The first usable Cardano DeFi dApp goes live, and it’s not SundaeSwap

The first usable Cardano DeFi dApp goes live, and it’s not SundaeSwap The first usable Cardano DeFi dApp goes live, and it’s not SundaeSwap

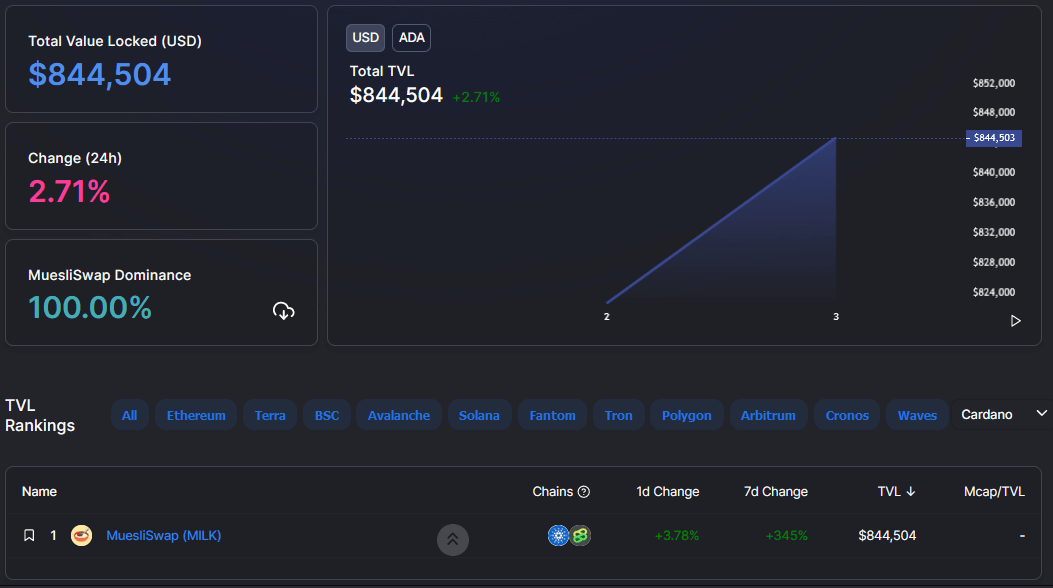

Cardano's DeFi ecosystem gets off to a start in the New Year with a total value locked of $845k over two days.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Data aggregator DeFi Lama adds Cardano marking the start of the project’s foray into decentralized finance. This happened thanks to an under-the-radar DeFi offering going live at the beginning of the new year.

Recently, Cardano has been feeling the heat over its lack of useable dApps. Critics say it’s been around four months since the chain had smart contract functionality, and still, the ecosystem is struggling to gain traction.

Throughout this period, Input Output (IO) CEO Charles Hoskinson addressed these concerns. Most recently, during an end-of-year live stream, Hoskinson said a huge DeFi ecosystem is starting to present itself.

Nonetheless, the skeptics among us would say talk is cheap. And that Hoskinson’s words do not support a functioning, usable dApp ecosystem of significance.

However, two days after posting the live stream in question, Cardano gets its first usable DeFi dApp.

Cardano DeFi is officially here

Since Alonzo went live on September 12, the Cardano ecosystem has been under pressure to grow. Hundreds of projects across DEXes, wallets, DeFi, meme coins, stablecoins, oracles, and NFTs, to name a few categories, are in the works.

Given SundaeSwap’s high publicized testnet at the start of December, not to mention IO’s collaboration with the team to ensure a smooth testnet, many assumed SundaeSwap would be the first usable DeFi dApp to go live.

However, a month on, SundaeSwap is not ready for its mainnet launch. Other contenders for the first usable DeFi dApp include Ergo and Liqwid.

But leapfrogging them all was MuesliSwap, which, according to DeFi Lama, went live on January 2 and currently has a total value locked (TVL) of $845,000, accounting for 100% of the Cardano DeFi ecosystem.

MuesliSwap is a DEX with launchpad functionality that also runs on the Bitcoin Cash blockchain.

This ranks Cardano 78th out of 87 blockchains listed on DeFi Lama, placing it above little-known chains such as Ubiq, Hoo, and Liquidchain.

Placing first is Ethereum with $158 billion TVL. In contrast, Terra ranks second, way behind Ethereum in TVL, with a value locked of $20 billion. As such, Cardano has a mountain to climb in terms of living up to its “Ethereum-killer” label.

The work isn’t done yet

While it’s encouraging that Cardano is now off the line, in his most recent live stream, Hoskinson said there’s more to come in 2022.

Specifically, Hoskinson referred to “finding a sweet spot of expressiveness as a community.” In other words, while the foundation is in place, IO still needs to refine the protocol, ensuring DeFi is the best it can be. This entails developing better scalability, more interoperability, and working on governance.

“Cardano is our attempt as a community to try to reflect that evolve that and push it along and there’s a little bit of sprinkled magic and scalability and a lot of discussion about interoperability and identity and a lot of work done on governance.”

His overall take-home message highlighted the scale of work that has gone into Cardano to date. And what’s to come in terms of futureproofing.

That way, the community can be assured that the project has efficacy for decades to come, if not indefinitely due to its governance setup.

CoinGlass

CoinGlass

Farside Investors

Farside Investors