BitGo vaults ahead in crypto custody space, valued at $1.75B following fresh funding rounds

BitGo vaults ahead in crypto custody space, valued at $1.75B following fresh funding rounds BitGo vaults ahead in crypto custody space, valued at $1.75B following fresh funding rounds

Amid tough market conditions, Bitgo's regulatory focus attracts $100M in funding

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

BitGo, the Palo Alto-based crypto custody firm, has raised $100 million in funding, setting its valuation at an impressive $1.75 billion, a stark contrast to its price tag in 2021 when a $1.2 billion acquisition deal by Galaxy Digital Holdings was eventually called off, according to Bloomberg.

BitGo focuses on securing crypto assets, with private keys often protected in physical vaults. The company acts as the custodian for major players in the crypto space, including the creditors of the bankrupt digital asset exchange FTX alongside Pantera Capital, Swan Bitcoin, and many others.

BitGo’s focus on regulatory safety and licensed operations may have given it a competitive edge in this uncertain market landscape, marked by increasing tensions over classifying cryptocurrencies as securities. Speaking to Bloomberg, CEO Mike Belshe acknowledged the market’s difficulty but emphasized the importance of being licensed and regulated, stating that “regulatory safety is just on everybody’s minds right now.”

Interestingly, Bloomberg reports that BitGo’s funding came entirely from new investors, based in the US and Asia, with some venturing from outside the crypto industry, according to Belshe.

The company has not disclosed the names of the participants in this funding round but made it clear that the raised capital will be used in part for strategic acquisitions, with two deals already in the pipeline.

Navigating the crypto custody competitive landscape.

While BitGo thrives, it’s worth noting the adverse circumstances surrounding another notable player in the crypto custody market, Prime Trust.

As reported by CryptoSlate, Prime Trust, once a reputable force in digital asset custody, has filed for Chapter 11 bankruptcy following a cease and desist order from the Nevada Financial Institutions Division due to the company’s inability to fulfill customer withdrawal requests. This situation led BitGo to terminate its planned acquisition of Prime Trust in June.

The contrasting fortunes of BitGo and Prime Trust shed light on the volatility of the crypto market and the criticality of regulatory compliance, underlining the importance of the ‘trust’ element in digital assets.

Prime Trust is registered as a Qualified Custodian, according to its website. However, its inability to fulfill customer withdrawals casts doubt on the efficacy of its segregation of funds. CryptoSlate asked Prime Trust whether customer funds are appropriately siloed from other company assets and was informed that “No further statement is available at this time.”

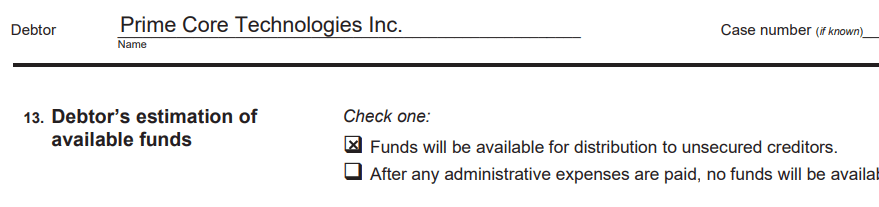

Yet, the Chapter 11 filings for Prime Trust did indicate that funds are available to repay unsecured creditors.

Other active players in the crypto custody space include Anchorage Digital, Coinbase Prime, Fireblocks, Gemini, and Fidelity, among others.

Farside Investors

Farside Investors

CoinGlass

CoinGlass