Analysis: How Polkadot (DOT) could become Blockchain 3.0

Analysis: How Polkadot (DOT) could become Blockchain 3.0 Analysis: How Polkadot (DOT) could become Blockchain 3.0

Ethereum. Solana. Avalanche. Cardano. Cosmos... More blockchains, more problems.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Well, not always, but one of the biggest problems is the lack of interoperability, where it is impossible or inefficient for users on one blockchain to make transactions or transfer data with another.

Just as the ARPANET became the internet we know today with the development of a TCP/IP, a handful of projects aim to be the connectivity technology that makes the whole blockchain ecosystem a seamless experience.

Polkadot is one example.

Gavin Wood, its most well-known co-founder, was also the co-founder of Ethereum and authored the yellow paper (a more technical version of a whitepaper).

As the project officially launched its much-anticipated first parachains slot auction (also called a parachain auction) on Nov. 12, now is a great time to understand what it aims to accomplish and how.

About Polkadot

Polkadot, founded in 2015, is positioned as a next-generation blockchain protocol capable of connecting multiple dedicated blockchain networks into a common network, allowing them to operate seamlessly at scale.

It is a blockchain that can be composed of multiple chains and uses a scalable heterogeneous multi-chain system.

Polkadot attempts to address the issues of scalability, speed, and cost by allowing for more personalized blockchains, interoperability and upgrades between chains, and self-governance of chains. In addition to supporting token transfers, Polkadot also supports the interchange of data between different chains.

Polkadot has three main network infrastructures.

- Relay Chain: Called Polkadot’s master chain, it’s responsible for network sharing security, consensus and cross-chain interoperability, which can be thought of as a plug outlet with 100 slots.

- Parachains: Processing data operations and transaction information, these can be thought of as different appliances connected to the plug outlet. These allow the blockchain to be expanded and solve the performance issues of the blockchain.

- Bridges: These allow parachains and parathreads to connect and communicate with external networks like Ethereum and Bitcoin.

Polkadot was created to address the joint interaction of separate chains of value silos on Etheruem, similar to a Cross-Chain Bridge.

How Polkadot differs from Ethereum

Blockchain 1.0 essentially provided computing power for bookkeeping with a decentralized ledger, but there was no ecosystem. It was basically just Bitcoin.

Then Blockchain 2.0 emerged as Ethereum introduced programmable properties and smart contracts. However, there were problems like congestion and high transaction fees.

To solve these problems and explore new possibilities, projects in so-called Blockchain 3.0 are now booming, including Ethereum 2.0, Layer2 Rollups and other ecosystems.

Interoperability projects realize that blockchain is not a zero-sum game and that connecting these various proliferating projects and chains is inevitable. Gavin Wood set up Polkadot to create a pivotal core where different blockchains can interact, which could also help solve Ethereum’s network congestion problem.

Now, let’s get technical to see the main differences between Polkadot and Ethereum.

- Sharding: Ethereum 2.0 will have 64 sharding chains by 2022 with the same transition function (STF) while Polkadot uses heterogeneous sharding, or unique STF where each parachain can be customized and optimized for each case, running in parallel rather than the same across all shards.

- Upgrades: Ethereum 2.0 follows the regular hard fork process (i.e. old and new versions are not compatible), while Polkadot uses the Wasm (WebAssembly) metaprotocol, the first to implement a chain upgrade without a hard fork.

- Governance mechanisms: Ethereum 1.0 relies primarily on off-chain governance, whereas Polkadot network development is a DOT holder decision, with an overall reduced scope relative to the Ethereum governance mechanism.

- Consensus mechanism: In order to increase efficiency and save resources, Ethereum 1.0 used the PoW mechanism and is now Ethereum 2.0 moving to PoS, which requires a lot of computing power as well as resources without being a game-changer. Polkadot uses the NPoS mechanism (Nominated Proof of Stake) to select verifiers from a smaller set, so it is cheaper and more efficient compared to Ethereum.

The current Polkadot ecosystem

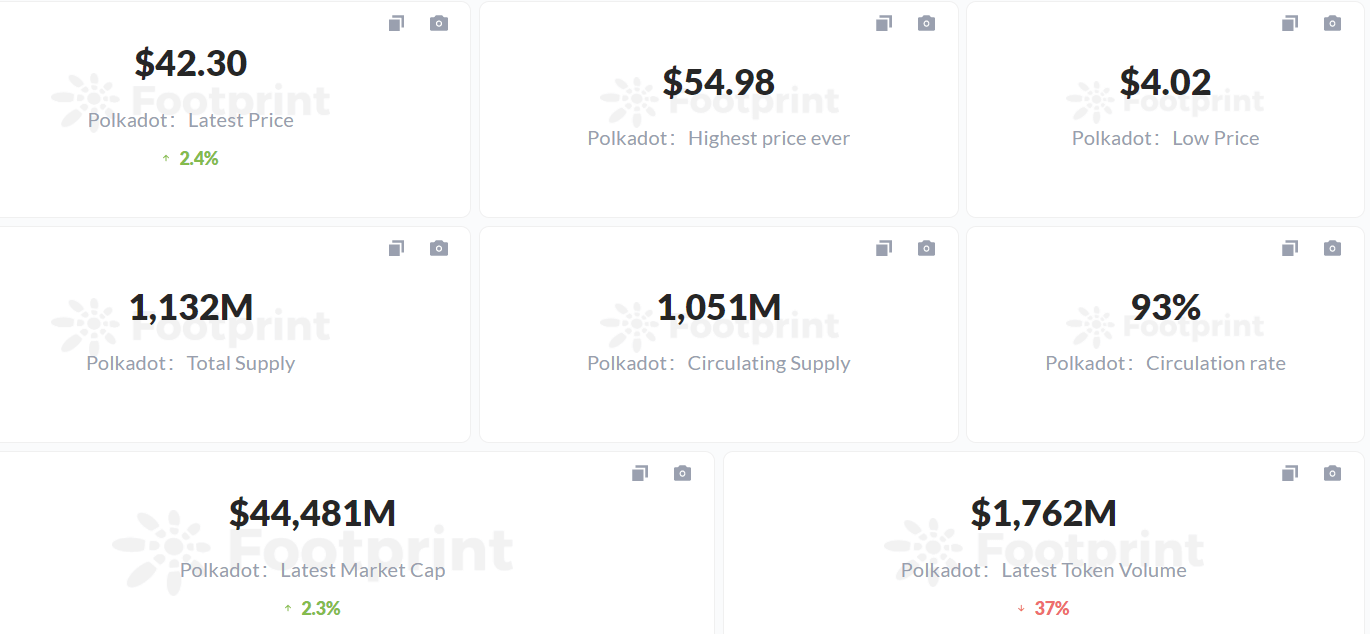

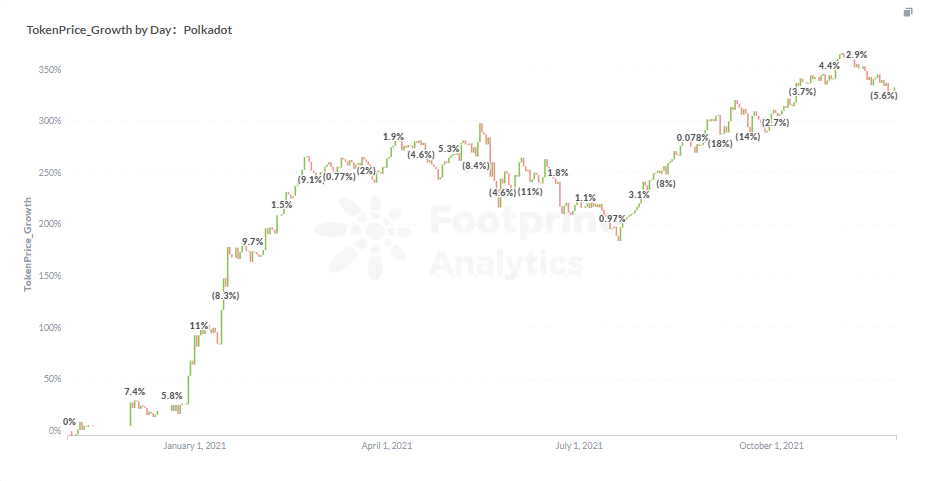

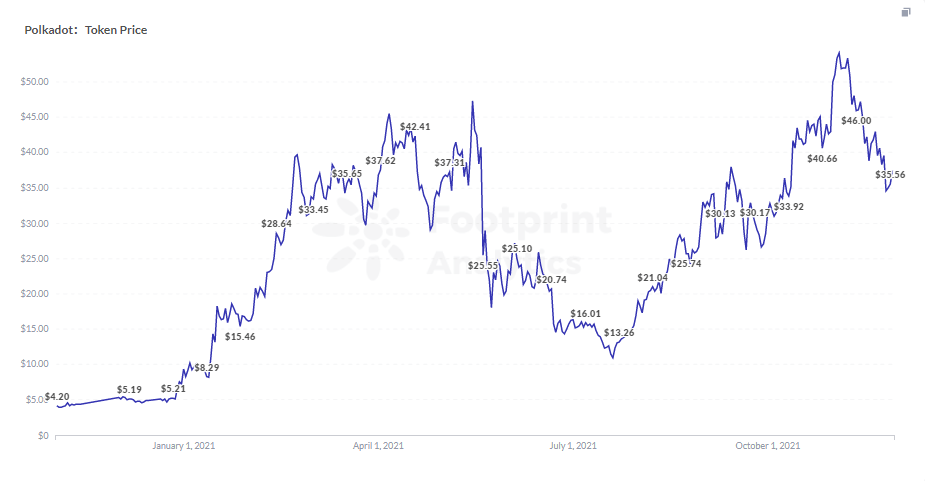

As seen in the DOT token price trend, Polkadot was hot at the beginning of August as the parachain slot auctions launched, which required pledging a large amount of DOT. This expanded the Polkadot ecosystem. According to Polkaproject’s statistics, there are now more than 510 projects, in categories including infrastructure, wallets, stablecoins, DApps, and more.

Some of the most popular projects are Kusama, Acala, Moonriver, Phala Network, and Parallel Finance.

Let’s take a look at Kusama and Acala.

Kusama is Polkadot’s canary network

Kusama is known as a canary network, or test network, before Polkadot went live. It is like an earlier, unaudited and unapproved version of Polkadot. It was introduced to test the Polkadot—approximating the real Polkadot environment—to ensure the security of the Polkadot network.

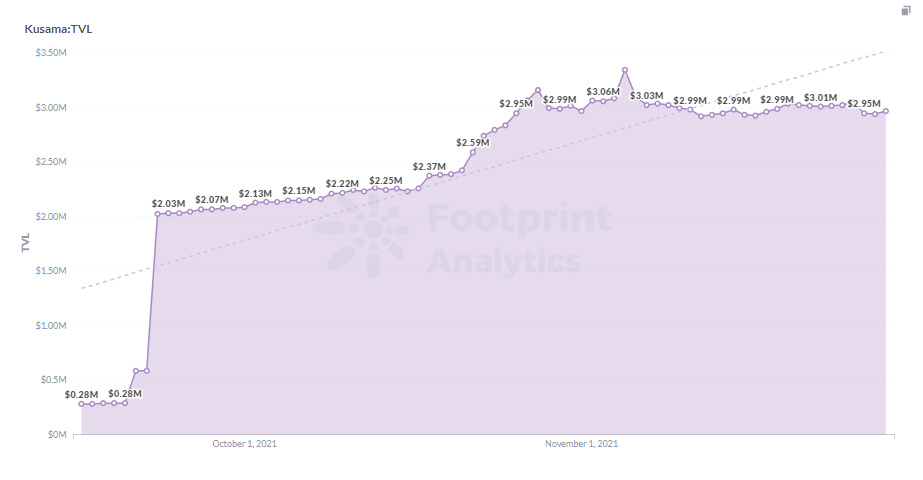

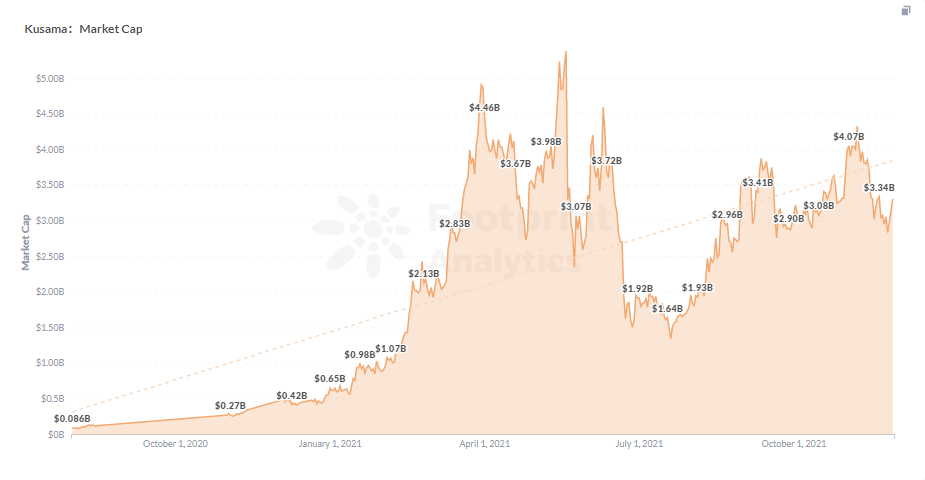

According to Footprint Analytics, Kusama’s TV surged from $580,000 to $2.03 million on Sept. 22, an increase of 250% in one day, with the current TVL remaining above $3 million. Kusama’s growth has a lot to do with the development of the Polkadot ecosystem, where heterogeneous cross-chain information interactions are becoming increasingly popular.

Kusama serves as a testing ground where participants can build and deploy parachains in the Kusama network or test Polkadot’s governance, equity pledge and validation functions.

It allows future Polkadot network participants to practice in advance. New projects on Polkadot have unknown risks, and all projects involving protocols and operating environments will be tested on the Kusama network first.

Acala is the center of DeFi on Polkadot

Acala is a Polkadot parachain optimized for DeFi, the economic hub of Polkadot, and won the first auction slot. It has raised two rounds of funding totaling $8.5 million, led by Polychain and Pantera Capital.

Acala is positioned as a decentralised financial centre and stablecoin platform, providing substantial support for cross-blockchain liquidity, stability and applications.

Acala has completed three sectors:

- Decentralized overcollateralized stablecoin system: Based on the Horizon protocol, generating a stablecoin, AUSD, through multi-asset over-collateralization, similar in principle to MakerDAO’s DAI.

- Release of pledged liquidity: For users of DOT/KSM pledged for mining, the Homa protocol allows the exchange of DOT/KSM for Liquid DOT/Liquid KSM, a token that can be traded freely and other financial activities, for example, to alleviate the opportunity costs associated with pledged tokens when the coin price plummets during the pledge period.

- Decentralized exchange with automatic market maker mechanism (AMM DEX): Similar to Uniswap and Pancakeswap.

While Acala has a grand vision that resembles MakerDAO’s, it will take some time for it to create a full DeFi ecosystem chain.

Polkadot’s unique facility for parachain slot auctions

Polkadot’s token DOT price broke new highs after the slot auction officially launched on Nov. 12.

Why are parachain slots auctioned?

Parachains allow both Bitcoin and Ethereum networks, for example, to be able to link cross-chain information interactions via relay chains, so anyone who wants to participate in the auction can access the parachains.

The current goal of Polkadot is to support 100 parachains slots and it will take some time before these parachains live on Polkadot mainnet.

Because of the limited number of parachains, only projects with a large amount of DOT can access the services to communicate with other blockchains.

Note that Polkadot uses a candle auction, where the organisers open the auction for a set period of time and the winner is decided by who has the highest bid just before the candle goes out. However, the random mechanism of this auction might result in low revenue when the candle will go out right after the first offer.

Polkadot will lock up the funds of the final winner of the parachains slot auction until the end of the slot usage period when the funds will be returned to the bidder, which is often years.

A summary of Polkadot’s strengths and weaknesses

Strengths

- Central hubs for data interaction between blockchains with different characteristics

- Increased efficiency, saving resources and costs

- A canary network to test projects in advance

Weaknesses

- Long lock-up period for funds in parachain auctions

- Lack of stablecoin: the introduction of stablecoins is an important factor in determining the success of all blockchain ecosystems, including Polkadot, either generated using collateral or introduced across chains,

Polkadot has been online for six years since 2015, and its ecosystem development has been slower compared to other blockchains like Solana.

The Polkadot ecosystem will also need more native and cross-chain projects to join in order to realize its vision of “running cross-chain projects seamlessly and efficiently at scale.”

For more data developments and content from the DeFi ecosystem, click on the Footprint link for more project dashboards and analysis.

The above content is only a personal view, for reference and information only, and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Disclaimer: CryptoSlate has received a grant from the Polkadot Foundation to produce content about the Polkadot ecosystem. While the Foundation supports our coverage, we maintain full editorial independence and control over the content we publish.

Farside Investors

Farside Investors

CoinGlass

CoinGlass