Dormant Bitfinex whales cash out 12K BTC

Dormant Bitfinex whales cash out 12K BTC Dormant Bitfinex whales cash out 12K BTC

The Bitcoin has been stale in long positions since June 2022 until they were cashed out at around 13:00 UTC on Mar. 25.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin (BTC) whales holding long BTC positions on Bitfinex suddenly cashed out on March 25 at around 13:00 UTC, according to data from Datamish.

These wallets have been dormant since June 2022, and their aggregate value sits at 12,000 BTC, as the data indicates. This movement represents a small segment of investors who are motivated to exit their long and short BTC positions to take advantage of the recent price pump.

Bitfinex exits

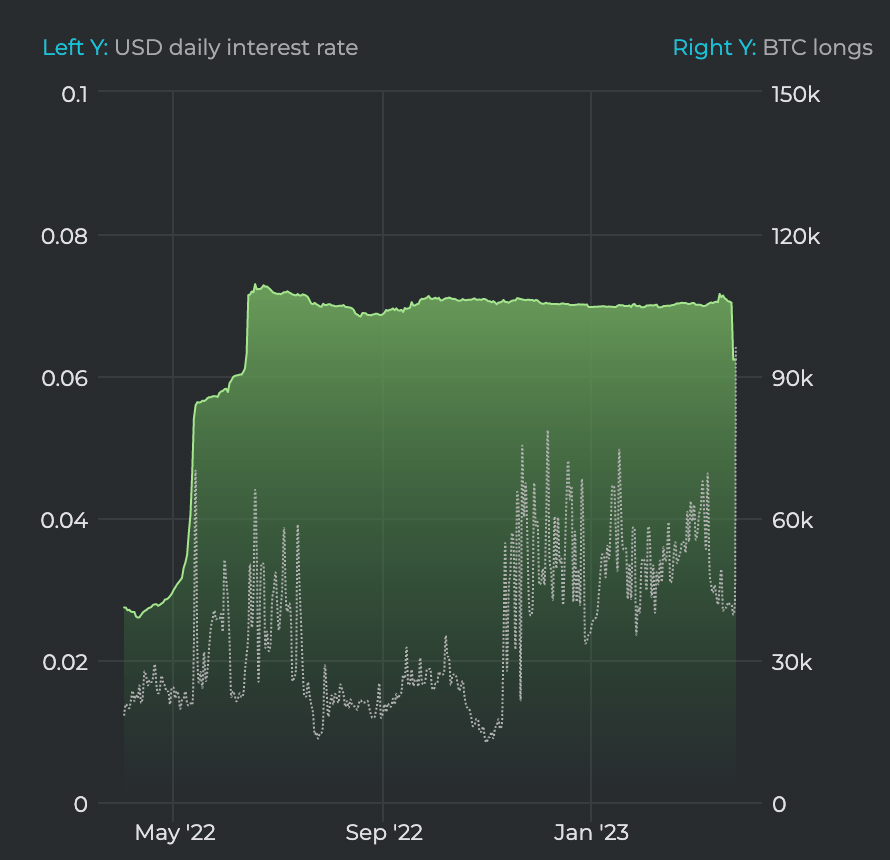

The cash out on March 25 marks the most significant change in BTC’s long positions since June last year. The chart below represents the volume of long BTC positions since May 2022.

The 12,000 BTC drop occurred when the aggregate volume of long BTC positions was just above 110,000 BTC. Even though the whale exits may indicate a bearish sentiment, the overall picture is not so pessimistic. At the time of writing, the total volume of BTC sitting at long positions is at 93,511, which reflects a strong bullish market sentiment.

Short positions

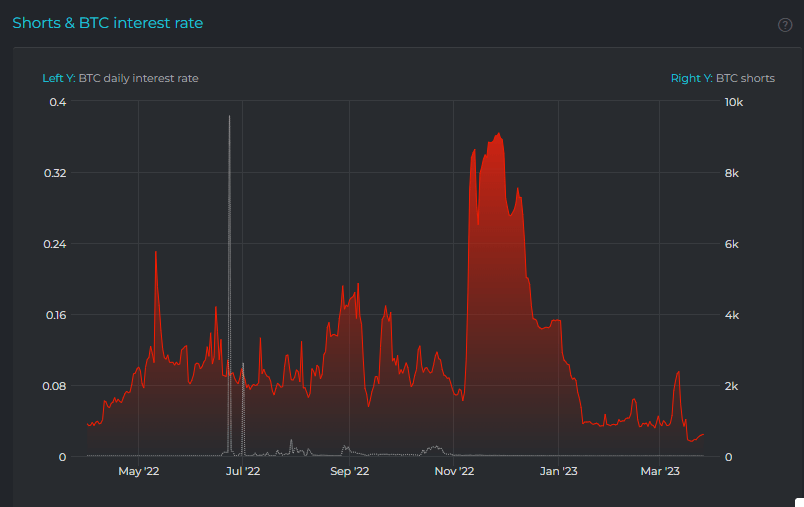

The behaviors of investors who hold short BTC positions also support the bullish market sentiment. According to CryptoSlate analysts, short BTC positions have been recording a steady decline since the end of 2022.

Currently, they sit at their one-year lowest. This indicates that “investors don’t want to bet against BTC,” as CryptoSlate analyst James V. Straten states.

BTC price pump

BTC’s recent price pump considerably contributed to the current bullish market sentiment.

BTC surged past $28,000 on March 21, which led liquidations to raise over $230 million within 24 hours. The surge also motivated the long-term holders to liquidate their positions, CryptoSlate research revealed on March 21.

“Long-term holders are one of the most important factors,” the research states, “as their behavior determines local bottoms and fuels future price rallies.” As soon as BTC broke through $28,000, long-term holders rushed to sell a portion of their holdings, leading the BTC price to decrease slightly.

The same movement was recorded during the slight BTC price increase recorded on March 15. Long-term BTC holders sold off over 43,000 BTC between March 15 and March 17.

Bitcoin Market Data

At the time of press 7:30 pm UTC on Mar. 26, 2023, Bitcoin is ranked #1 by market cap and the price is up 1.2% over the past 24 hours. Bitcoin has a market capitalization of $538.66 billion with a 24-hour trading volume of $14.2 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:30 pm UTC on Mar. 26, 2023, the total crypto market is valued at at $1.16 trillion with a 24-hour volume of $33.34 billion. Bitcoin dominance is currently at 46.32%. Learn more about the crypto market ›