Bitcoin long positions spike 60% on Bitfinex

Bitcoin long positions spike 60% on Bitfinex Bitcoin long positions spike 60% on Bitfinex

The last time Bitfinex BTCUSD Longs spiked bitcoin ran up to a new all-time high within four months. Could this be an indicator of a local bottom?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Long positions on Bitcoin have hit an all-time high on Bitfinex as they spike over 60% in a day. The spike is one of the most aggressive moves up that has ever been seen on the exchange. The previous all-time high was hit in July 2021 with the BTCUSD Longs product being first introduced in August 2017.

The history of long positions on Bitfinex can perhaps give some insight into the state of the market and where we could be headed next. Some analysts are looking for the last time that longs peaked to suggest that there may be a respite in the downward movement of the market ahead.

A review of the BTCUSD Shorts product also makes interesting reading. On the weekly chart, there is a long wick up towards 7500 before a weekly close of 3111. This indicates that the short positions took advantage of the volatility in the market across the past week but have now closed out positions. When this is paired with the 60% increase in long positions it indicates bullish sentiment for the market overall.

Bitfinex CTO, Paolo Ardoino called the event “accumulation” suggesting that he agrees Whales are acquiring Bitcoin at a discounted price. He went on to say,

“Some whales are increasing their existing longs a lot. Keep in mind that he may hedge himself somewhere else, so not necessarily bullish (although I am by nature)” (from Italian via Google Translate)

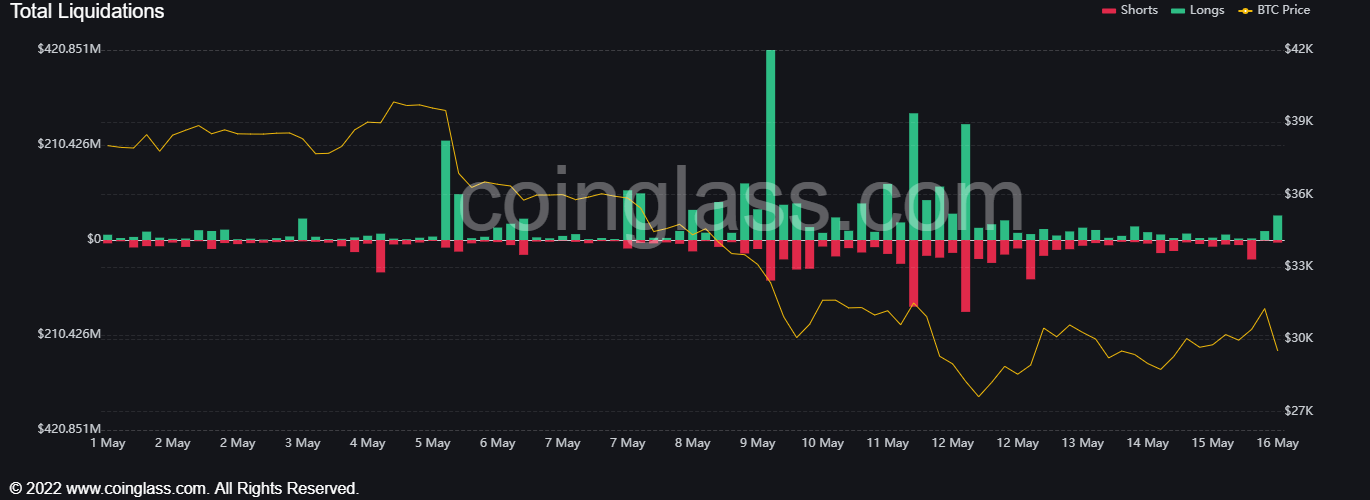

This comment is important to note as Ardoino highlights that long positions in futures markets are often offset by selling Bitcoin (shorting) on the spot market. This strategy can give you a hedge against further market volatility depending on how you set your limit orders in the futures contract. A small miss-step in this strategy can lead to oversized losses, especially for those using margin or leverage. Over $500 million in Bitcoin long positions have been liquidated since May 9 and over $2 billion across the entire crypto market. The below graph from Coinglass shows both long and short liquidations since May 1.

Bitcoin Market Data

At the time of press 12:00 pm UTC on May. 16, 2022, Bitcoin is ranked #1 by market cap and the price is up 0.93% over the past 24 hours. Bitcoin has a market capitalization of $573.23 billion with a 24-hour trading volume of $32.26 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:00 pm UTC on May. 16, 2022, the total crypto market is valued at at $1.29 trillion with a 24-hour volume of $87.73 billion. Bitcoin dominance is currently at 44.50%. Learn more about the crypto market ›