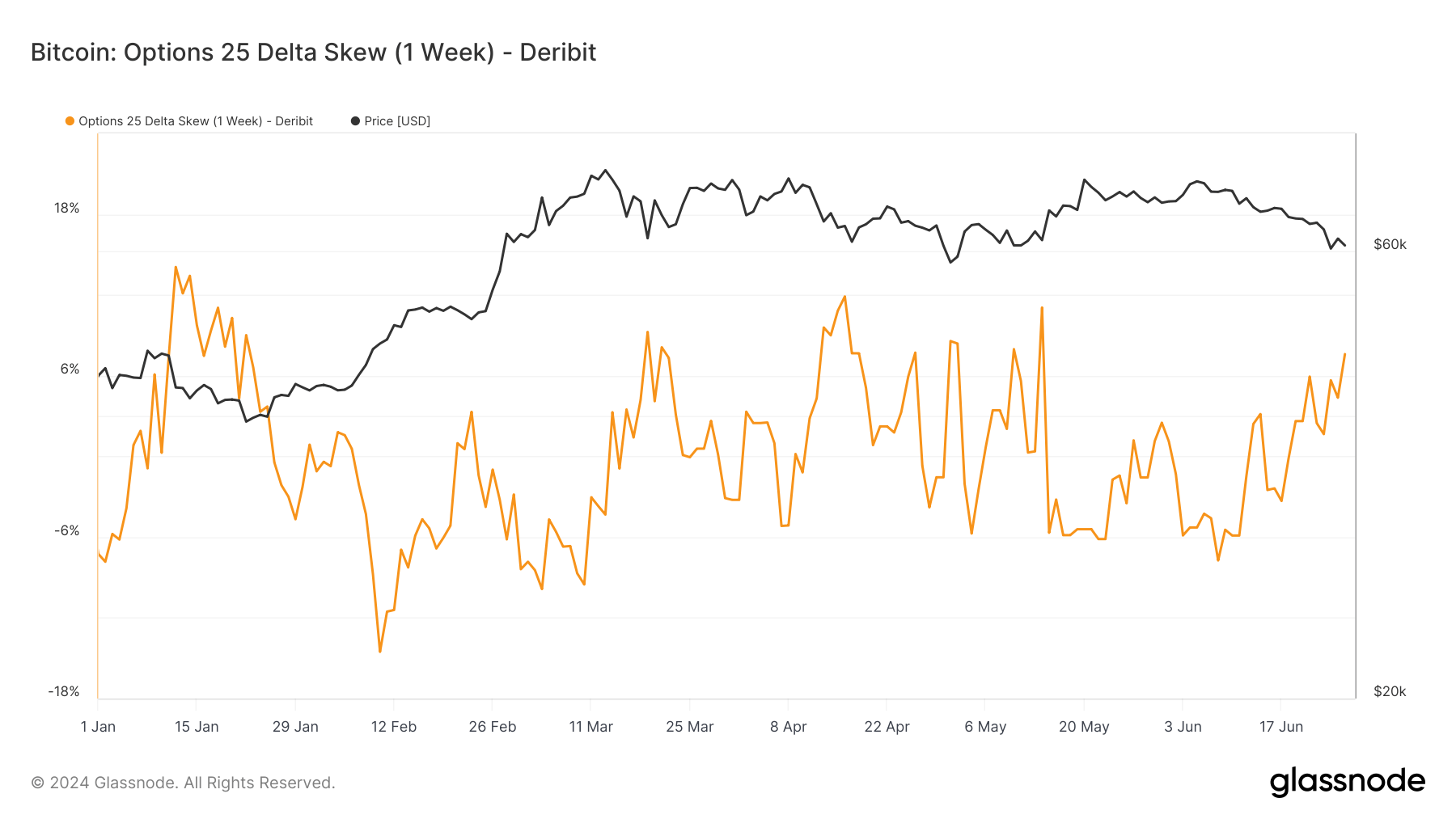

Bitcoin’s options 25 delta skew signals ongoing market anxiety near $60,000

Bitcoin’s options 25 delta skew signals ongoing market anxiety near $60,000 Onchain Highlights

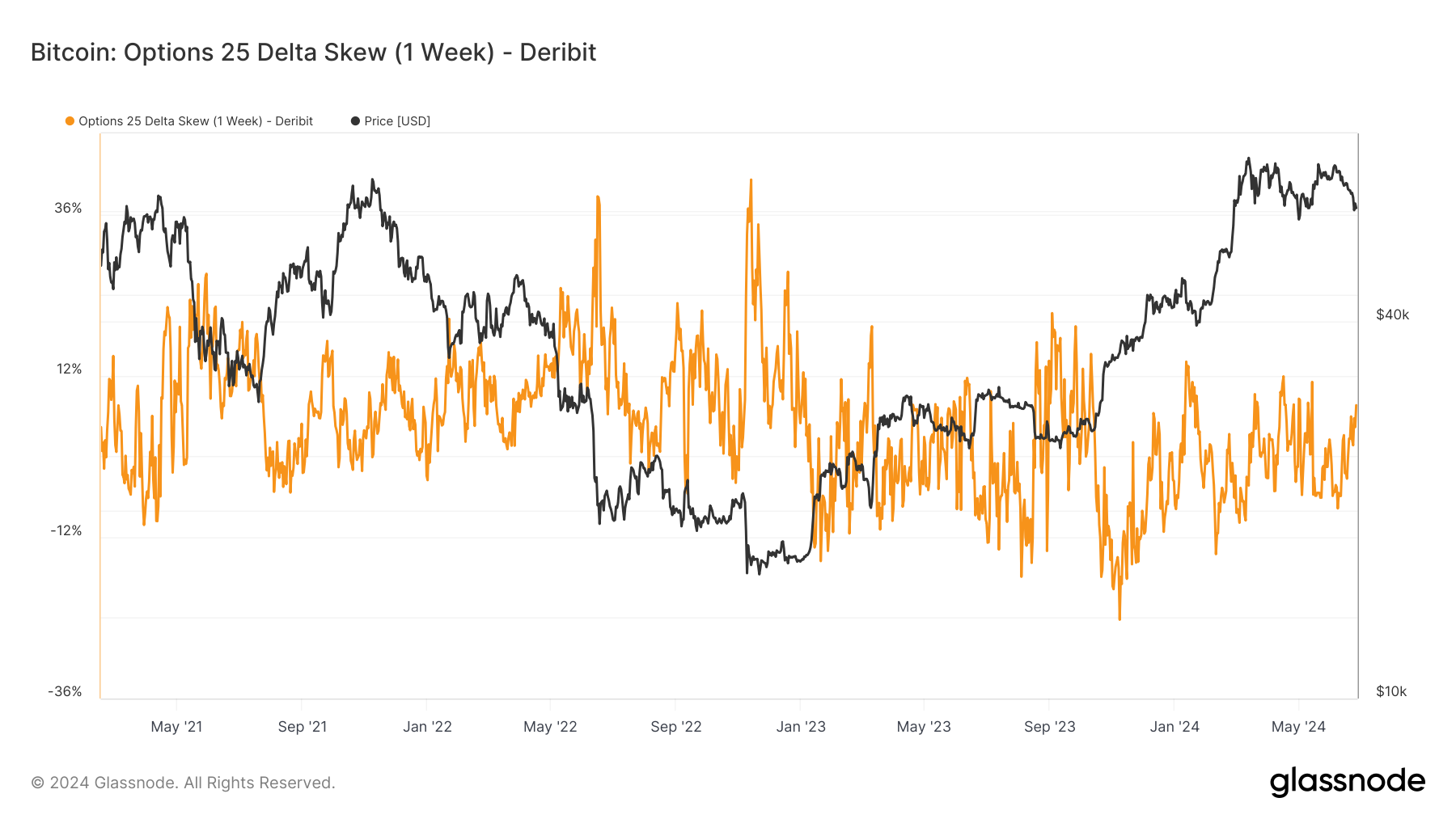

DEFINITION: Skew is the relative richness of put vs call options, expressed in terms of Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility. 25 Delta Skew is calculated as the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility, normalized by the ATM Implied Volatility. This metric focuses on option contracts expiring in 1 week.

Bitcoin’s Options 25 Delta Skew (1 Week) indicates a fluctuating market sentiment. This metric, representing the difference in implied volatility between 25-delta puts and calls, has seen significant variability since May 2021. The recent trend loosely correlates with Bitcoin’s price movements, reflecting heightened trader uncertainty. In the past months, the skew has oscillated sharply, aligning with Bitcoin’s approach towards and retreat from the $60,000 mark.

Historically, high skew values often preceded major price corrections (Luna and FTX collapse), suggesting bearish sentiment, while low skew values hinted at bullish outlooks. This pattern is evident in the chart, where spikes in skew frequently align with Bitcoin price drops. Currently, as Bitcoin hovers near $60,000, the skew remains elevated, indicating continued market anxiety and potential for volatility.

The post-halving period this year has not stabilized the market’s expectations, maintaining a turbulent sentiment. As the market digests the halving effects and macroeconomic factors, the Options 25 Delta Skew remains a crucial indicator for anticipating Bitcoin’s near-term price movements.

CoinGlass

CoinGlass

Farside Investors

Farside Investors