Explosive market data suggests Bitcoin’s buy streak could just be getting started

Explosive market data suggests Bitcoin’s buy streak could just be getting started Explosive market data suggests Bitcoin’s buy streak could just be getting started

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A sudden jump in key metrics in both the futures and spot markets indicates strength and institutional sponsorship behind Bitcoin’s latest rally, a factor that could mark the start of an extended winning streak for the bulls.

As it stands, the five-day rally has seen Bitcoin gain more than 16 percent in price and $15 billion in market capitalization, having kicked off at $6,900 January 2 and peaking January 7 at $8,440. Bulls have dominated the market since December 18, however, when BTC broke market structure in the form of a sheer thousand-dollar rally to the upside.

Futures, spot data look promising for BTC despite technical overextension

Since June last year trading volumes and volatility have been declining across the entire Bitcoin market, casting doubt over the near-term prospects of an extended bull-run. Recent developments could change this, however,

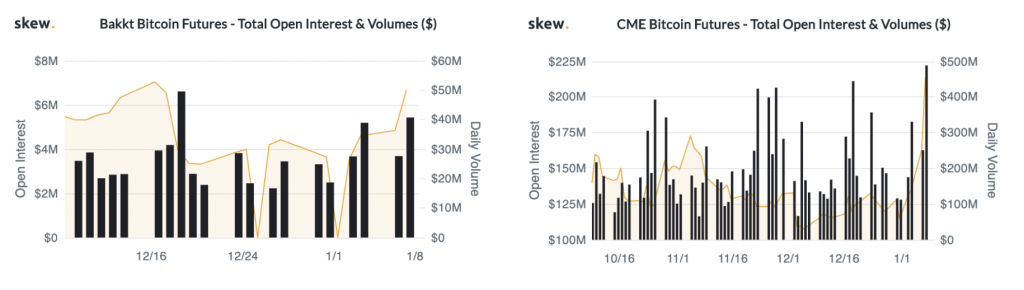

There has been a dramatic surge in open interest and trading volumes on Bakkt and CME Group, two venues that are widely considered to have a vital bearing over Bitcoin’s price movements as the incumbent institutional venues for Bitcoin derivatives.

On Tuesday both venues saw hikes in open interest of 50 percent or more on their monthly BTC futures markets, coming as Bitcoin blew through the $8,000-mark and topped out at $8,440. This indicates the addition of participants to the marketplace in the form of new contracts being opened and—seen alongside an increase in price—can be considered an indication of aggressive buying.

Both markets have seen significant increases in volume, with CME nearly hitting $500 million on Tuesday—the highest volumes in months. Bakkt saw the same trend, with $40.7 million taking the monthly contract just shy of its all-time high of $49.6 million (December 18).

Spot volumes have also rocketed to levels not seen since late October. According to Bitwise, who measures trading volumes minus “fake” or “non-economic” activity, Tuesday saw nearly $1.5 billion worth of Bitcoin change hands in the spot market, a 300 percent increase from the December average of $500 million.

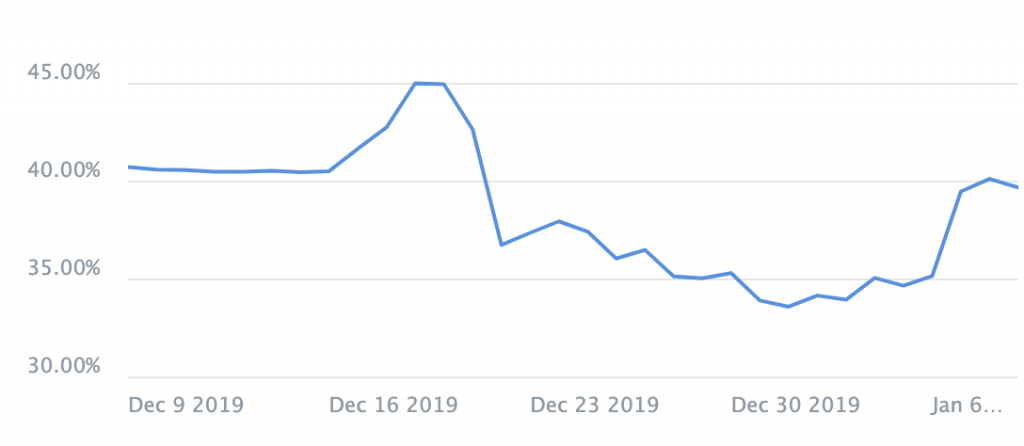

Volatility has also increased during the latest rally — another sign that Bitcoin could continue to trend higher or lower, and not stagnate in a consolidation. Granted, at its current level of 40 percent, volatility is nowhere near the levels seen in the first half of 2019, when Bitcoin rallied nearly $10,000 (a 260 percent increase) in three months.

While several technical indicators suggest that Bitcoin could be overextended after its latest rally and due for a retracement, the sudden increases in futures and spot trading could be a portent of a coming bull market.

Bitcoin Market Data

At the time of press 1:18 am UTC on Apr. 6, 2020, Bitcoin is ranked #1 by market cap and the price is down 4.89% over the past 24 hours. Bitcoin has a market capitalization of $143.9 billion with a 24-hour trading volume of $27.99 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:18 am UTC on Apr. 6, 2020, the total crypto market is valued at at $209.26 billion with a 24-hour volume of $86.91 billion. Bitcoin dominance is currently at 68.65%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)