Here’s why Ethereum (ETH) prices are not surging even as DeFi heats up

Here’s why Ethereum (ETH) prices are not surging even as DeFi heats up Here’s why Ethereum (ETH) prices are not surging even as DeFi heats up

Photo by Fabian Struwe on Unsplash

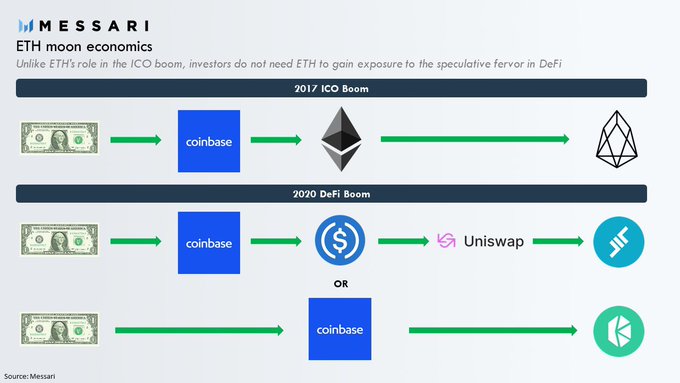

Much of the ICO boom in 2017 was driven by massive surges in ETH prices — with scammers, aspiring technologists choosing the Ethereum protocol to issue their tokens, and reap some profits off the frenzy.

At the time, currently available stablecoins were either not popular or didn’t exist, meaning token holders had to sell their holdings to either ETH or BTC, and then convert to USD to fully cash out.

The above, among other reasons, form part of why stablecoins have killed the narrative for Ethereum to be used as an onboarding currency of choice — in terms of both currency and technology aspects.

Stablecoins killing the ETH narrative

Messari analyst Ryan Watkins said Wednesday that no “direct reason” exists why ETH must rise as DeFi tokens surged. The latter, in all regards, is already showing signs of ICO-like returns, with some rather unknown tokens surging up to 10,000 percent in the past week.

Watkins quoted Qiao Wang, an ex-Messari product lead-turned-investor, who said back in 2019 that stablecoins had “killed the chance” for some platforms to be significant to profit-seekers:

First the short story.

Last year, @QWQiao was one of the first people to argue why this is the case when he argued that stablecoins (crypto dollars), allow investors to bypass native cryptoassets like ETH for their speculative fervor. https://t.co/56vhp1O28N

— Ryan Watkins (@RyanWatkins_) June 24, 2020

Watkins notes some DeFi tokens, like Compound or Balancer, can be purchased straight from Coinbase or Uniswap for USD, eliminating the Ethereum bridge that was required in 2017. The below graphic explains:

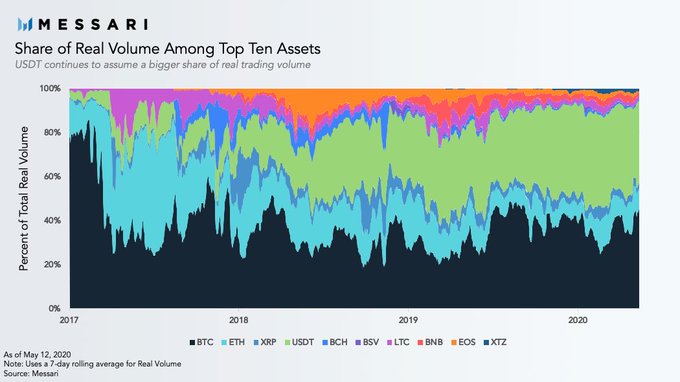

Exchange data reflects this falling demand. Metrics show trading volumes for Ethereum-based products, such as spot, futures, and derivatives, have decreased significantly since 2017. Instead, stablecoins like Tether have gained prominence, despite all the criticism and controversy surrounding USDT:

ETH’s rising utility

Not all is lost for ETH. For one, Watkins noted the sheer progress of DeFi applications, presumably from both a tech and institutional standpoint, were proof of Ethereum’s “product-market fit.” He added:

“In the past two years, Ethereum has developed from a piggy bank for ICO projects to a burgeoning digital economy.”

Watkins notes utility is a core driver for any currency; such as how the U.S. dollar is more valuable than the Venezuelan Bolivar for reasons like an overall utility, worldwide acceptability, and underlying value.

With updates like ETH 2.0 on the horizon — its public multi-client testnet goes live in under a week — Ethereum’s utility does not look like one that will be usurped anytime soon.

It is possible that within a couple years, ETH may not only be the most useful asset in crypto given its on-chain economy, but also crypto’s most credibly scarce asset given ETH 2.0 and EIP 1559.

Only time will tell. pic.twitter.com/IplOvSNtDz

— Ryan Watkins (@RyanWatkins_) June 24, 2020

Ethereum Market Data

At the time of press 9:26 pm UTC on Jun. 26, 2020, Ethereum is ranked #2 by market cap and the price is down 1.44% over the past 24 hours. Ethereum has a market capitalization of $25.76 billion with a 24-hour trading volume of $7.26 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 9:26 pm UTC on Jun. 26, 2020, the total crypto market is valued at at $261.41 billion with a 24-hour volume of $72.9 billion. Bitcoin dominance is currently at 64.45%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass