Crypto trading bot founder: Lack of killer applications is the biggest obstacle to mainstream adoption

Crypto trading bot founder: Lack of killer applications is the biggest obstacle to mainstream adoption Crypto trading bot founder: Lack of killer applications is the biggest obstacle to mainstream adoption

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

CryptoSlate recently had the opportunity to chat with Anthony Xie. Xie is the founder of HodlBot, a tool that helps investors diversify their portfolios and automate their trading strategies. HodlBot is a customizable cryptocurrency trading bot that enables users to index the market, create custom portfolios, and automatically rebalance their cryptocurrency portfolios.

In addition to being a founder, Xie is also a programmer and crypto analyst. In October 2018, Xie wrote an article for CryptoSlate arguing that the first Bitcoin ETF would be physically backed.

Interview with Anthony Xie, HodlBot Founder

What is your professional background and how/when did you get into crypto?

Before HodlBot, I spent a few years working in finance & consulting before switching to growth at a software company. I was a growth engineer at a YC B2B SaaS start-up for about two years before I left to pursue HodlBot full-time.

During my time working in finance, I gained an interest in passive investing, ETFs, and indexing. Those experiences pushed me to build a passive trading investing platform for cryptocurrency.

I was first introduced to cryptocurrency back in university in 2010, by a crazy professor named JP Vergne. He’s one of the leading scholars on piracy & the economics of black markets. In his lectures, he would frequently conjure up ideas on how blockchain was going to transform different industries. One time, he made the entire class do an exercise on public-key cryptography.

Tell us about why you decided to start HodlBot? What is the mission?

The mission has always been to democratize investing for everyday people.

We started with cryptocurrency because the tools & products at the time were very undeveloped and immature. Also, to me, the spirit of cryptocurrency represents financial inclusion and self- sovereignty over your wealth.

Where is your team located and why did you choose that jurisdiction?

Our office is in Toronto. Our 3 person team all grew up or went to school around here. We spent our first year bootstrapping our business in Waterloo. Waterloo is a fantastic place because it’s got a high density of technology companies, and a big pool of tech talent. Plus, it’s so boring, the only thing you can do is work.

What are some of HodlBot’s notable achievements or milestones?

We crossed $100 in transaction volume sometime this year.

We did this with $0 spent on marketing, and a team of 3 people.

What are the benefits of using HodlBot as opposed to other crypto trading bots?

Most crypto trading bots tend to promise ridiculous returns, and then undelivered. They try to beat the market and completely miss the mark.

Or they try to offer complex, non-user friendly trading options that are only really suited for a handful of extremely dedicated, quantitative people who don’t know how to code themselves. These people don’t mind putting full-time hours in figuring out how to automate their strategies.

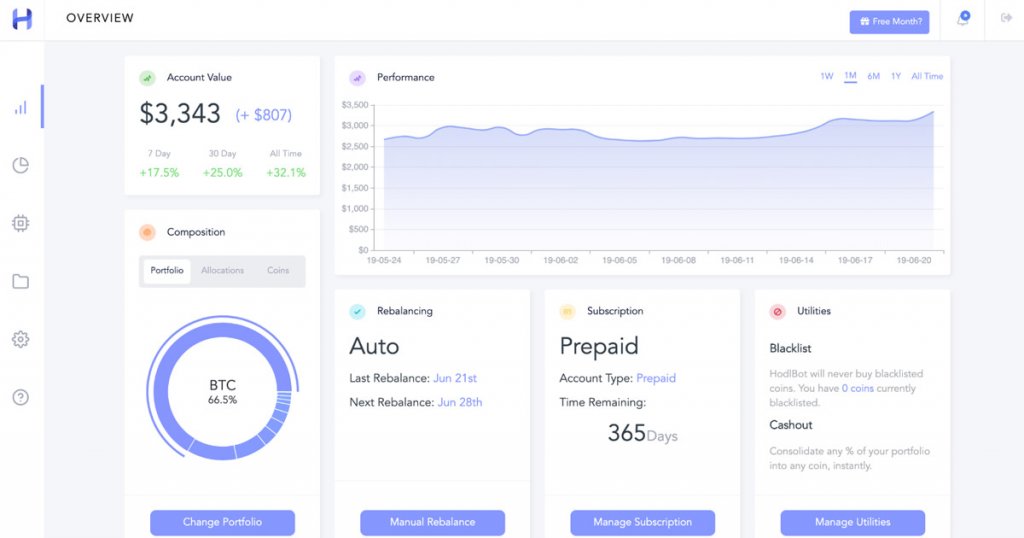

We think of ourselves as a portfolio management tool. We take basic, core financial principles like portfolio diversification and rebalancing and apply them to the world of cryptocurrency.

We’re here to automate all the boring stuff that would otherwise take you way too much time to do manually.

The thing we do best is indexing the market. In equity markets, 80% of active money managers fail to beat the index. We believe that it is a similar case in crypto. With HodlBot, you can choose a pre-made index (top 10, 20 30), or create your own. We handle everything else, like portfolio rebalancing automatically.

Finally, a word of caution, if trading bots are offering you something too good to be true, be wary. Think about whether it would make economic sense for a trading bot with a winning strategy to share that with anybody else. Why not just raise money and keep the secret sauce to themselves?

What can you tell us about the HodlBot roadmap? What upcoming features are you most excited about rolling out?

- Including futures in custom portfolios for hedging purposes and for active traders who want to bet against the market.

- Simple rules-based trading configurations (e.g. Trade portfolio A → B when X happens).

- Smart order routing to maximize cost savings.

What are the biggest challenges of building a crypto trading bot platform for crypto users?

The single biggest challenge for us has been learning how to compromise across customer needs because the range between our customers’ backgrounds and personalities is astoundingly vast.

You’ve got middle-aged dads who are super meticulous, rational and super savvy with personal finance. They understand everything about passive investing and are super onboard with our existing features.

You’ve got extremely active traders who want to make trades every millisecond. (They probably closed five orders the last time they took a shit). If they’re not trading, they better be asleep or dead.

You’ve got privacy, security idealists who want everything about our platform to be open-source and decentralized at the same time.

You’ve got developers who are trying to ask you what your API rate limits are for different endpoints, so they can reverse engineer your API and run their code on top of HodlBot.

Because our philosophy has always been about democratizing investing for everybody. We care about inclusions and don’t want to shut out any groups of people. We’ve been cautious about not letting a small vocal minority dilute the platform’s usefulness for a broad audience.

What other projects and or blockchain developments are you most excited about?

I like the compound protocol. It’s a protocol for money markets. You can lend crypto and earn interest. In traditional finance, financial institutions like banks, discount brokerages, etc. make a large portion of their revenue by lending out deposits in bonds & money markets. I think there is an opportunity for cryptocurrency exchanges, who hold a bunch of idle capital, to do this as well.

Do you have any blockchain and or other crypto predictions for 2020 or beyond?

I think the cryptocurrency market will be at a healthier place when we see correlations between coins prices go down.

I wrote a piece that found that 70 percent of cryptocurrencies had a correlation coefficient of 0.87 or higher in 2018. If everything just moves up and down together, then we don’t have real individual cryptocurrency price discovery based on any concept of intrinsic value. It means we can’t sniff out BS.

What are the biggest obstacles for the mainstream adoption of crypto?

- Regulatory controls. While the government can’t control a decentralized cryptocurrency per se, they can certainly block the shit out of fiat-onramps.

- Lack of killer applications. Even if it’s not a mass-market product, I want to see more cryptocurrency applications used by a small group of obsessed people.

What is your most controversial opinion relating to blockchain and/or cryptocurrency?

More coins need to die for the market to live. Removing danger and mortality from failure causes competition to stagnate. Improving the survivability of individuals can hurt the well-being of the system.

52 percent of dot com companies founded since 1996 perished by 2004 because they had:

- A get large or get lost mentality

- Extremely high burn rate.

Coins are not like Dot Com companies. They are too hard to kill. Most failures have been small projects that failed to get traction. Once big, they don’t seem to die (with an exception for obvious Ponzi scams) because:

- Projects that have completed a successful round of financing during the ICO mania have an insanely long-run rate. They can survive off their war chest for a long time.

- Mining offloads the operational expense of keeping the project running to others.

- There is no incentive for the token project to shut down. The founder(s) can simply walk away and keep the project going on its own, e.g. Dogecoin, Litecoin.

- Blockchain is resilient to death. Has redundancy, can fork, only needs one miner to survive.

- Cryptocurrencies have access to retail investors globally.

- It’s hard for a large group of retail investors to come to a consensus and hold a project accountable to its goals.

Connect with Anthony Xie

Anthony Xie is the founder of HodlBot, a tool that helps investors diversify their portfolios and automate their trading strategies..

Farside Investors

Farside Investors

CoinGlass

CoinGlass