There are Ethereum scammers attempting to impersonate top DeFi projects

There are Ethereum scammers attempting to impersonate top DeFi projects There are Ethereum scammers attempting to impersonate top DeFi projects

Photo by Tom Roberts on Unsplash

As Bitcoin has stalled over recent weeks, decentralized finance has ripped higher. DeFi, as it’s better known, is currently one of the only segments of the cryptocurrency market seeing growth.

Take the example of Compound‘s COMP altcoin, which is trading at $200 as of this article’s writing. This is six times higher than the crypto’s price during its public launch in the middle of June. Also, COMP now has a market capitalization in excess of $500 million despite it literally being weeks old.

With such a large amount of capital being thrown around in this crypto sector, it’s no surprise that there is some unscrupulous folk attempting to capitalize on the hype.

DeFi scams are becoming prevalent, Ethereum community warns

Because Ethereum is decentralized, anyone anywhere can use its native cryptocurrency ETH and tokens and applications based on the blockchain. This means that even scammers can use and have used Ethereum to their advantage.

With DeFi becoming the crypto industry’s flavor of the week, the Ethereum community and broader crypto industry have begun to warn of scams.

Commenting on the caveats in the recent growth in the DeFi sector, crypto trader Josh Rager said:

“Will certainly welcome if DeFi coins want to pump like ICOs… One must understand […] that there will be many scams and eventually prices will undergo massive retraces.”

DeFi portal DefiPrime was a bit more specific, identifying the most prevalent DeFi scam at the moment: fake token listings on Uniswap, an Ethereum-based decentralized liquidity network.

Be aware of scam #DeFi tokens on Uniswap

???

— defiprime (@defiprime) July 5, 2020

The past few weeks have seen many DeFi protocols launch their own tokens. The aforementioned COMP coin and Balancer’s BAL are just two examples of many more. And there remain many Ethereum-based applications that intend on launching their own tokens to spur revenue, adoption, and value.

Scammers are attempting to take advantage of this trend by listing ‘official’ protocol tokens on Uniswap before targeted protocols actually launch their respective cryptocurrencies.

DefiPrime identified at least six protocols that are being targeted by these scammers: Uniswap, Tornado Cash, BZRX (Fulcrum), Curve, dYdX, and 1inch. And unfortunately, some attempts at this scam have been successful.

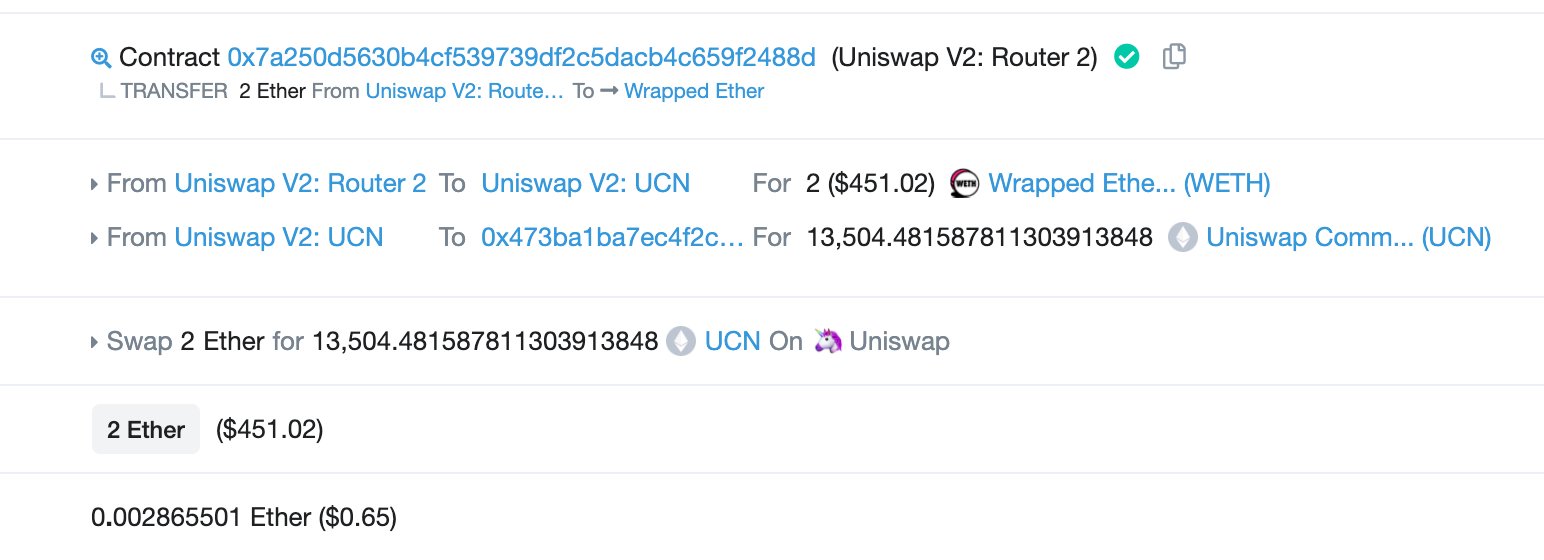

The screenshot below is of a user trading two Wrapped Ethereum (WETH), worth around $450, for 13,504 fake ‘Uniswap Community Tokens’.

There was also seemingly another instance of a user being scammed out of $1,270 worth of WETH for a fake ‘dYdX Token’.

Considering that Ethereum and DeFi continue to swell, it’s unlikely that these are the last scams, so users better keep their heads up.

Not DeFi’s only issue

Scams aren’t the only issue that DeFi is currently facing.

Qiao Wang, a former Messari head of product and crypto analyst, recently argued that DeFi is somewhat unusable due to extremely high Ethereum transaction fees:

“So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX,” he stated in a recent tweet.

Farside Investors

Farside Investors

CoinGlass

CoinGlass