Research: Bitcoin UTXOs grow despite bear market

Research: Bitcoin UTXOs grow despite bear market Research: Bitcoin UTXOs grow despite bear market

The growing number of Bitcoin UTXOs indicates a healthy network usage that defies the ongoing bear market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Unspent Transaction Outputs (UTXOs) are often referred to as the fundamental building block of Bitcoin. As the Bitcoin network is built on an accounting model based on unspent outputs, they can be used to measure the overall state and growth of the network.

Changes in the cumulative value settled through UTXOs, their number, and the percentage of them in profit or loss can indicate where the network stands and where it’s heading.

What are UTXOs?

Put bluntly, an unspent transaction output is the amount of BTC that remains after every transaction. Every time a Bitcoin transaction takes place, existing inputs are deleted and new outputs are created. Outputs that aren’t spent immediately become UTXOs tied to the sender.

For example, if an address with a balance of 1 BTC wants to send a transaction of 0.4 BTC, the transaction will break up the balance into two separate outputs: the 0.4 BTC paid to the receiver, and the 0.6 BTC that’s left behind. The 0.6 BTC is “unspent,” returned to the sender, and becomes a UTXO that can be used as an input in later transactions.

Almost all Bitcoin transactions end up using unspent transaction outputs. Only transactions using a single unified data byte — i.e. transactions in increments of whole numbers — don’t generate UTXOs. However, these transactions are rare enough that they can be ignored when looking at unspent output data.

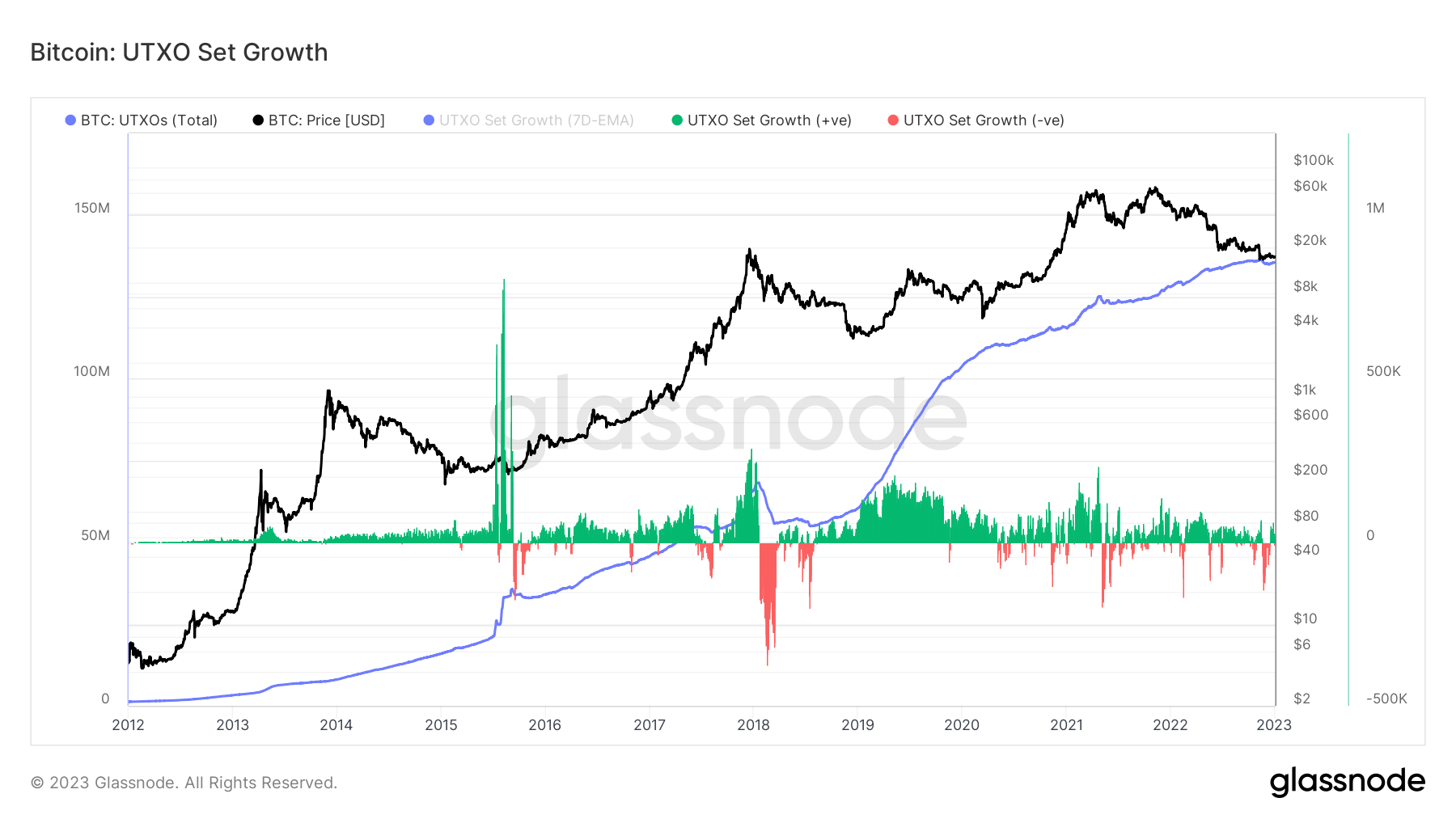

CryptoSlate’s analysis of Bitcoin UTXOs showed that there has been continuous growth in the total number of UTXOs since 2018. The rising number of unspent outputs defied every instance of price volatility and continues to grow through the ongoing bear market. Positive growth in the UTXO set indicates increased network usage, while negative values show a contraction in network usage.

Data from Glassnode showed that the total set of Bitcoin UTXOs reached its all-time high in the first days of January, counting over 136 million UTXOs.

The persistent growth in the UTXO set shows that the network has been growing despite the bear market. Crypto winters have historically been periods of stagnating network growth, as low prices and uncertainty push many users out of the network. On the other hand, bull markets have historically triggered periods of fast network growth, as an increase in speculators drives the overall network usage up.

UTXOs can also help determine future market momentum.

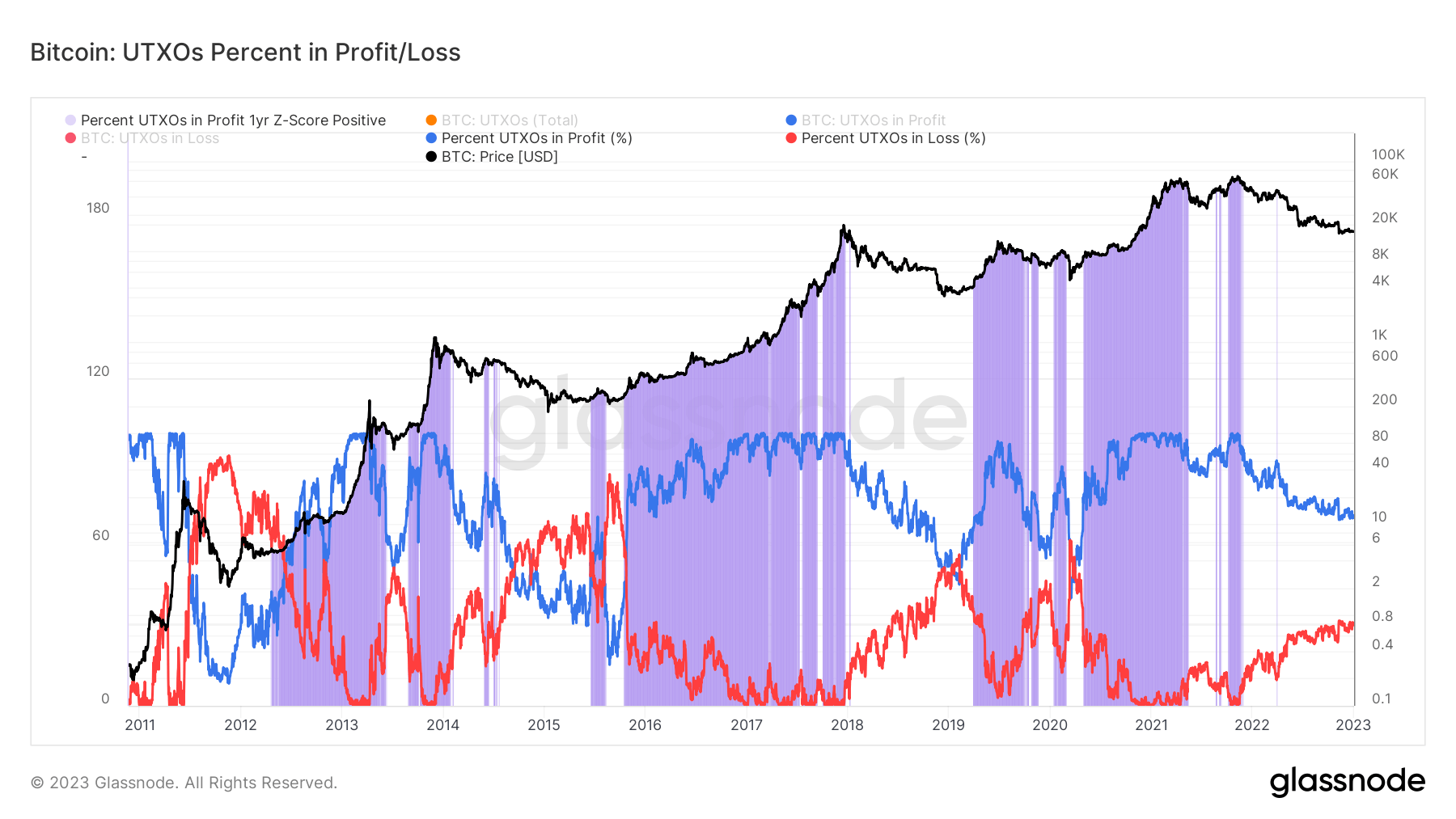

Looking at the price stamp assigned at the time of the creation of each UTXO and comparing it to BTC’s current price shows which outputs are in profit and which are in loss.

As of Jan. 3, around 100 million of UTXOs are in profit. This means that 70% of all unspent transaction outputs ever created have transacted with BTC below its current price. An above-average count of in-profit outputs has historically been associated with positive market momentum.

However, it’s still too early to tell when the positive price action might occur. The 1-year rolling Z-Score of UTXOs in profit has last been positive at the end of 2021, suggesting that the bear market might continue well into 2023.

CoinGlass

CoinGlass

Farside Investors

Farside Investors