Economic woes drive Bitcoin below $63,000 James Van Straten · 4 months ago

Economic woes drive Bitcoin below $63,000 James Van Straten · 4 months ago Quick Take

Bitcoin experienced a sharp decline to below $63,000 on Aug.1 following disappointing economic data, leading to significant liquidations in the market.

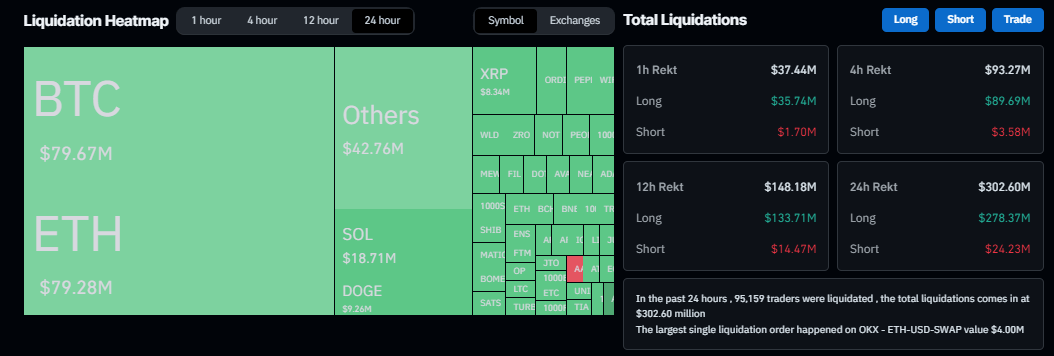

Over the past 24 hours, $300 million has been liquidated, with over $277 million of these being long positions. In just the past hour, $40 million has been liquidated, predominantly from long positions, according to Coinglass.

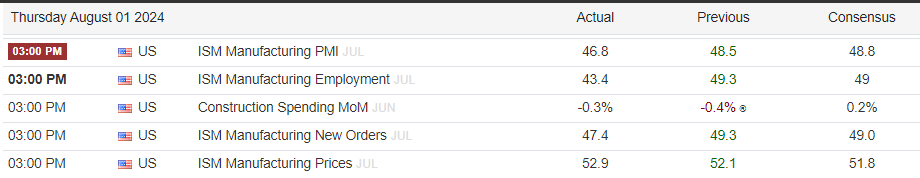

This market turbulence coincides with disappointing economic data. The ISM manufacturing PMI fell below expectations, recording 46.8 against a consensus of 48.8. Similarly, ISM manufacturing employment dropped to 43.4, below the anticipated 49.0.

New orders also fell short, coming in at 47.4 compared to the consensus of 49.0. In contrast, manufacturing prices rose to 52.9, slightly above the expected 51.8.

These economic indicators have contributed to Bitcoin’s decline, mirroring a broader market reaction where tech stocks also faced a downturn. Additionally, the US 10-year Treasury yield has dipped below 4%, reflecting investor concerns about the economic outlook.

James Van Straten

Former Lead Analyst at CryptoSlateJames fervently appreciates data, technology, and trend-spotting. As a tech and liberty maximalist, he hails Bitcoin as the 21st century's paramount invention.

Latest Insights

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

In this insight

Bitcoin, a decentralized currency that defies the sway of central banks or administrators, transacts electronically, circumventing intermediaries via a peer-to-peer network.

Farside Investors

Farside Investors

CoinGlass

CoinGlass