DeFi had a successful Q1 with an increase in TVL, new focus on Arbitrum

DeFi had a successful Q1 with an increase in TVL, new focus on Arbitrum DeFi had a successful Q1 with an increase in TVL, new focus on Arbitrum

Despite experiencing a drop in the number of active users, the DeFi space saw a notable increase in TVL.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

DappRadar’s latest report on the state of DeFi showed that the industry saw a successful quarter, despite the difficulties it faced at the end of 2022.

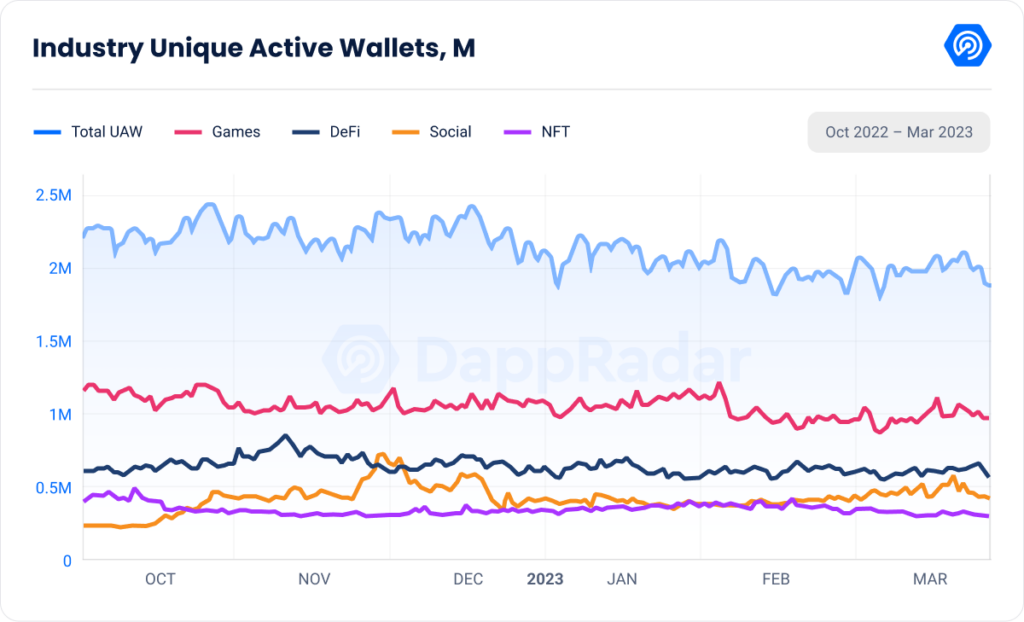

The ongoing bear market only affected the number of active users interacting with DeFi apps. According to the report, the number of daily unique active wallets (dUAWs) decreased by almost 10% compared to the previous quarter.

However, this is in line with the overall drop in dUAWs across all crypto sectors since last quarter.

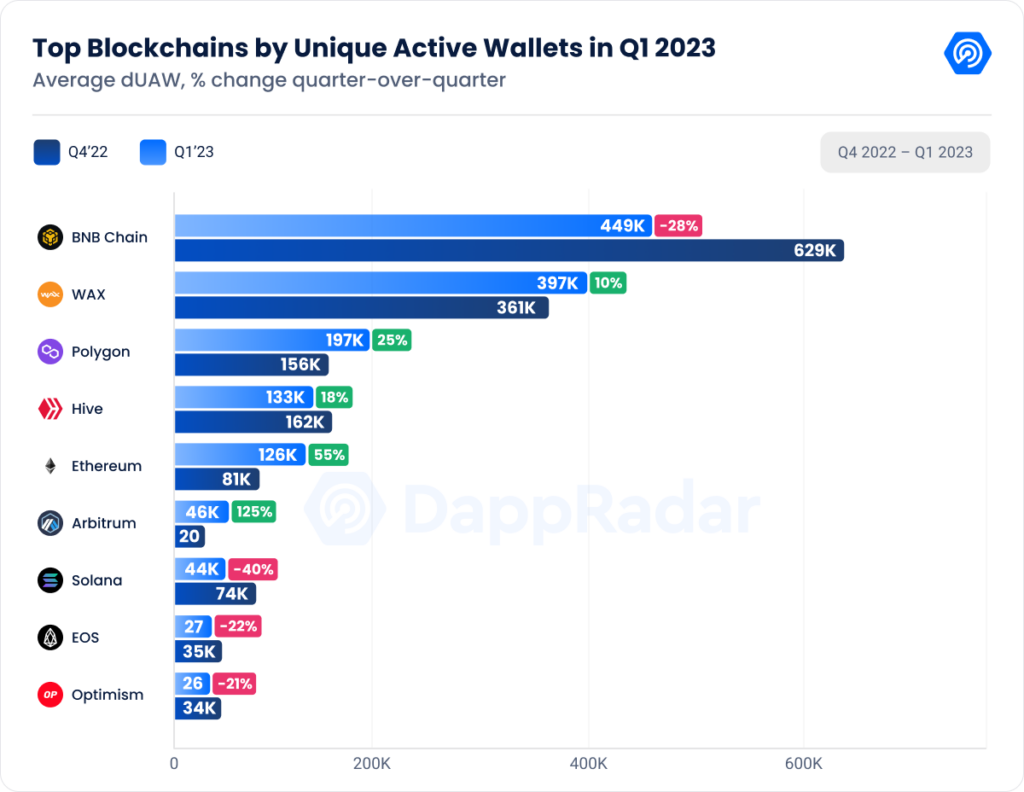

The majority of these users are active on Binance, which saw 449,000 dUAWs this quarter. However, this is still a 28% decrease from the 629,000 dUAWs it registered last quarter, showing its dominance in DeFi could be decreasing.

Wax took second place with just under 400,000 dUAWs, a 9% increase over the past three months. Polygon saw a 25% increase in dUAWs, surpassing 197,000 unique wallets per day.

While most other blockchain platforms experienced some growth in terms of active users, none rival Arbitrum which saw its number of dUAWs increase by 125% compared to last quarter.

Increased interest in Arbitrum also increased the total value locked (TVL) in DeFi. The DeFi sector closed the quarter with $83.3 billion in TVL — a 37% increase from the previous quarter.

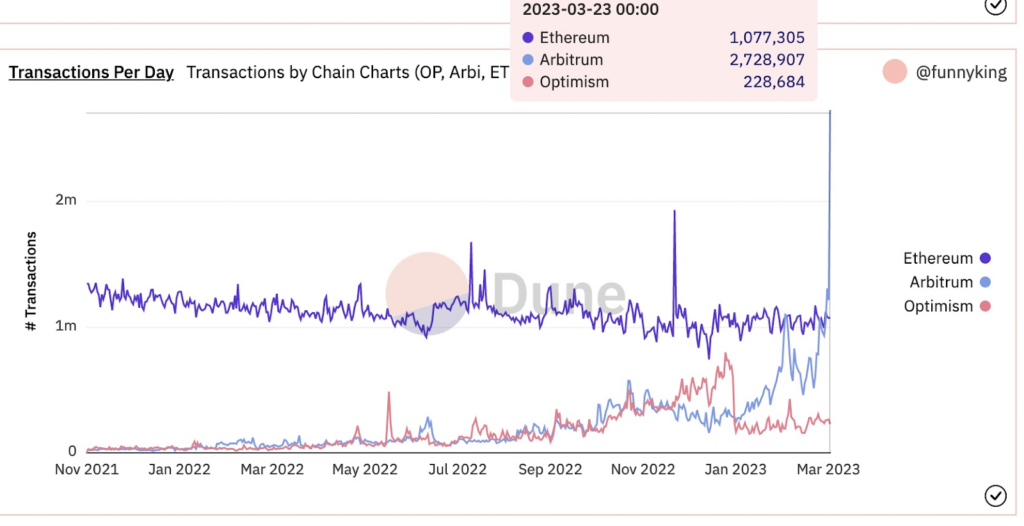

Abirtrum’s long-awaited airdrop attracted a significant amount of users to the platform, pushing the whole sector forward. Data from DappRadar showed that Arbitrum saw a 118% increase In TVL, closing the quarter with $3.2 billion.

GMX, a decentralized exchange offering perpetual future trading, accounted for over 80% of all TVL in Arbirum.

Arbitrum distributed over 1 billion ARB tokens to around 600,000 users, pushing the number of transactions on the blockchain to a record of 2.7 million, surpassing both Ethereum and Optimism.

Farside Investors

Farside Investors

CoinGlass

CoinGlass