Unlike 2016, analysts say Bitcoin won’t see a brutal post-halving crash for 2 reasons

Unlike 2016, analysts say Bitcoin won’t see a brutal post-halving crash for 2 reasons Unlike 2016, analysts say Bitcoin won’t see a brutal post-halving crash for 2 reasons

Photo by Katerina Pavlyuchkova on Unsplash

On March 12, 2020, during the infamous “Black Thursday,” the price of Bitcoin (BTC) dropped to as low as $3,600 across major exchanges. Now, analysts believe the intense correction will benefit the dominant cryptocurrency in the coming months.

After a block reward halving, the price of BTC tends to drop. In the previous two halvings in 2012 and 2016, Bitcoin saw a similar trend.

A Bitcoin halving immediately decreases the amount of BTC miners can generate by using computing power and mining equipment. A halving can lead to a drop in price as miners sell existing BTC to cover imminent operational costs.

This time around, the projected decline in the price of Bitcoin may not be as intense.

Why Bitcoin may not see a big post-2020 halving correction

The third halving in the history of Bitcoin was activated on May 11. Following the halving, the price of BTC slightly declined and technical analysts generally anticipate a sizable pullback in the short-term.

There are two main reasons that support the argument of a less severe Bitcoin correction following the halving: less capitulation of miners and the March 12 drop of BTC.

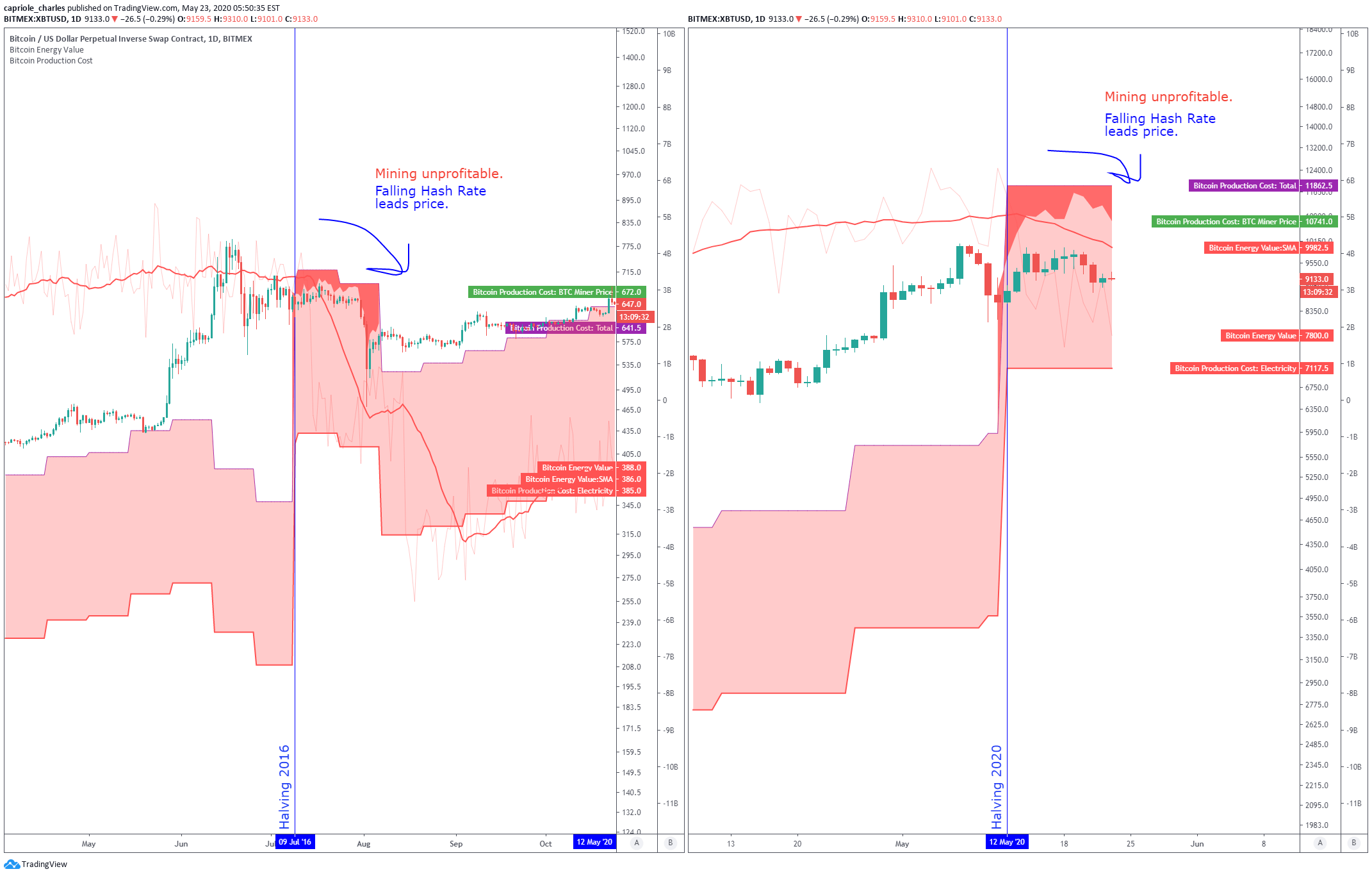

According to data shared by Capriole market researcher Charles Edwards, the hash rate of Bitcoin has been leading its price down in the past week.

The difference between the 2020 and 2016 halving, however, is that the capitulation of miners is not as strong as four years ago.

Edwards explained:

“2016 and 2020. Spot the difference? There isn’t one, except the start of the capitulation this time (falling Energy Value) isn’t as extreme, likely due to the March 12 flush out. Another example of Hash Rate leading price down.”

Miners are not shutting down their mining equipment as fast as they did in previous halvings due to the price trend of BTC.

Weeks before the May 11 halving, the price of Bitcoin was hovering at around $6,000. If BTC remained in the $6,000 to $7,000 range, it would have increased the probability of a more severe capitulation of miners.

The decline in the price of Bitcoin to the $3,000s in mid-March can be another catalyst that prevents a large correction in the near-term.

The so-called Black Thursday wiped out most long and short contracts in the Bitcoin futures market. It led to the spot and institutional market accumulating BTC over a two-month span, which creates a stronger foundation for a renewed rally.

There are variables, though

The halving ended, but its effect on miners is still real. If the price of Bitcoin does not increase in the upcoming weeks, miners will be operating with a substantial loss.

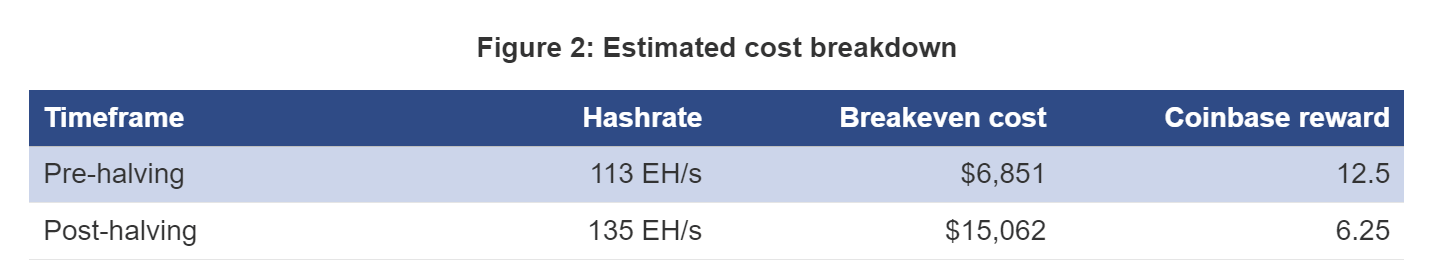

Estimates place the cost of mining after the halving at around $12,500 at the lowest.

The TradeBlock team wrote:

“The gross cost to mine one bitcoin at projected levels following the halving would be $15,062. If we adjust our assumption on hash rate, and assume hash rate stays nearly flat from current levels then the cost to mine one bitcoin would fall to $12,525.”

Given that the price of Bitcoin is now just hovering over $9,000, it would lead to a $3,000 loss per BTC for miners. The discrepancy between the cost of mining and the cost to mine BTC may cause miners to sell more BTC.

Bitcoin Market Data

At the time of press 11:13 pm UTC on May. 24, 2020, Bitcoin is ranked #1 by market cap and the price is down 1.67% over the past 24 hours. Bitcoin has a market capitalization of $166.68 billion with a 24-hour trading volume of $31.38 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 11:13 pm UTC on May. 24, 2020, the total crypto market is valued at at $252.84 billion with a 24-hour volume of $103.74 billion. Bitcoin dominance is currently at 65.83%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass