Bitcoin withdrawals outpace deposits in trend unseen since FTX collapse

Bitcoin withdrawals outpace deposits in trend unseen since FTX collapse Quick Take

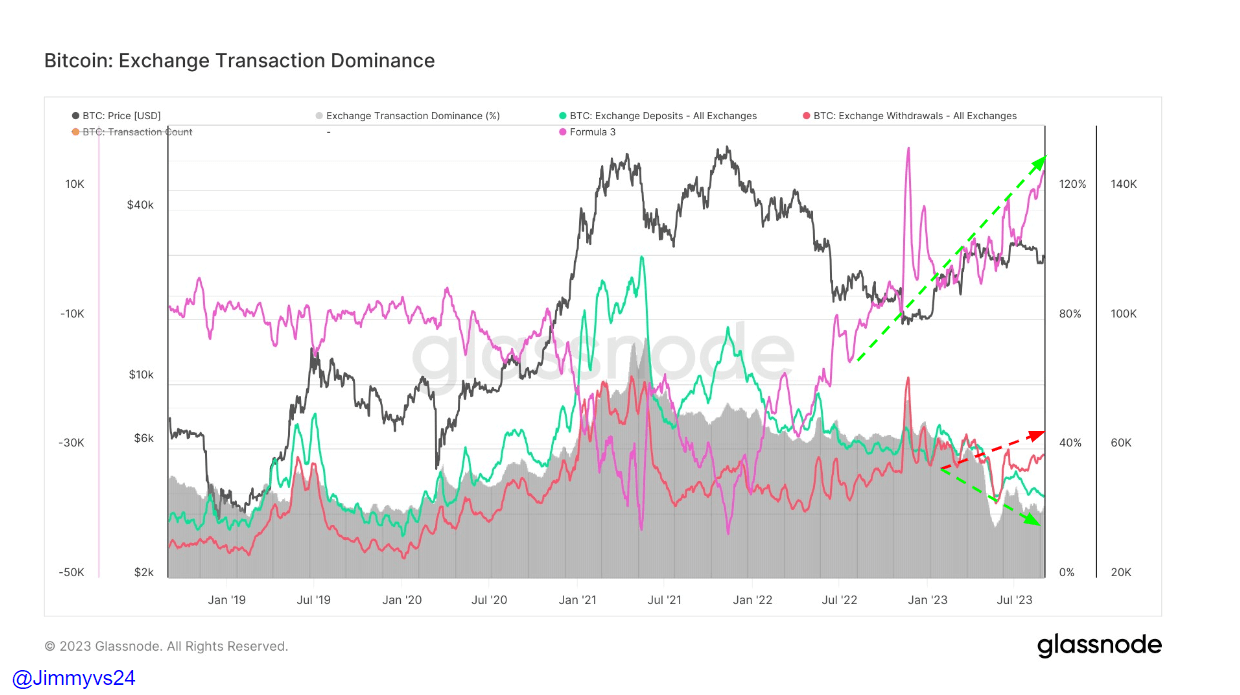

Recent data reveals a remarkable trend as Bitcoin withdrawals from exchanges are outpacing deposits at a rate unseen since the FTX collapse in November. This rapid divergence between deposits and withdrawals is accelerating, with the current ratio standing at 58,000 Bitcoin being withdrawn for every 45,000 Bitcoin deposited.

This trend reflects a significant shift in market behavior. While deposits have continued to dwindle, the withdrawal increase has remained consistent. The implications of this widening between deposit and withdrawal activity could potentially have a profound impact on exchange liquidity and overall market dynamics.

This withdrawal surge might indicate an increasing preference among Bitcoin holders for secure storage away from exchanges, possibly driven by concerns over regulatory clampdowns or exchange security.

Alternatively, it may signal a growing confidence in holding Bitcoin long-term, reflecting bullish sentiment. Monitoring these developments closely is crucial, as they could signify critical shifts in the crypto landscape.

Farside Investors

Farside Investors

CoinGlass

CoinGlass