These macro trends are likely to hold massive sway over Bitcoin in 2020

These macro trends are likely to hold massive sway over Bitcoin in 2020 These macro trends are likely to hold massive sway over Bitcoin in 2020

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Throughout the past couple of months Bitcoin has traded against a macro backdrop of economic uncertainty for the first time in its relatively short decade-long history.

Although the crypto has not been able to match the gains seen by other forms of hard money like gold throughout the past several weeks, it has held up surprisingly well – given its relatively small market size.

It is important to bear in mind that there are a few rapidly unfolding trends that could hold heavy sway over which direction BTC moves in the year ahead, including its imminent inflation reduction.

Bitcoin sees tapering volatility as global markets send mixed signals to investors

The unprecedented nature of the current global economic situation has left bulls and bears in limbo, with key economic strength metrics like consumer spending and unemployment both cratering while the stock market holds steady.

One would expect that these data metrics would be linked to the market’s performance, but it appears that the Fed’s attempts to curb the economic damage done by the Coronavirus pandemic are working.

This lack of direction within the traditional markets has influenced even smaller outlier markets like crypto, with Bitcoin seeing lackluster price action around $7,000 for the past week while its volatility dives alongside that of most other markets.

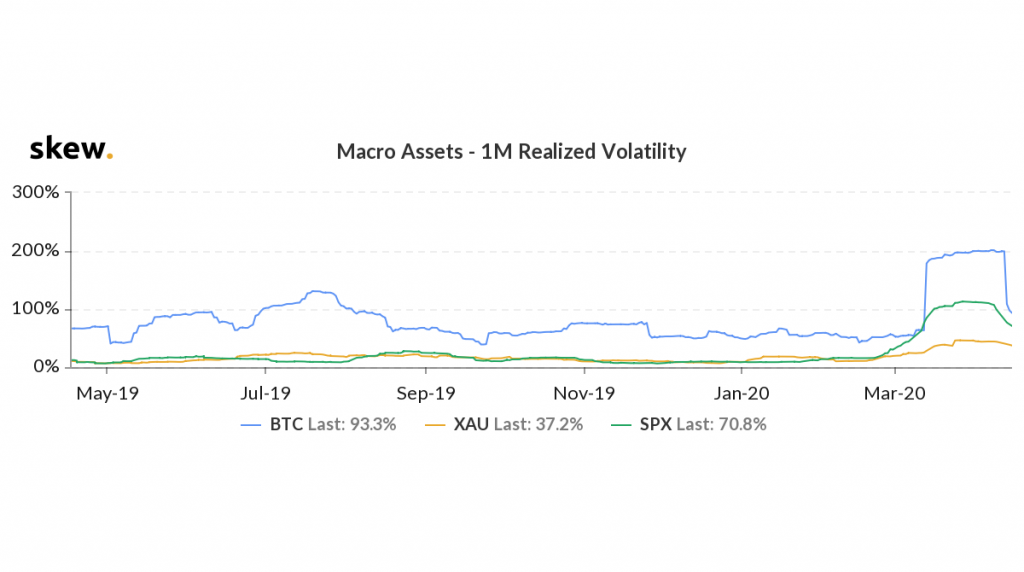

While looking at the below chart from Skew, it’s clear that the volatility seen by the S&P 500, gold, and Bitcoin has all decreased in tandem throughout the past month.

This suggests that Bitcoin’s fate in the near-term still remains dependent on that of the global legacy markets, and how it trends should the economy continue weakening may depend largely on whether or not it forms a long-term correlation with gold or with the benchmark indices.

Global inflation makes the case for BTC

Fiat currencies are virtually all seeing unprecedented levels of inflation in recent times, primarily due to the incessant money printing that is required to fund government’s economic stimulus packages.

The devaluing of these currencies is coming just weeks before Bitcoin’s halving event, which lowers the cryptocurrency’s inflation rate by just over 50% and showcases the cryptocurrency’s deflationary properties.

The ironic timing of this event may ultimately boost the “digital safe haven” narrative and help Bitcoin form a closer correlation with gold, boosting its price action should the economy weaken as most countries face wide-spread lockdowns.

Farside Investors

Farside Investors

CoinGlass

CoinGlass

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)