August 2022 GameFi Report

August 2022 GameFi Report August 2022 GameFi Report

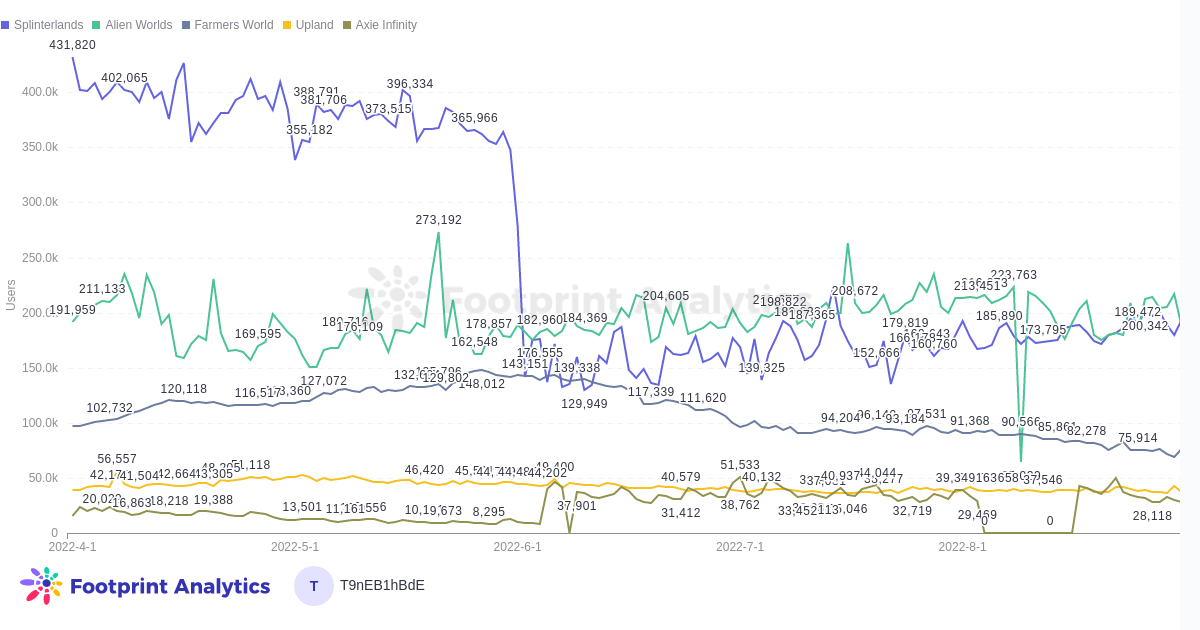

Splinterlands and Alien Worlds continue to be neck-and-neck as they steadily increase the number of users since June despite the market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

While the number of new users entering GameFi has dropped precipitously, the average number of transactions per user is increasing steadily. Therefore, with the users in the market today more likely to be actively gaming, GameFi data from August can help us understand which projects and ecosystems are sustainable in the long run.

Splinterlands and Alien Worlds continue to be neck-and-neck as they steadily increase the number of users since June despite the market. In contrast, once promising Farmers World continues to bleed users.

A massive $200M funding round for stealth mode Web3 gaming studio Limit Break and large rounds for other developers like Animoca and Gunzilla Games show that investors are banking on studios to carry the torch once the market reverses.

Key Findings

Overall Market

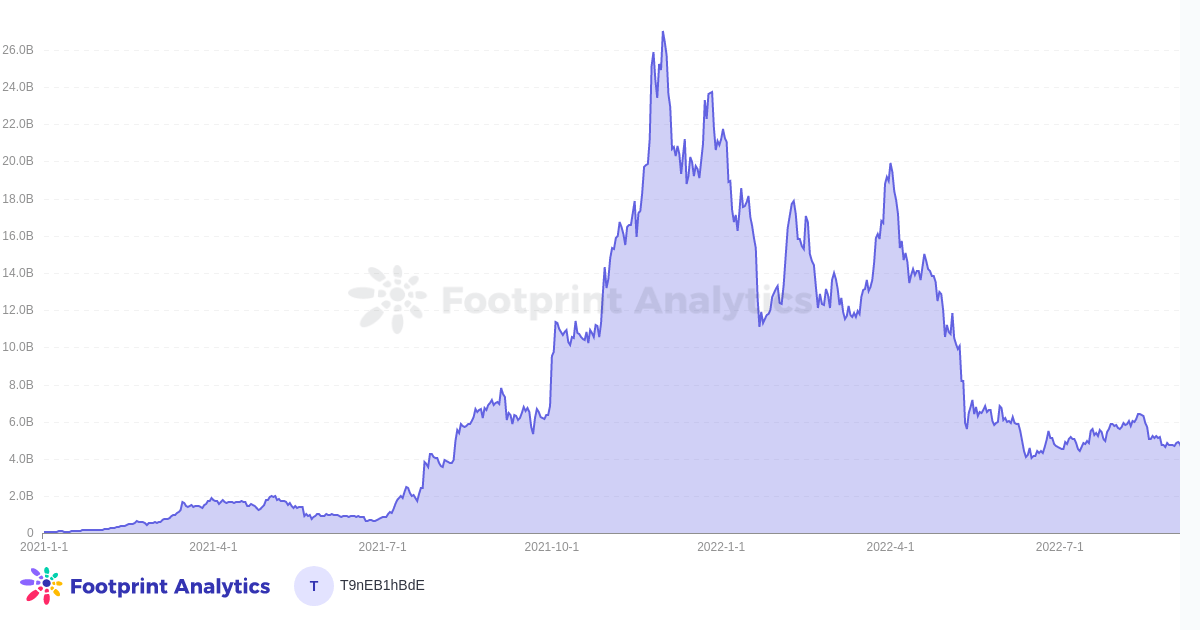

- The total volume in GameFi saw its first MoM respite after nine months of consecutive declines, growing 28% percent—not enough to break the overall downwards trend or warrant celebration just yet

- For perspective, volume in August was 93.5% under its December 2021 highs at the peak of the bear market

- While the volume per user declines, the transactions per user increase—there is no straightforward conclusion to draw. Still, it may mean that participants in the market today are more likely to be actively gaming and enjoying the games.

- BNB has a relatively tiny portion of volume (10.6%) and of gaming transactions (under 5%) despite having the most projects—lending credence to the argument that the chain is full of vaporware games nobody wants to play.

Financing & Investment

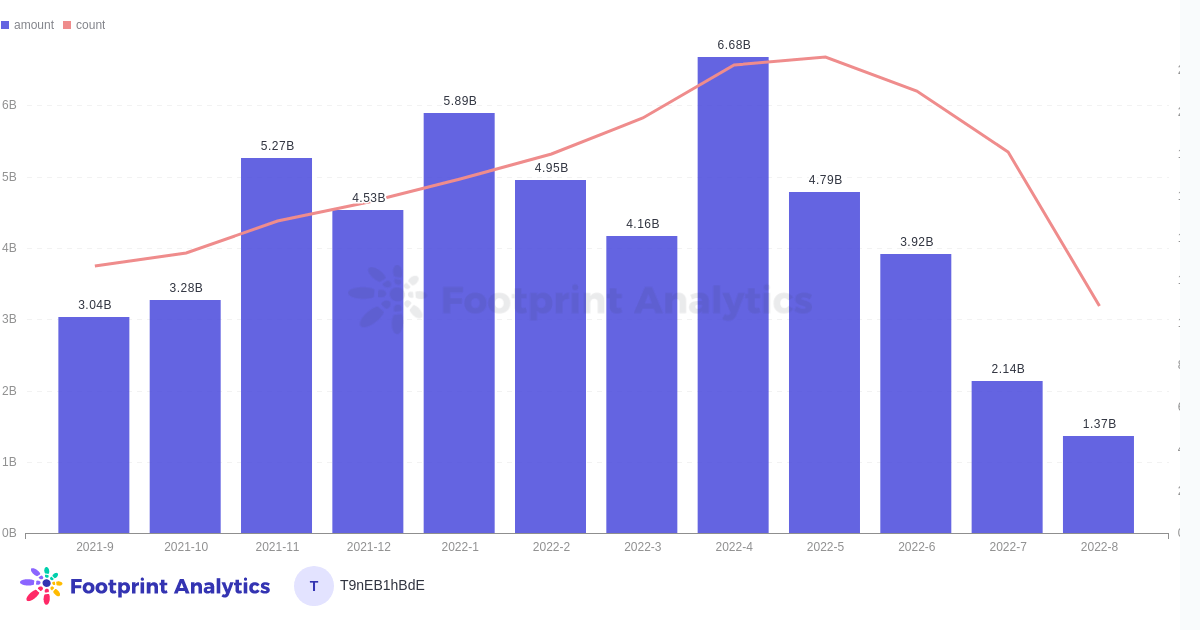

- The amount of funding raised in the GameFi space dropped 36% MoM from $2.14B to $1.37B. The number of rounds continues to collapse precipitously.

- Game developers and studios closed four of the top 10 largest investment rounds in August.

- This reflects an ongoing trend in this bear market where investors are betting big on Web3 game studios and traditional developers and seeking to enter GameFi.

- Among the rounds in August was another $45M for Animoca Brands, which has dozens of blockchain games in its portfolio, including The Sandbox, Crazy Defense Heroes, and the upcoming Phantom Galaxies. The round brings the company’s total investment funding to $775.3M.

GameFi Users

- MAU continued for the 6th month of decline (by 9.4%), whereas the number of new users/participants in GameFi increased by 19.8% MoM.

- There were no significant shifts in the distribution of users among the major chains; however, ThunderCore quickly emerged to take up 4.5% of users. The largest game on ThunderCore is JellySquish, which averaged around 400-600 users per day in August.

Projects Overview

- Since Splinterlands’ collapse in user numbers in June, the game has been steadily rebuilding, growing by 54% from its low on June 6 to its high on August 26.

- Alien Worlds continued to be neck-and-neck with Splinterlands, vying for the most popular blockchain game spot.

- Interestingly, both Splinterlands and Alien Worlds are relatively basic card and text-based games with no ability for the user to control characters or interact with a 3D world—demonstrating the primitiveness of the current GameFi industry.

- Farmers World continued to bleed users, reaching an August low of 66,228 active daily users on the 30th, a 55% decline from its ATH in May.

Crypto Macro Overview

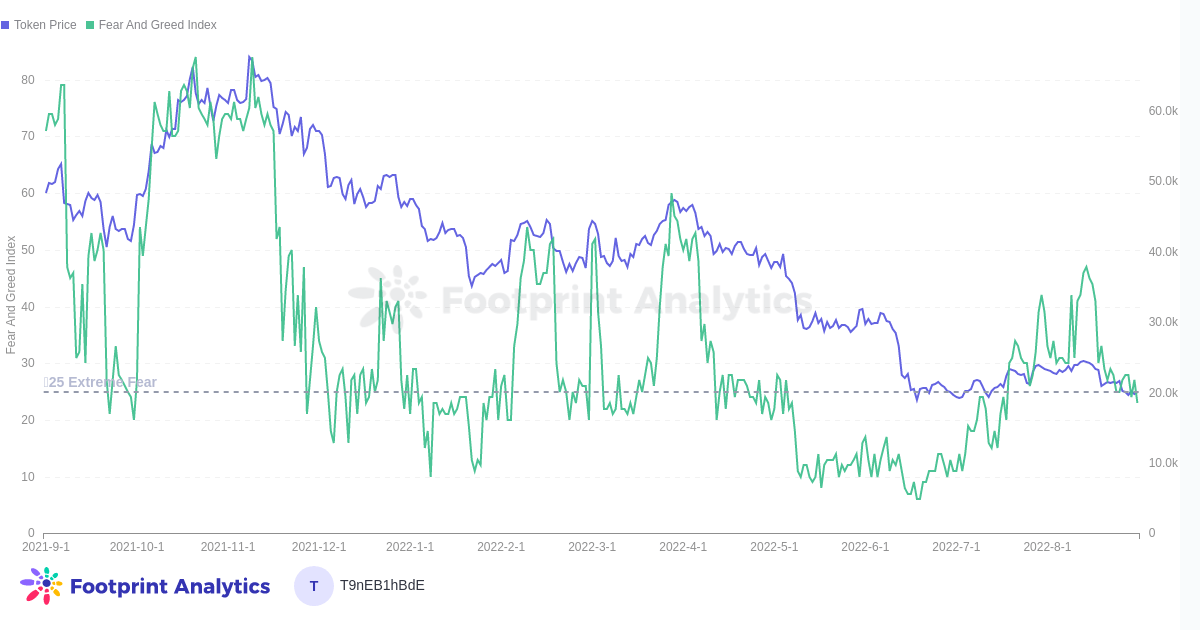

The crypto market saw its most substantial rally in half a year from mid-July to August, spearheaded by Ethereum’s jump above $2,000 in mid-August.

Explanations include:

- Anticipation for The Merge will see Ethereum move to Proof of Stake (and eventually burn supply).

- The possible beginning of less aggressive monetary tightening by the Federal Reserve.

- Just a dead cat bounce on the way to lower lows.

GameFi does not quickly recover on macro news

Either way, the trend did not translate to a significant increase in market cap or users for most games. The total GameFi token market cap rallied precariously in mid-August to $6.43 billion but then declined by 26% by the end of the month.

Most concerningly, the number of new GameFi users continues to sit at extreme lows. This is because the GameFi sector takes more resources and time investment to re-enter than others, requires active participation to generate yield, and is still highly speculative.

Splinterlands and Alien Worlds show a sustainable player base

Besides a collapse for Splinterlands user numbers in June, Splinterlands and Alien Worlds have shown steady growth in their user numbers.

Interestingly, both Splinterlands and Alien Worlds are relatively basic card and text-based games with no ability for the user to control characters in an immersive world. However, they involve strategy on the player’s part to win and achieve profitability.

Both are far from what people imagine gaming to look like in 2022 (the next major cohort of games, which includes Illuvium and Phantom Galaxies, aims to redress this.)

Investors bet big on game developers and studios

While overall funding has tanked, investors still close rounds for proven teams with a record of viable products in either Web3 or Web2.

The top financing rounds in August reflect a trend that’s been long building—investors are closing funding for Web3 game studios, and traditional developers are now seeking to enter GameFi. Studios and developers have had significantly more success in this bear market than GameFi infrastructure projects or individual games.

Among the rounds in August was $45 million for Animoca Brands, which has dozens of blockchain games in its portfolio, including The Sandbox, Crazy Defense Heroes, and the upcoming Phantom Galaxies. The round brings the company’s total investment funding to $775.3 million.

The top round for the month went to Limit Break, the studio behind the DigiDaiku NFT collection with plans to launch free-to-play blockchain games.

Summary

By the numbers, the GameFi industry has had a bad month in August as its rut continues, with little relief from the month’s Ethereum-driven rally.

Overall volume, the number of new projects, and investment stay near July levels or drop further.

However, now is a great time to build—proven developers and studios with ideas for future blockchain games and metaverse projects continue to receive record funding rounds. With the healthiest games right now being the relatively basic Splinterlands and Alien Worlds, there’s a lot of room for improvement.

The Footprint Analytics community contributed to this piece.

- Sept. 9, 2022, Daniel

- Data Source: August 2022 GameFi Report (ENG)

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.