Bitcoin breaks $31k as it continues to shake off recent slumps

Bitcoin breaks $31k as it continues to shake off recent slumps Bitcoin breaks $31k as it continues to shake off recent slumps

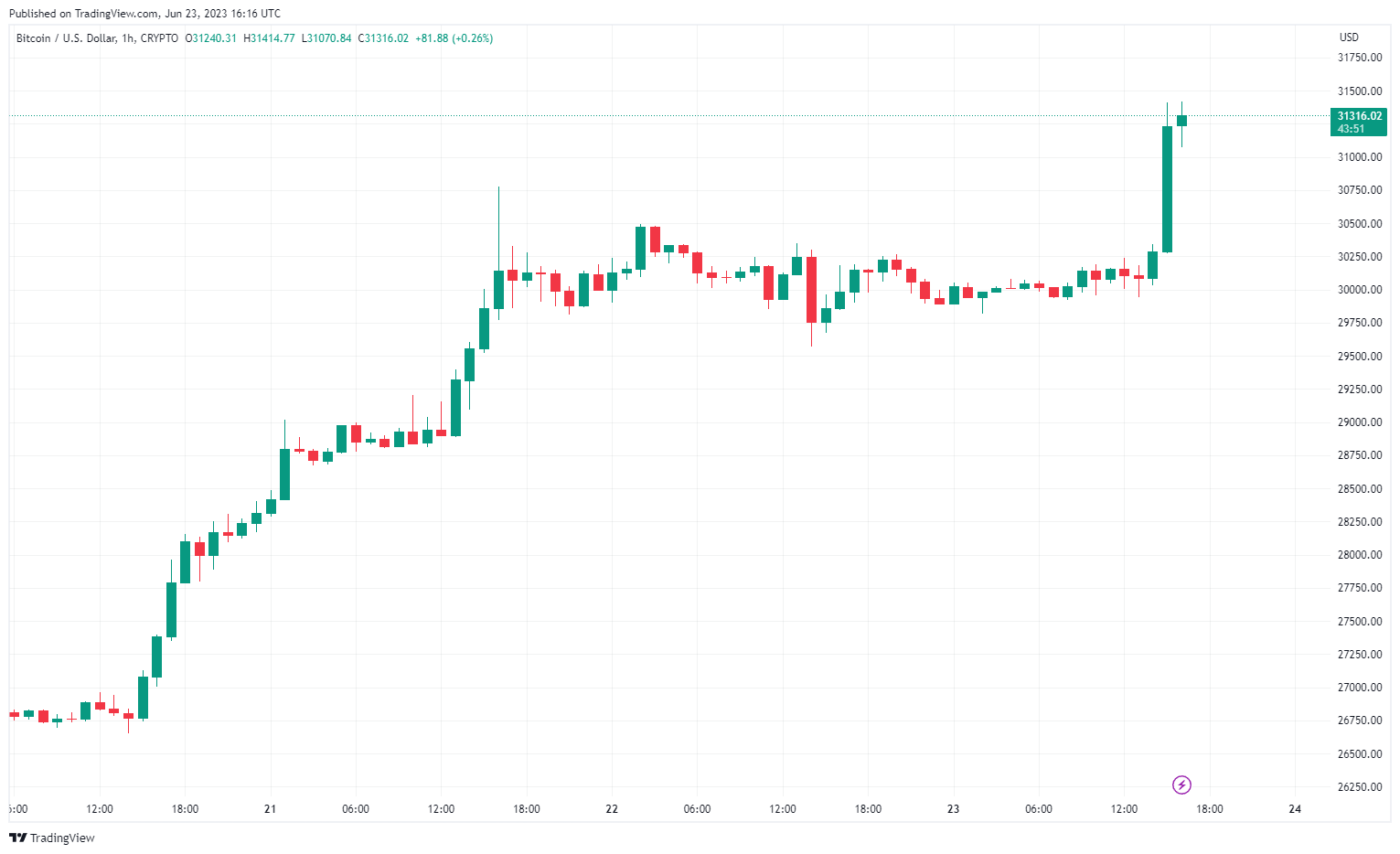

Bitcoin surged to a year-to-date high of $31,000, buoyed by a wave of institutional interest and exemption from recent enforcement actions.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As ongoing regulatory pressures ramp up towards several cryptocurrencies, Bitcoin (BTC)has shown impressive resilience, breaking the $31,000 barrier today and marking its highest close of the year.

This jump comes after a prolonged period of stagnant trading, with Bitcoin wavering between $25,000 and $30,000 since March 16.

The liquidation volumes for each cryptocurrency over the past 4 hours were $30.01 million in Bitcoin, $17.27 million in Ethereum (ETH), and $3.15 million in Bitcoin Cash (BCH), according to Coinglass data. These values contribute to the total 4-hour liquidation amount of $72.20 million, comprised of $13.01 million of long positions and $59.18 million of short positions.

Bitcoin was trading at $31,234 as of press time.

BTC surge after institutional interest

This Bitcoin surge follows a wave of institutional interest. Global investment giant BlackRock submitted an application last week to the U.S. Securities and Exchange Commission for a spot Bitcoin ETF. The regulator has yet to grant approval for a spot Bitcoin ETF.

Adding to the positive sentiment around Bitcoin, the launch of EDX Markets on June 20, which coincided with Bitcoin reclaiming the $28,000 mark, has been well-received by the market. Backed by heavyweights Fidelity, Charles Schwab, and Citadel Securities, EDX Markets is a promising institutional crypto exchange.

Bitcoin’s rise is a stark contrast to the rest of the cryptocurrency market, which has been struggling in the aftermath of the SEC’s unprecedented lawsuits against Binance and Coinbase. The SEC has alleged that several popular cryptocurrency tokens are, in their view, unregistered securities.

SEC Chair Gary Gensler has been explicit about his plan to take action against crypto firms that, in his view, operate outside U.S. law. Gensler has stated that all cryptocurrencies, with the sole exception of Bitcoin, qualify as securities under U.S. law. However, Gensler’s stance on Ethereum, the second-largest cryptocurrency by market cap, remains unclear.