Ripple CEO discusses plans for 2020; where is XRP heading next?

Ripple CEO discusses plans for 2020; where is XRP heading next? Ripple CEO discusses plans for 2020; where is XRP heading next?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Brad Garlinghouse, CEO at Ripple, sat down with Bloomberg to discuss the future of the company and the developments done on XRP.

Making Strides

Garlinghouse affirmed that the cryptocurrency market is currently oversaturated with worthless projects. He believes that it is “incredible” how people are trying to solve real problems with the use of blockchain technology. But, most of them are creating meaningless tokens just to benefit from the investment rush that the industry has seen.

According to Garlinghouse, out of the 3,000 different digital assets in the market, only 1 percent will prevail.

“I have said before that I think 99 percent of all crypto is likely to go to zero. But, there is that 1 percent that is focused on solving real problems for real customers and can do that on a scale. And, that is going to be game-changing and will continue to grow significantly in the years ahead.”

The former chairman at Hightail added that XRP is seeing a significant amount of traction as it accelerates the adoption of blockchain technology. He believes that SWIFT is a company that defined how cross-border payments are enabled in the world, but it is obsolete. Meanwhile, XRP brings cross-border payments into the modern world.

“Today, a SWIFT transaction can take several days. You don’t know for sure if it arrived. It’s almost like a postcard, the only way you know is if your friend says ‘hey, I received that.’ But, in a world of the internet where I can order an Uber and shows up right away. [XRP meets the expectations] that people have about how the financial system should work in the modern era.”

RippleNet, a cross-border payment processor, recently surpassed 300 customers. The project has seen a 10x year-over-year growth in transactions, according to a blog post by Ripple. Some of the most notable customers committed to using RippleNet include MoneyGram, goLance, Viamericas, FlashFX, and Interbank Peru.

As Ripple continues to expand its cross-border payment solutions, XRP is consolidating without a clear sign of where it is heading next.

XRP Technical Analysis

XRP is trading within a no-trade zone mostly between $0.24 and $0.30. This trading range is containing the price of this cryptocurrency since mid-August without a precise movement that determines the direction of its trend.

When looking at its 12-hour chart, XRP appears to be breaking out of an ascending parallel channel that formed in late October. Every time this crypto reached the bottom of the channel, it bounced off to the middle or the top. But, when it reached the top, it fell back to the middle or the bottom.

Now that XRP broke below the bottom of the channel, it plunged to the 100-twelve-hour moving average. A further increase in the selling pressure behind this cryptocurrency could send it back to the $0.24 support level.

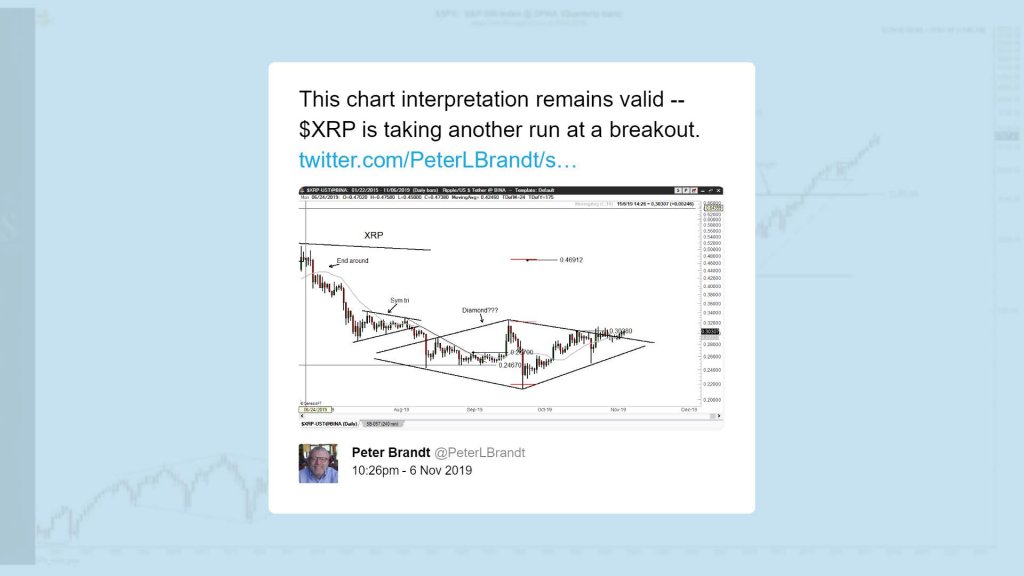

Nonetheless, 40-year trading veteran Peter Brandt recently stated that a diamond bottom seems to be forming in XRP’s daily chart. Diamond bottoms are reversal patterns that are not common on traditional assets. Brandt estimates that despite the decline seen in the last 24 hours if XRP is able to close above $0.30, it could shoot up more than 50 percent to $0.47.

Moving Forward

According to Garlinghouse, the entire cryptocurrency industry will continue to grow in the years ahead. The utility of cryptocurrencies is evolving significantly as people start to use them to solve real-world problems.

“First the market was used for illegal activity such as Silk Road, then it became a speculation bubble that we will continue to see in the coming years. Then, the focus will be on utility and how these digital assets can solve real problems.”

Garlinghouse believes that the journey to make digital assets make transactions more efficient will last for a couple of decades. The head of Ripple described it as a marathon and he believes that the industry is still on “mile two.” Finally, regardless of the price of XRP, he said that the most important part is the developments being done in the underlying technology. Garlinghouse concluded:

“I don’t think about the price of XRP in the short term. I think if we can enable XRP to be the most efficient in terms of the speed of a transaction and the cost of a transaction more and more people will use it.”

CoinGlass

CoinGlass

Farside Investors

Farside Investors