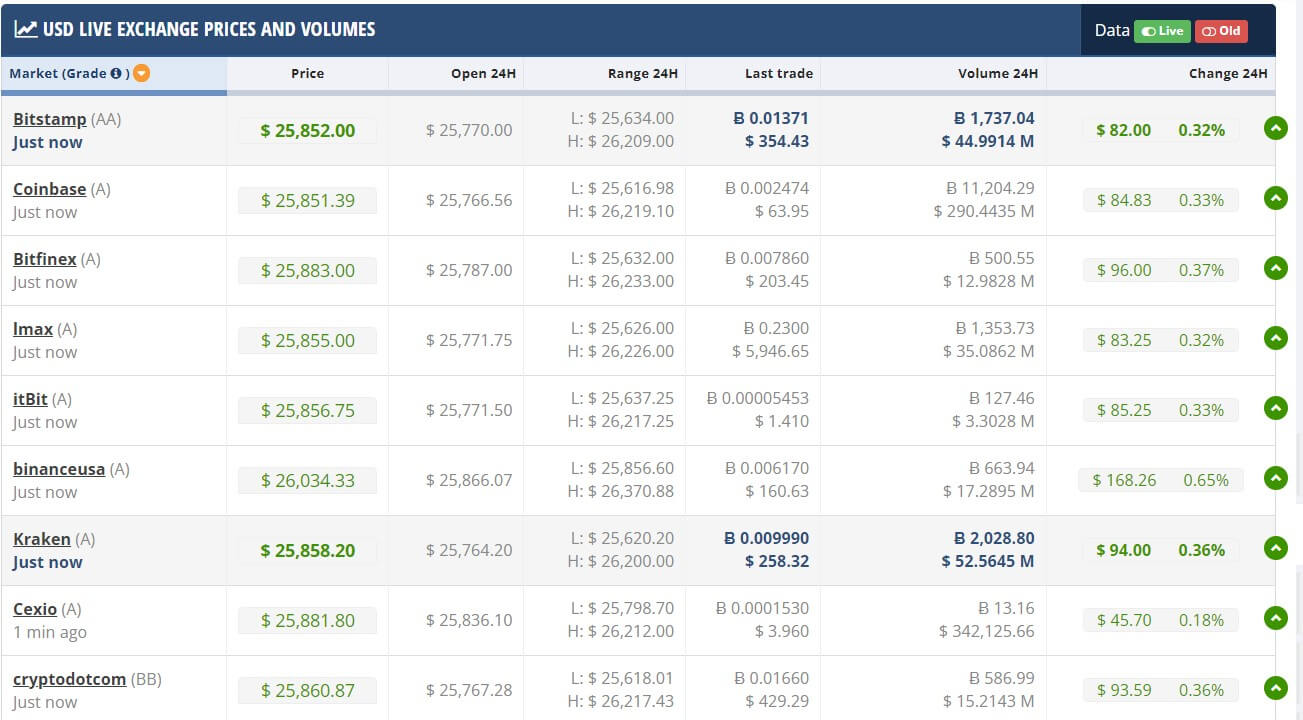

Bitcoin (BTC) is trading at a premium of over 1% on Binance.US as the exchange’s USD trading volume has dropped to new lows after the U.S. SEC’s lawsuit, according to CryptoCompare data.

CryptoCompare data indicates that BTC was trading above $26,000 on Binance.US, surpassing the prices of major rivals like Kraken and Coinbase with over $150 as of press time.

Binance US trading volume falters

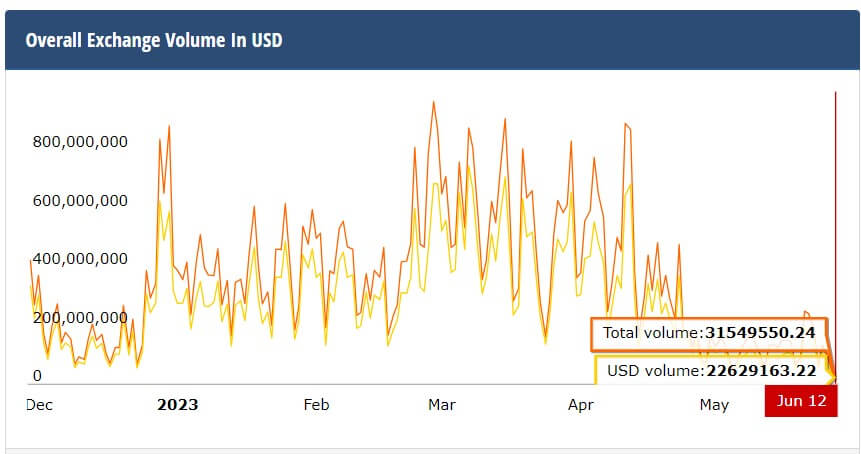

Despite its BTC premium, USD volume on the exchange has slowed significantly, dropping from a peak of over $684 million recorded on March 14 to less than $25 million, according to CryptoCompare data.

This decline can be linked to the exchange’s banking partners’ decision to halt USD payment channels by June 13. Due to this, Binance US said it would transition to a crypto-only platform because of its regulatory issues.

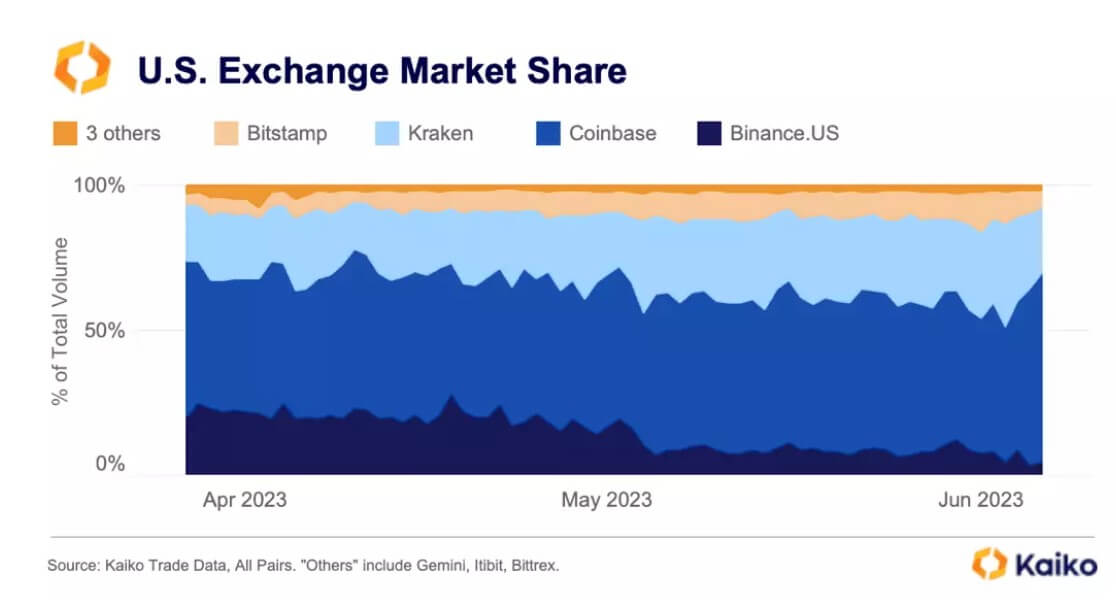

Data from Kaiko further corroborates the exchange’s declining trading activities. Kaiko reported that Binance US market share, compared to other U.S. exchanges, dropped to 4.8% after the lawsuit, down from 20% in April.

On the other hand, Coinbase market share surged from 46% to 64% within a week of its own SEC lawsuit.

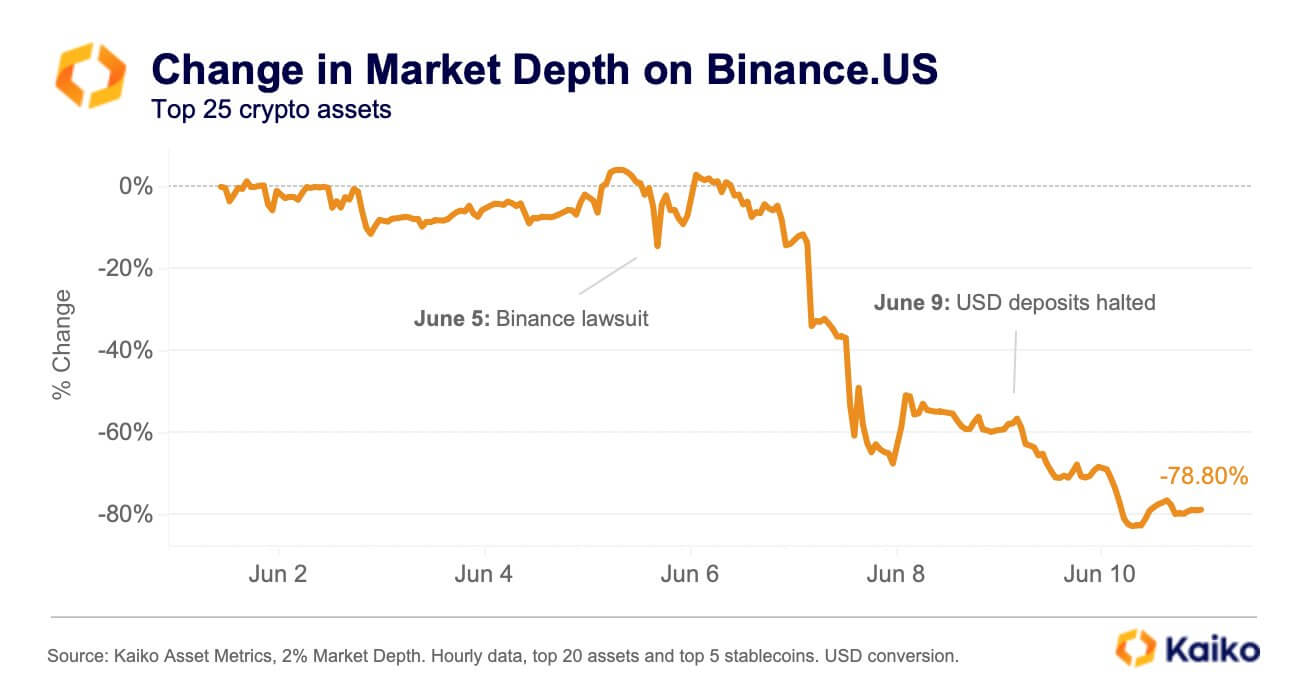

Binance US market depth declines 78%

Meanwhile, Binance US’ market depth dropped by 78% within a week of the U.S. SEC filing a lawsuit against the company for violating federal securities law, as per Kaiko data.

During the past week, Kaiko noted that the exchange’s market depth for 17 tokens dropped to just $7 million from the $34 million recorded on June 4 — a day before the SEC’s lawsuit.

Kaiko stated that market makers and traders left the exchange due to concerns about potential asset lock-ups. On June 6, the SEC moved to freeze Binance’s U.S. assets, arguing that this action was needed to ensure the safety of customers’ funds.

“[Binance US] market makers are nervous and want to avoid volatility-induced losses and the non-negligible possibility that their assets could get stuck on an exchange à la FTX collapse.”